Global Animal Internal Parasiticide Market - Industry Dynamics,Size, And Opportunity Forecast To 2030

Report ID: MS-558 | Electronics and Semiconductors | Last updated: Mar, 2025 | Formats*:

Animal Internal Parasiticide Report Highlights

| Report Metrics | Details |

|---|---|

| Forecast period | 2019-2030 |

| Base Year Of Estimation | 2024 |

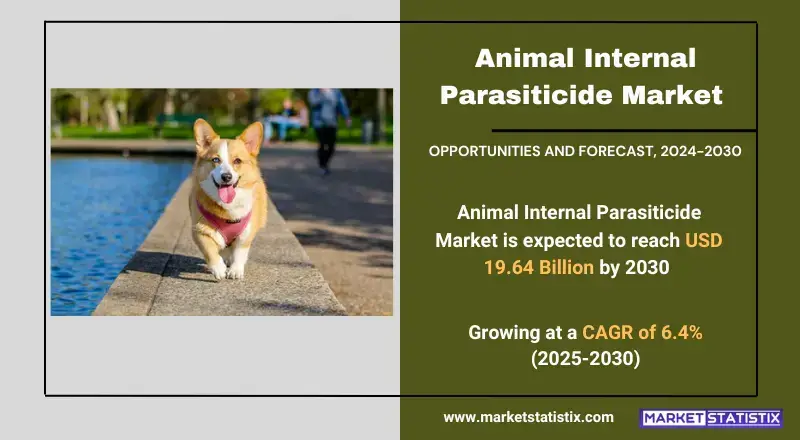

| Growth Rate | CAGR of 6.4% |

| Forecast Value (2030) | USD 19.64 Billion |

| By Product Type | Endoparasiticides, Ectoparasiticides, Endectocides |

| Key Market Players |

|

| By Region |

Animal Internal Parasiticide Market Trends

Illustrating the present scenario of animal internal parasiticides in wellness and management from prevention to specific parasite control, it is mainly the increasing awareness regarding sheltering animals and the economic effect due to parasitic diseases that is responsible for that shift. Parallelly, there has been a rise in using combination parasiticides or broad-spectrum treatments, which make treatment easy and improve efficiency. A rise in pet ownership worldwide and preventive care is one important market driver. Integrated parasite management strategies—e.g., strategic treatments in combination with better hygiene—will increasingly find their way into the livestock industry.Animal Internal Parasiticide Market Leading Players

The key players profiled in the report are Boehringer Ingelheim, Merck and Co., Sanofi, Zoetis, Inc., Ceva Sante Animale, Perrigo Company, Vetoquinol S.A., Eli Lilly and Company, Inc., Virbac, Bayer AGGrowth Accelerators

The demand for an animal internal parasiticide is primarily due to the increasing global requirement for animal protein, which can maintain healthy livestock populations. Rising consumption of meat, particularly in developing economies, would require measures to protect the livestock from parasitic infections hindering the growth and productivity of livestock. The growing trend of pet ownership also plays a significant role in driving the market, with pet owners ready to spend on preventive and curative treatments for their animals. Another major driving factor would definitely be more intensive livestock farming practices since increasing animal numbers in very high densities are favouring the spreading of parasitic infections. Regulatory mandates for food safety and animal health are also crucial and lay a strong emphasis on the use of parasiticides to maintain the safety of animal products. Furthermore, advances in drug delivery and formulation technologies, along with the advent of new antiparasitic molecules, have had a direct impact on market growth. Huge developments in aquaculture, an industry vulnerable to parasitic infestations, have also contributed to the dynamic characteristics of this market.Animal Internal Parasiticide Market Segmentation analysis

The Global Animal Internal Parasiticide is segmented by Type, Application, and Region. By Type, the market is divided into Distributed Endoparasiticides, Ectoparasiticides, Endectocides . The Application segment categorizes the market based on its usage such as Farms, R&D Facilities, Veterinary Clinics. Geographically, the market is assessed across key Regions like {regionNms} and others, each presenting distinct growth opportunities and challenges influenced by the regions.Competitive Landscape

The major players in this competitive landscape of the animal internal parasiticidal market are primarily global pharmaceutical firms and animal health manufacturers, such as Zoetis, Merck Animal Health, Boehringer Ingelheim, Elanco, and Bayer Animal Health. The companies manufacture and market a variety of antiparasitic drugs that include formulations effective for internal parasites such as worms, protozoa, and flukes in livestock, companion animals, and poultry. Such factors, among others, are propelling the market growth by demanding treatments that are efficient and effective for parasitic infections, livestock farming, and increasing pets owned by individuals. Competitive advantages stem from product innovation, regulatory approvals, and strategic collaborations.Challenges In Animal Internal Parasiticide Market

