Global Alternate Marine Power Market – Industry Trends and Forecast to 2030

Report ID: MS-677 | Energy and Natural Resources | Last updated: Apr, 2025 | Formats*:

Alternate Marine Power Report Highlights

| Report Metrics | Details |

|---|---|

| Forecast period | 2019-2030 |

| Base Year Of Estimation | 2024 |

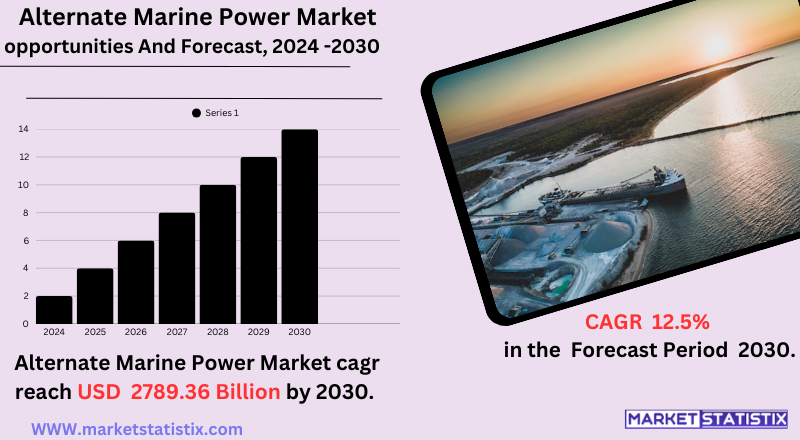

| Growth Rate | CAGR of 12.5% |

| Forecast Value (2030) | USD 2789.36 Billion |

| By Product Type | Battery Systems, Liquefied Natural Gas (LNG), Hybrid Propulsion, Fuel Cells, Hydrotreated Vegetable Oil (HVO), Liquefied Biogas (LBG), Others |

| Key Market Players |

|

| By Region |

Alternate Marine Power Market Trends

Government directives, financial incentives, and measures intended to promote the enhanced uptake of AMP installations in major ports across the world will bolster these trends. This includes technological developments in power conversion and connection systems geared toward enhancing the cost-effective application of AMP for ports-imposed costs on shipping. Furthermore, there are several standardization efforts underway geared toward achieving compatibility among many sorts of vessels and ports that is significant for mass-scale implementation. The growing trend in the development of joint ventures or partnerships or consortia or public-private partnerships between port authorities or port managers and shipping companies with the technology developers for establishing and operating the AMP infrastructure facilities. This considers shore-side power installations and retrofitting existing ships or the construction of brand-new ones with AMP capabilities. There is a significant level of buzz surrounding integrating AMP with renewable sources of energy like solar and wind, further reducing the already low carbon footprint for port operations.Alternate Marine Power Market Leading Players

The key players profiled in the report are General Electric, Schneider Electric, ABB, Rolls-Royce, Wartsila, Hyundai Heavy Industries, Kongsberg Gruppen, Siemens, MAN Energy Solutions, Parker Hannifin, Hempel, EcoMarine Power, Caterpillar, Cavotec, DNV GLGrowth Accelerators

The AMP (Alternate Marine Power) market is being driven forward primarily by the erstwhile environmental regulations on ships while at berth aimed at cutting air pollution and greenhouse gas emissions. In the meantime, every port city globally has been under environmental governance wherein emission control areas (ECAs) or any such regulations are forcing vessels to switch to cleaner energy alternatives. Public consciousness and pressure over health implications related to port pollution have begun to assume importance, as communities near ports demand cleaner air. Economic incentives and financing options provided by governments and port authorities have driven the AMP implementation even further. Numerous ports have reduced docking fees and extended other financial incentives to vessels using shore power. The steady expansion of shore-side power infrastructure in both availability and reliability, combined with an increase in AMP-compatible vessels, is further supporting the growth of this market. In general, regulatory pressure, environmental consciousness, and economic incentives have created a confluence of factors that undeniably sustain demand for AMP solutions.Alternate Marine Power Market Segmentation analysis

The Global Alternate Marine Power is segmented by Type, Application, and Region. By Type, the market is divided into Distributed Battery Systems, Liquefied Natural Gas (LNG), Hybrid Propulsion, Fuel Cells, Hydrotreated Vegetable Oil (HVO), Liquefied Biogas (LBG), Others . The Application segment categorizes the market based on its usage such as Cruise Ships, Ships, Bulk Carriers, Others. Geographically, the market is assessed across key Regions like {regionNms} and others, each presenting distinct growth opportunities and challenges influenced by the regions.Competitive Landscape

