Global Antimicrobial Packaging Market - Industry Dynamics, Market Size, And Opportunity Forecast To 2031

Report ID: MS-1593 | Manufacturing and Construction | Last updated: Sep, 2024 | Formats*:

Antimicrobial Packaging Report Highlights

| Report Metrics | Details |

|---|---|

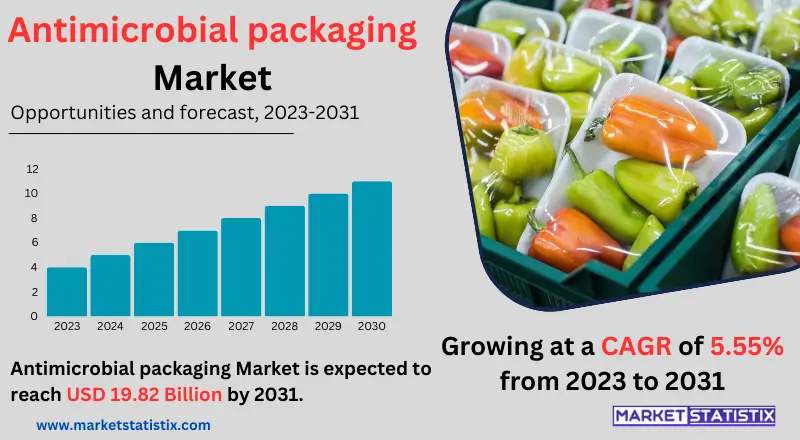

| Forecast period | 2019-2031 |

| Base Year Of Estimation | 2023 |

| Growth Rate | CAGR of 5.55% |

| By Product Type | Trays, Cartons, Bags, Pouches, Cups & Lids, Films |

| Key Market Players |

|

| By Region |

|

Antimicrobial Packaging Market Trends

The antimicrobial packaging market is growing at a fast pace; there are a number of key trends driving this growth. First of all, increasing consumer awareness with regard to the safety and hygiene of food acts as the main driver. Consumers are becoming more and more demanding of products that can be stored for a longer time, thus fuelling demand for antimicrobial packaging solutions. Besides, the outbreak of pandemics across the globe has emphasised the hygienic conditions of packaging, further fuelling growth. Another major trend driving the market is increasing interest in sustainable packaging. Antimicrobial packaging will contribute to extending shelf life, which reduces waste and thereby lessens the strain on the environment. Improvements in packaging technologies and the discovery of new antimicrobial agents drive innovations in the market and result in effective and sustainable packaging solutions.Antimicrobial Packaging Market Leading Players

The key players profiled in the report are Microban International, Klöckner Pentaplast Europe GmbH & Co. KG, BASF SE, Biocote Limited, Dunmore Corporation, The Dow Chemical Company, Mondi Plc, PolyOne Corporation, Foodtouch, Biomaster, Olpon Pure Sciences Ltd, Takex Labo Co. LtdGrowth Accelerators

The key factors driving the antimicrobial packaging market are as follows: The increased incidence of foodborne illnesses and food safety awareness among consumers is generating the need for packaging solutions that have the ability to hinder the growth of microbes. Furthermore, the expanding disposable incomes and changing lifestyles tend to drive higher demand for ready-to-eat foods and convenient food products, thus demanding extended shelf life. In addition, food protection and quality parameters have been highly regulated by government agencies, owing to which antimicrobial packaging has been adopted. On the other hand, fast growth in the healthcare sector, primarily in developing nations, has consistently increased the use of antimicrobial packaging in medical devices and pharmaceutical products.Antimicrobial Packaging Market Segmentation analysis

The Global Antimicrobial Packaging is segmented by Type, Application, and Region. By Type, the market is divided into Distributed Trays, Cartons, Bags, Pouches, Cups & Lids, Films . The Application segment categorizes the market based on its usage such as Personal Care & Cosmetics, Consumer Electronics, Food & Beverages, Healthcare. Geographically, the market is assessed across key Regions like North America(United States.Canada.Mexico), South America(Brazil.Argentina.Chile.Rest of South America), Europe(Germany.France.Italy.United Kingdom.Benelux.Nordics.Rest of Europe), Asia Pacific(China.Japan.India.South Korea.Australia.Southeast Asia.Rest of Asia-Pacific), MEA(Middle East.Africa) and others, each presenting distinct growth opportunities and challenges influenced by the regions.Competitive Landscape