With parasite resistance to existing therapeutic measures increasing day by day, the market for internal parasiticides for use in animals faces numerous challenges. Misuses of antiparasitic agents have selected for resistance in internal parasites, which, in turn, has rendered dewormers ineffective. Hence, there is an urgent need for the fabrication of psychotropic formulations, but for manufacturers, the hurdles are delayed patents and the indispensable high cost of the new drug development. Another daunting challenge is posed by the rising organic and chemical-free trends in the livestock products market. Synthetic parasiticides are now under more scrutiny than ever before. The consumers and regulators are clamouring for safer substitutes that will, thus, prompt the companies to engage in research and development for herbal or biological alternatives. Limited awareness and access to effective parasiticides in developing areas also hinder the growth of this market, wherein many livestock owners lack the financial resources and knowledge to put in place proper parasite control programs. An industry-wide effort with investment in sustainable solutions and improvement in education on parasite management will be necessary to address these challenges.Risks & Prospects in Animal Internal Parasiticide Market

Besides, the advent of new veterinary pharmaceuticals and new broad-spectrum parasiticides presents opportunities for market participants. The European region dominates the animal internal parasiticide market at the moment, due to a high awareness of animal health care and high spending on animal welfare. Key countries that contribute to the European market include Germany, France, and the U.K. Meanwhile, North America shares a considerable market for the same reason, that is, high pet ownership and a well-established veterinary health care system. The highest growth in animal internal parasiticides will be seen from the Asia-Pacific region, which is projected to grow on account of increasing livestock numbers, changing pet adoption patterns, and better awareness regarding animal health. Regional dynamics thus require customized approaches to fulfil specific market needs and harvest emerging opportunities in the animal internal parasiticides market.Key Target Audience

, Livestock farmers and producers form the primary target audience for the Animal Internal Parasiticide Market. Animals are treated for the well-being and productivity of their herds and flocks. Fortifying their case for using antiparasitic drugs is prevention against economic losses due to parasitic infections, animal welfare concerns, and food safety regulations. Another crucial target audience would be veterinarians, who prescribe and recommend parasiticides and offer guidance regarding an entire range of strategies for parasite management and treatment protocols., Aquaculture farmers are entering the fray as an emerging concern. The farmers need parasiticides for fish and shellfish affected by internal parasites useful in affecting production yields. Therefore, distributors of animal health products, retailers including feed stores and online platforms, play an important role in reaching these end-users. The successful addressing of needs and concerns of these diverse target personas shall become the criteria for commercial survival in the market, presenting them with the most reliable, safe, and effective antiparazitic solutions.Merger and acquisition

Over the past few decades, the animal internal parasiticide market has witnessed a fair number of M&A, suggestive of most leading companies' strategic attempts to improve their product offerings and extend their presence further globally. In September 2022, an animal health giant, Zoetis Inc., acquired Jurox, an Australian-based veterinary pharmaceutical firm. This acquisition was part of an effort to strengthen the parasiticide offering of Zoetis, specifically in markets like that of the United States, Canada, and the United Kingdom. On the other hand, the acquisition of Bayer's Animal Health by Elanco Animal Health enabled the enhancement of Elanco's parasiticide product range and solidified its position on the global stage. With the acquisition of Merial from Sanofi, Boehringer Ingelheim enhanced its own position in the parasiticides market. These strategic considerations in view indicate a movement toward consolidation in the animal health sector as companies seek to fill their product pipeline and further capitalize on their market." >Analyst Comment

The animal internal parasiticide market is growing steadily, mainly due to rising demand for animal proteins, growing pet ownership, and increasing awareness of animal health and welfare. Livestock production, especially in developing economies, is another major driver since farmers want to maximize yields and save their animals from parasitic diseases. Companion animals too are expanding since there is an increasing expenditure towards preventive care and treatment of pets by their owners. Advancement in drug delivery and formulation technologies is making parasiticides more effective and convenient for use, thus aiding in the market growth.- 1.1 Report description

- 1.2 Key market segments

- 1.3 Key benefits to the stakeholders

2: Executive Summary

- 2.1 Animal Internal Parasiticide- Snapshot

- 2.2 Animal Internal Parasiticide- Segment Snapshot

- 2.3 Animal Internal Parasiticide- Competitive Landscape Snapshot

3: Market Overview

- 3.1 Market definition and scope

- 3.2 Key findings

- 3.2.1 Top impacting factors

- 3.2.2 Top investment pockets

- 3.3 Porter’s five forces analysis

- 3.3.1 Low bargaining power of suppliers

- 3.3.2 Low threat of new entrants

- 3.3.3 Low threat of substitutes

- 3.3.4 Low intensity of rivalry

- 3.3.5 Low bargaining power of buyers

- 3.4 Market dynamics

- 3.4.1 Drivers

- 3.4.2 Restraints

- 3.4.3 Opportunities

4: Animal Internal Parasiticide Market by Type

- 4.1 Overview

- 4.1.1 Market size and forecast

- 4.2 Endoparasiticides

- 4.2.1 Key market trends, factors driving growth, and opportunities

- 4.2.2 Market size and forecast, by region

- 4.2.3 Market share analysis by country

- 4.3 Ectoparasiticides

- 4.3.1 Key market trends, factors driving growth, and opportunities

- 4.3.2 Market size and forecast, by region

- 4.3.3 Market share analysis by country

- 4.4 Endectocides

- 4.4.1 Key market trends, factors driving growth, and opportunities

- 4.4.2 Market size and forecast, by region

- 4.4.3 Market share analysis by country

5: Animal Internal Parasiticide Market by Application / by End Use

- 5.1 Overview

- 5.1.1 Market size and forecast

- 5.2 R&D Facilities

- 5.2.1 Key market trends, factors driving growth, and opportunities

- 5.2.2 Market size and forecast, by region

- 5.2.3 Market share analysis by country

- 5.3 Farms

- 5.3.1 Key market trends, factors driving growth, and opportunities

- 5.3.2 Market size and forecast, by region

- 5.3.3 Market share analysis by country

- 5.4 Veterinary Clinics

- 5.4.1 Key market trends, factors driving growth, and opportunities

- 5.4.2 Market size and forecast, by region

- 5.4.3 Market share analysis by country

6: Animal Internal Parasiticide Market by Animal Type

- 6.1 Overview

- 6.1.1 Market size and forecast

- 6.2 Cats

- 6.2.1 Key market trends, factors driving growth, and opportunities

- 6.2.2 Market size and forecast, by region

- 6.2.3 Market share analysis by country

- 6.3 Dogs

- 6.3.1 Key market trends, factors driving growth, and opportunities

- 6.3.2 Market size and forecast, by region

- 6.3.3 Market share analysis by country

- 6.4 Pigs

- 6.4.1 Key market trends, factors driving growth, and opportunities

- 6.4.2 Market size and forecast, by region

- 6.4.3 Market share analysis by country

- 6.5 Cattle

- 6.5.1 Key market trends, factors driving growth, and opportunities

- 6.5.2 Market size and forecast, by region

- 6.5.3 Market share analysis by country

- 6.6 Goats

- 6.6.1 Key market trends, factors driving growth, and opportunities

- 6.6.2 Market size and forecast, by region

- 6.6.3 Market share analysis by country

- 6.7 Sheep

- 6.7.1 Key market trends, factors driving growth, and opportunities

- 6.7.2 Market size and forecast, by region

- 6.7.3 Market share analysis by country

- 6.8 Others

- 6.8.1 Key market trends, factors driving growth, and opportunities

- 6.8.2 Market size and forecast, by region

- 6.8.3 Market share analysis by country

7: Competitive Landscape

- 7.1 Overview

- 7.2 Key Winning Strategies

- 7.3 Top 10 Players: Product Mapping

- 7.4 Competitive Analysis Dashboard

- 7.5 Market Competition Heatmap

- 7.6 Leading Player Positions, 2022

8: Company Profiles

- 8.1 Eli Lilly and Company

- 8.1.1 Company Overview

- 8.1.2 Key Executives

- 8.1.3 Company snapshot

- 8.1.4 Active Business Divisions

- 8.1.5 Product portfolio

- 8.1.6 Business performance

- 8.1.7 Major Strategic Initiatives and Developments

- 8.2 Sanofi

- 8.2.1 Company Overview