The competitive environment of the market for antimicrobial packaging is highly dynamic, with established firms in the packaging field, speciality chemical manufacturers, and new emerging entities. The major players in this market are primarily involved in innovative developments in antimicrobial packaging solutions, product diversification programs, and augmenting their presence in the market. The competition is high, based on differentiating products, new technologies, compliance issues, and consumer preferences. This has made firms increase their spending on research and development in a move to establish viable and sustainable antimicrobial packaging. Strategic partnerships and collaborations are also emerging in order to leverage expertise and expand market reach. Companies are rapidly changing the competitive landscape as they jostle to get a competitive edge in this growing market.Challenges In Antimicrobial Packaging Market

However, along with such promises, the market for antimicrobial packaging is also faced with a couple of hurdles to grow against. One of the major barriers includes an obstacle in terms of antimicrobial agents used within packaging materials to gain regulatory approvals, which might be a tough line because of the systematic safety and efficacy criteria. Further, consumer acceptance regarding food packed in the highly sanitised package is also of concern, since using the bioactive around foods is seen as a health haggle according to some consumers. Another challenge is to develop cost-effective and sustainable antimicrobial packaging solutions that could provide a balance between fulfilling the needs of the antimicrobial properties and the environmental considerations. At a time quite similar to this, nonetheless, the efficiency of the antimicrobial agents employed can be interfered with by a number of factors, including the packaging material, the storage conditions, and the types of the targeted microorganisms. Consistent performance and efficacy are not obvious characteristics to secure.Risks & Prospects in Antimicrobial Packaging Market

The antimicrobial packaging market is full of opportunities and simultaneously innovates. Increasing cases of foodborne illnesses, on the other hand, drive market expansion, coupled with consumer demand for safe and fresh food products. On the other hand, the growth of the healthcare sector and sterile packaging applications in medical uses create huge growth potential. Growth in emerging economies with increasing disposable incomes and a rising middle class is also supporting the growth of the market. Besides, advancements in packaging technologies and the development of novel antimicrobial agents create opportunities for product differentiation and market expansion. With increasing consumer awareness about food safety and hygiene of the product, demand for antimicrobial packaging will rise significantly, offering several opportunities for industry players.Key Target Audience

Major end-user industries of antimicrobial packaging are the food and beverage industry, which is extensively using it to provide extended shelf life for perishable products and to minimise food waste. Major applications of antimicrobial food and beverage packaging are in meat, poultry, seafood, dairy, and ready-to-eat meal categories. Its use extends to several segments within the healthcare industry. More specifically, these are medical devices and pharmaceutical packaging.,, Antimicrobial packaging fuels consumer market awareness in an indirect way because it enables the availability of fresh and safe merchandise. Retailers and distributors benefit from superior supply chain efficiency and less merchandise spoilage from the use of antimicrobial packaging. More so, government agencies and regulatory organisations support the market by defining standards and regulations against the use of antimicrobial packaging materials.Merger and acquisition

The antimicrobial packaging market has been highly consolidated through mergers and acquisitions in recent times. Key players in the industry have bought out companies that bring onboard the capability in the area of antimicrobial technologies, packaging materials, and manufacturing processes. Such deals have helped the leading players in the market broaden their product lines, enhance their market positions, and offer support to accelerated growth strategies. For instance, companies acquired smaller firms with innovative antimicrobial solutions in order to add to their products and enable the expansion of their markets to newer applications. Additionally, big packaging company mergers resulted in other greater companies that can more effectively take advantage of a more wide-ranging portfolio of antimicrobial packaging products for the various needs of different industries. Hence, these strategic steps refashioned the competitive scenario and accelerated the uptake of antimicrobial packaging across many industries.- 1.1 Report description