- 8.2.2 Key Executives

- 8.2.3 Company snapshot

- 8.2.4 Active Business Divisions

- 8.2.5 Product portfolio

- 8.2.6 Business performance

- 8.2.7 Major Strategic Initiatives and Developments

- 8.3 Virbac

- 8.3.1 Company Overview

- 8.3.2 Key Executives

- 8.3.3 Company snapshot

- 8.3.4 Active Business Divisions

- 8.3.5 Product portfolio

- 8.3.6 Business performance

- 8.3.7 Major Strategic Initiatives and Developments

- 8.4 Zoetis

- 8.4.1 Company Overview

- 8.4.2 Key Executives

- 8.4.3 Company snapshot

- 8.4.4 Active Business Divisions

- 8.4.5 Product portfolio

- 8.4.6 Business performance

- 8.4.7 Major Strategic Initiatives and Developments

- 8.5 Inc.

- 8.5.1 Company Overview

- 8.5.2 Key Executives

- 8.5.3 Company snapshot

- 8.5.4 Active Business Divisions

- 8.5.5 Product portfolio

- 8.5.6 Business performance

- 8.5.7 Major Strategic Initiatives and Developments

- 8.6 Ceva Sante Animale

- 8.6.1 Company Overview

- 8.6.2 Key Executives

- 8.6.3 Company snapshot

- 8.6.4 Active Business Divisions

- 8.6.5 Product portfolio

- 8.6.6 Business performance

- 8.6.7 Major Strategic Initiatives and Developments

- 8.7 Vetoquinol S.A.

- 8.7.1 Company Overview

- 8.7.2 Key Executives

- 8.7.3 Company snapshot

- 8.7.4 Active Business Divisions

- 8.7.5 Product portfolio

- 8.7.6 Business performance

- 8.7.7 Major Strategic Initiatives and Developments

- 8.8 Merck and Co.

- 8.8.1 Company Overview

- 8.8.2 Key Executives

- 8.8.3 Company snapshot

- 8.8.4 Active Business Divisions

- 8.8.5 Product portfolio

- 8.8.6 Business performance

- 8.8.7 Major Strategic Initiatives and Developments

- 8.9 Inc.

- 8.9.1 Company Overview

- 8.9.2 Key Executives

- 8.9.3 Company snapshot

- 8.9.4 Active Business Divisions

- 8.9.5 Product portfolio

- 8.9.6 Business performance

- 8.9.7 Major Strategic Initiatives and Developments

- 8.10 Perrigo Company

- 8.10.1 Company Overview

- 8.10.2 Key Executives

- 8.10.3 Company snapshot

- 8.10.4 Active Business Divisions

- 8.10.5 Product portfolio

- 8.10.6 Business performance

- 8.10.7 Major Strategic Initiatives and Developments

- 8.11 Boehringer Ingelheim

- 8.11.1 Company Overview

- 8.11.2 Key Executives

- 8.11.3 Company snapshot

- 8.11.4 Active Business Divisions

- 8.11.5 Product portfolio

- 8.11.6 Business performance

- 8.11.7 Major Strategic Initiatives and Developments

- 8.12 Bayer AG

- 8.12.1 Company Overview

- 8.12.2 Key Executives

- 8.12.3 Company snapshot

- 8.12.4 Active Business Divisions

- 8.12.5 Product portfolio

- 8.12.6 Business performance

- 8.12.7 Major Strategic Initiatives and Developments

9: Analyst Perspective and Conclusion

- 9.1 Concluding Recommendations and Analysis

- 9.2 Strategies for Market Potential

Scope of Report

| Aspects | Details |

|---|---|

By Type |

|

By Application |

|

By Animal Type |

|

Report Licenses

Our Team

Frequently Asked Questions (FAQ):

What is the estimated market size of Animal Internal Parasiticide in 2030?

+

-

Which type of Animal Internal Parasiticide is widely popular?

+

-

What is the growth rate of Animal Internal Parasiticide Market?

+

-

What are the latest trends influencing the Animal Internal Parasiticide Market?

+

-

Who are the key players in the Animal Internal Parasiticide Market?

+

-

How is the Animal Internal Parasiticide } industry progressing in scaling its end-use implementations?

+

-

What product types are analyzed in the Animal Internal Parasiticide Market Study?

+

-

What geographic breakdown is available in Global Animal Internal Parasiticide Market Study?

+

-

Which region holds the second position by market share in the Animal Internal Parasiticide market?

+

-

Which region holds the highest growth rate in the Animal Internal Parasiticide market?

+

-