- 1.2 Key market segments

- 1.3 Key benefits to the stakeholders

2: Executive Summary

- 2.1 Antimicrobial Packaging- Snapshot

- 2.2 Antimicrobial Packaging- Segment Snapshot

- 2.3 Antimicrobial Packaging- Competitive Landscape Snapshot

3: Market Overview

- 3.1 Market definition and scope

- 3.2 Key findings

- 3.2.1 Top impacting factors

- 3.2.2 Top investment pockets

- 3.3 Porter’s five forces analysis

- 3.3.1 Low bargaining power of suppliers

- 3.3.2 Low threat of new entrants

- 3.3.3 Low threat of substitutes

- 3.3.4 Low intensity of rivalry

- 3.3.5 Low bargaining power of buyers

- 3.4 Market dynamics

- 3.4.1 Drivers

- 3.4.2 Restraints

- 3.4.3 Opportunities

4: Antimicrobial Packaging Market by Type

- 4.1 Overview

- 4.1.1 Market size and forecast

- 4.2 Trays

- 4.2.1 Key market trends, factors driving growth, and opportunities

- 4.2.2 Market size and forecast, by region

- 4.2.3 Market share analysis by country

- 4.3 Cartons

- 4.3.1 Key market trends, factors driving growth, and opportunities

- 4.3.2 Market size and forecast, by region

- 4.3.3 Market share analysis by country

- 4.4 Bags

- 4.4.1 Key market trends, factors driving growth, and opportunities

- 4.4.2 Market size and forecast, by region

- 4.4.3 Market share analysis by country

- 4.5 Pouches

- 4.5.1 Key market trends, factors driving growth, and opportunities

- 4.5.2 Market size and forecast, by region

- 4.5.3 Market share analysis by country

- 4.6 Cups & Lids

- 4.6.1 Key market trends, factors driving growth, and opportunities

- 4.6.2 Market size and forecast, by region

- 4.6.3 Market share analysis by country

- 4.7 Films

- 4.7.1 Key market trends, factors driving growth, and opportunities

- 4.7.2 Market size and forecast, by region

- 4.7.3 Market share analysis by country

5: Antimicrobial Packaging Market by Application / by End Use

- 5.1 Overview

- 5.1.1 Market size and forecast

- 5.2 Personal Care & Cosmetics

- 5.2.1 Key market trends, factors driving growth, and opportunities

- 5.2.2 Market size and forecast, by region

- 5.2.3 Market share analysis by country

- 5.3 Consumer Electronics

- 5.3.1 Key market trends, factors driving growth, and opportunities

- 5.3.2 Market size and forecast, by region

- 5.3.3 Market share analysis by country

- 5.4 Food & Beverages

- 5.4.1 Key market trends, factors driving growth, and opportunities

- 5.4.2 Market size and forecast, by region

- 5.4.3 Market share analysis by country

- 5.5 Healthcare

- 5.5.1 Key market trends, factors driving growth, and opportunities

- 5.5.2 Market size and forecast, by region

- 5.5.3 Market share analysis by country

6: Antimicrobial Packaging Market by Material

- 6.1 Overview

- 6.1.1 Market size and forecast

- 6.2 Paperboard

- 6.2.1 Key market trends, factors driving growth, and opportunities

- 6.2.2 Market size and forecast, by region

- 6.2.3 Market share analysis by country

- 6.3 Plastic

- 6.3.1 Key market trends, factors driving growth, and opportunities

- 6.3.2 Market size and forecast, by region

- 6.3.3 Market share analysis by country

- 6.4 Biopolymers

- 6.4.1 Key market trends, factors driving growth, and opportunities

- 6.4.2 Market size and forecast, by region

- 6.4.3 Market share analysis by country

- 6.5 Others

- 6.5.1 Key market trends, factors driving growth, and opportunities

- 6.5.2 Market size and forecast, by region

- 6.5.3 Market share analysis by country

7: Antimicrobial Packaging Market by Region

- 7.1 Overview

- 7.1.1 Market size and forecast By Region

- 7.2 North America

- 7.2.1 Key trends and opportunities

- 7.2.2 Market size and forecast, by Type

- 7.2.3 Market size and forecast, by Application

- 7.2.4 Market size and forecast, by country

- 7.2.4.1 United States

- 7.2.4.1.1 Key market trends, factors driving growth, and opportunities

- 7.2.4.1.2 Market size and forecast, by Type

- 7.2.4.1.3 Market size and forecast, by Application

- 7.2.4.2 Canada

- 7.2.4.2.1 Key market trends, factors driving growth, and opportunities

- 7.2.4.2.2 Market size and forecast, by Type

- 7.2.4.2.3 Market size and forecast, by Application

- 7.2.4.3 Mexico

- 7.2.4.3.1 Key market trends, factors driving growth, and opportunities

- 7.2.4.3.2 Market size and forecast, by Type

- 7.2.4.3.3 Market size and forecast, by Application

- 7.2.4.1 United States

- 7.3 South America

- 7.3.1 Key trends and opportunities

- 7.3.2 Market size and forecast, by Type

- 7.3.3 Market size and forecast, by Application

- 7.3.4 Market size and forecast, by country

- 7.3.4.1 Brazil

- 7.3.4.1.1 Key market trends, factors driving growth, and opportunities

- 7.3.4.1.2 Market size and forecast, by Type

- 7.3.4.1.3 Market size and forecast, by Application

- 7.3.4.2 Argentina

- 7.3.4.2.1 Key market trends, factors driving growth, and opportunities

- 7.3.4.2.2 Market size and forecast, by Type

- 7.3.4.2.3 Market size and forecast, by Application

- 7.3.4.3 Chile

- 7.3.4.3.1 Key market trends, factors driving growth, and opportunities

- 7.3.4.3.2 Market size and forecast, by Type

- 7.3.4.3.3 Market size and forecast, by Application

- 7.3.4.4 Rest of South America

- 7.3.4.4.1 Key market trends, factors driving growth, and opportunities

- 7.3.4.4.2 Market size and forecast, by Type

- 7.3.4.4.3 Market size and forecast, by Application

- 7.3.4.1 Brazil

- 7.4 Europe

- 7.4.1 Key trends and opportunities

- 7.4.2 Market size and forecast, by Type

- 7.4.3 Market size and forecast, by Application

- 7.4.4 Market size and forecast, by country

- 7.4.4.1 Germany

- 7.4.4.1.1 Key market trends, factors driving growth, and opportunities

- 7.4.4.1.2 Market size and forecast, by Type

- 7.4.4.1.3 Market size and forecast, by Application

- 7.4.4.2 France

- 7.4.4.2.1 Key market trends, factors driving growth, and opportunities

- 7.4.4.2.2 Market size and forecast, by Type

- 7.4.4.2.3 Market size and forecast, by Application

- 7.4.4.3 Italy

- 7.4.4.3.1 Key market trends, factors driving growth, and opportunities

- 7.4.4.3.2 Market size and forecast, by Type

- 7.4.4.3.3 Market size and forecast, by Application

- 7.4.4.4 United Kingdom

- 7.4.4.4.1 Key market trends, factors driving growth, and opportunities

- 7.4.4.4.2 Market size and forecast, by Type

- 7.4.4.4.3 Market size and forecast, by Application

- 7.4.4.5 Benelux

- 7.4.4.5.1 Key market trends, factors driving growth, and opportunities

- 7.4.4.5.2 Market size and forecast, by Type

- 7.4.4.5.3 Market size and forecast, by Application

- 7.4.4.6 Nordics

- 7.4.4.6.1 Key market trends, factors driving growth, and opportunities

- 7.4.4.6.2 Market size and forecast, by Type

- 7.4.4.6.3 Market size and forecast, by Application

- 7.4.4.7 Rest of Europe

- 7.4.4.7.1 Key market trends, factors driving growth, and opportunities

- 7.4.4.7.2 Market size and forecast, by Type

- 7.4.4.7.3 Market size and forecast, by Application

- 7.4.4.1 Germany

- 7.5 Asia Pacific

- 7.5.1 Key trends and opportunities

- 7.5.2 Market size and forecast, by Type

- 7.5.3 Market size and forecast, by Application

- 7.5.4 Market size and forecast, by country

- 7.5.4.1 China

- 7.5.4.1.1 Key market trends, factors driving growth, and opportunities

- 7.5.4.1.2 Market size and forecast, by Type

- 7.5.4.1.3 Market size and forecast, by Application

- 7.5.4.2 Japan

- 7.5.4.2.1 Key market trends, factors driving growth, and opportunities

- 7.5.4.2.2 Market size and forecast, by Type

- 7.5.4.2.3 Market size and forecast, by Application

- 7.5.4.3 India

- 7.5.4.3.1 Key market trends, factors driving growth, and opportunities

- 7.5.4.3.2 Market size and forecast, by Type

- 7.5.4.3.3 Market size and forecast, by Application

- 7.5.4.4 South Korea

- 7.5.4.4.1 Key market trends, factors driving growth, and opportunities

- 7.5.4.4.2 Market size and forecast, by Type

- 7.5.4.4.3 Market size and forecast, by Application

- 7.5.4.5 Australia

- 7.5.4.5.1 Key market trends, factors driving growth, and opportunities

- 7.5.4.5.2 Market size and forecast, by Type

- 7.5.4.5.3 Market size and forecast, by Application

- 7.5.4.6 Southeast Asia

- 7.5.4.6.1 Key market trends, factors driving growth, and opportunities

- 7.5.4.6.2 Market size and forecast, by Type

- 7.5.4.6.3 Market size and forecast, by Application

- 7.5.4.7 Rest of Asia-Pacific

- 7.5.4.7.1 Key market trends, factors driving growth, and opportunities

- 7.5.4.7.2 Market size and forecast, by Type

- 7.5.4.7.3 Market size and forecast, by Application

- 7.5.4.1 China

- 7.6 MEA

- 7.6.1 Key trends and opportunities

- 7.6.2 Market size and forecast, by Type

- 7.6.3 Market size and forecast, by Application

- 7.6.4 Market size and forecast, by country

- 7.6.4.1 Middle East

- 7.6.4.1.1 Key market trends, factors driving growth, and opportunities

- 7.6.4.1.2 Market size and forecast, by Type

- 7.6.4.1.3 Market size and forecast, by Application

- 7.6.4.2 Africa

- 7.6.4.2.1 Key market trends, factors driving growth, and opportunities

- 7.6.4.2.2 Market size and forecast, by Type

- 7.6.4.2.3 Market size and forecast, by Application

- 7.6.4.1 Middle East

- 8.1 Overview

- 8.2 Key Winning Strategies

- 8.3 Top 10 Players: Product Mapping

- 8.4 Competitive Analysis Dashboard

- 8.5 Market Competition Heatmap

- 8.6 Leading Player Positions, 2022

9: Company Profiles

- 9.1 Microban International

- 9.1.1 Company Overview

- 9.1.2 Key Executives

- 9.1.3 Company snapshot

- 9.1.4 Active Business Divisions

- 9.1.5 Product portfolio

- 9.1.6 Business performance

- 9.1.7 Major Strategic Initiatives and Developments

- 9.2 Klöckner Pentaplast Europe GmbH & Co. KG

- 9.2.1 Company Overview

- 9.2.2 Key Executives

- 9.2.3 Company snapshot

- 9.2.4 Active Business Divisions

- 9.2.5 Product portfolio

- 9.2.6 Business performance

- 9.2.7 Major Strategic Initiatives and Developments

- 9.3 BASF SE

- 9.3.1 Company Overview

- 9.3.2 Key Executives

- 9.3.3 Company snapshot

- 9.3.4 Active Business Divisions

- 9.3.5 Product portfolio

- 9.3.6 Business performance

- 9.3.7 Major Strategic Initiatives and Developments

- 9.4 Biocote Limited

- 9.4.1 Company Overview

- 9.4.2 Key Executives

- 9.4.3 Company snapshot

- 9.4.4 Active Business Divisions

- 9.4.5 Product portfolio

- 9.4.6 Business performance

- 9.4.7 Major Strategic Initiatives and Developments

- 9.5 Dunmore Corporation

- 9.5.1 Company Overview

- 9.5.2 Key Executives

- 9.5.3 Company snapshot

- 9.5.4 Active Business Divisions

- 9.5.5 Product portfolio

- 9.5.6 Business performance

- 9.5.7 Major Strategic Initiatives and Developments

- 9.6 The Dow Chemical Company

- 9.6.1 Company Overview

- 9.6.2 Key Executives

- 9.6.3 Company snapshot

- 9.6.4 Active Business Divisions

- 9.6.5 Product portfolio

- 9.6.6 Business performance

- 9.6.7 Major Strategic Initiatives and Developments

- 9.7 Mondi Plc

- 9.7.1 Company Overview

- 9.7.2 Key Executives

- 9.7.3 Company snapshot

- 9.7.4 Active Business Divisions

- 9.7.5 Product portfolio

- 9.7.6 Business performance

- 9.7.7 Major Strategic Initiatives and Developments

- 9.8 PolyOne Corporation

- 9.8.1 Company Overview

- 9.8.2 Key Executives

- 9.8.3 Company snapshot

- 9.8.4 Active Business Divisions

- 9.8.5 Product portfolio

- 9.8.6 Business performance

- 9.8.7 Major Strategic Initiatives and Developments

- 9.9 Foodtouch

- 9.9.1 Company Overview

- 9.9.2 Key Executives

- 9.9.3 Company snapshot

- 9.9.4 Active Business Divisions

- 9.9.5 Product portfolio

- 9.9.6 Business performance

- 9.9.7 Major Strategic Initiatives and Developments

- 9.10 Biomaster

- 9.10.1 Company Overview

- 9.10.2 Key Executives

- 9.10.3 Company snapshot

- 9.10.4 Active Business Divisions

- 9.10.5 Product portfolio

- 9.10.6 Business performance

- 9.10.7 Major Strategic Initiatives and Developments

- 9.11 Olpon Pure Sciences Ltd

- 9.11.1 Company Overview

- 9.11.2 Key Executives

- 9.11.3 Company snapshot

- 9.11.4 Active Business Divisions

- 9.11.5 Product portfolio

- 9.11.6 Business performance

- 9.11.7 Major Strategic Initiatives and Developments

- 9.12 Takex Labo Co. Ltd

- 9.12.1 Company Overview

- 9.12.2 Key Executives

- 9.12.3 Company snapshot

- 9.12.4 Active Business Divisions

- 9.12.5 Product portfolio

- 9.12.6 Business performance

- 9.12.7 Major Strategic Initiatives and Developments

10: Analyst Perspective and Conclusion

- 10.1 Concluding Recommendations and Analysis

- 10.2 Strategies for Market Potential

Scope of Report

| Aspects | Details |

|---|---|

By Type |

|

By Application |

|

By Material |

|

Report Licenses

Our Team

Frequently Asked Questions (FAQ):

Which application type is expected to remain the largest segment in the Global Antimicrobial Packaging market?

+

-

How do regulatory policies impact the Antimicrobial Packaging Market?

+

-

What major players in Antimicrobial Packaging Market?

+

-

What applications are categorized in the Antimicrobial Packaging market study?

+

-

Which product types are examined in the Antimicrobial Packaging Market Study?

+

-

Which regions are expected to show the fastest growth in the Antimicrobial Packaging market?

+

-

What are the major growth drivers in the Antimicrobial Packaging market?

+

-

Is the study period of the Antimicrobial Packaging flexible or fixed?

+

-

How do economic factors influence the Antimicrobial Packaging market?

+

-

How does the supply chain affect the Antimicrobial Packaging Market?

+

-