The AMP market is experiencing an increase in the number of players, which include electrical infrastructure providers, manufacturers of port equipment, and specialized engineering firms. Competition is increasingly built on the tendency of ports worldwide to apply stricter environmental regulations so as to find shore power solutions. The key competitive factors include the reliability, efficiency, and cost-effectiveness of AMP systems offered by suppliers, as well as the capacity to provide the correct power to the various vessel types. Companies have begun to promote their capacity to offer entire solutions ranging from the design process to installation and maintenance. Moreover, standardization and interoperability are going to be important competitive areas as well. Offering solutions that conform to international standards and ensure seamless connectivity among various ports and vessels is a competitive advantage. Great emphasis on sustainability and decarbonization would further heighten competition for companies to evolve more intelligent and greener AMP technologies.Challenges In Alternate Marine Power Market

The Alternate Marine Power (AMP) market has several key challenges preventing the AMP from being adopted widely. For instance, the up-front capital required for port infrastructure improvements and ship retrofitting constitutes an enormous barrier toward the adoption of AMP systems. Implementing AMP systems involves other significant costs for the enhancement of the electrical grid, shore-side connection equipment, and onboard modifications, greatly stressing both ports and shipping companies concerned financially. Apart from these, operational difficulties arise in terms of establishing seamless coordination among ports, shipping lines, and grid operators to ensure reliable power supply and connection procedures. The randomness of the power demand by the ship and the availability of electricity in the port can pose some challenges. Differences in regulation across various regions and poor enforcement of the pre-existing environmental regulations create a very uneasy situation for market growth.Risks & Prospects in Alternate Marine Power Market

Standardization of AMP infrastructure, increasing AMP potentials for different classes of ships, and interfacing smart grid technologies for efficient energy management are the key opportunities. Retrofitting existing ports and ships with AMP systems presents huge markets for engineering and installation services. The trend toward lower greenhouse gas emissions and better air quality in cities with ports is another reason for propelling AMP uptake, thereby attracting public and private investment. Region-wise, both Europe and North America remain the biggest markets for AMP due to the very rigid environmental regulations and huge port infrastructures. Asia-Pacific emerges as a new high-growth area because of the increased port traffic together with the growing environmental awareness in countries like China and Japan. Coastal areas with densely populated port cities, such as California and Northern Europe, are also able to draw great investments for AMP infrastructure.Key Target Audience

, The main target customers of the alternate marine power market are port authorities and terminal operators who build infrastructure and ensure environmental compliance in their facilities. They are the decision-makers in choosing the adoption and installation of AMP systems within different facilities. They are prompted by increasing environmental regulations, local air quality improvements, and sustainability for port operations., Another prospect is that shipping companies and cruising industries globally make up another significant audience in the market. They are mostly driven towards making less environmental footprint, legal obligations, and improved corporate social responsibility. Besides, electric grid operators and energy providers are major stakeholders, supplying the necessary power infrastructure and guaranteeing grid stability for AMP operations.Merger and acquisition

The AMP is an area in which deliberate mergers and acquisitions are being practiced to enhance sustainable energy solutions for marine operations. In March 2022, Aker Horizons ASA announced the potential merger with Aker Offshore Wind AS and Aker Clean Hydrogen AS. This merger was aimed at strengthening positions in renewable energy areas that include offshore wind and hydrogen production. A hoped-for outcome of the consolidation would be better access to financing, thus accelerating the development of large-scale hybrid decarbonization projects. Moreover, in July 2022, Mainstream Renewable Power and Aker Offshore Wind merged in an effort to create a renewable energy portfolio of 27 GW with a varied mix of solar, onshore wind, and offshore wind projects. The merger sought to combine Aker Offshore Wind's expertise in the floating offshore wind technical area with Mainstream's project development capabilities on a global scale. Both partners will now endeavour to unleash opportunities worldwide. >Analyst Comment

The Alternate Marine Power (AMP) market is gaining considerable momentum, attributed mainly to the increasing demand for environmental concern and the stringent controls on emissions from the maritime industry. The current market activity deals with the provision of shore-based electricity supply to the moored vessels to switch off their diesel engines and reduce air pollution and noise at port areas. Factors favouring the adoption of AMP systems include the global push towards sustainable shipping practices and the increasing awareness of the adverse health impacts related to port pollution.- 1.1 Report description

- 1.2 Key market segments

- 1.3 Key benefits to the stakeholders

2: Executive Summary

- 2.1 Alternate Marine Power- Snapshot

- 2.2 Alternate Marine Power- Segment Snapshot

- 2.3 Alternate Marine Power- Competitive Landscape Snapshot

3: Market Overview

- 3.1 Market definition and scope

- 3.2 Key findings

- 3.2.1 Top impacting factors

- 3.2.2 Top investment pockets

- 3.3 Porter’s five forces analysis

- 3.3.1 Low bargaining power of suppliers

- 3.3.2 Low threat of new entrants

- 3.3.3 Low threat of substitutes

- 3.3.4 Low intensity of rivalry

- 3.3.5 Low bargaining power of buyers

- 3.4 Market dynamics

- 3.4.1 Drivers

- 3.4.2 Restraints

- 3.4.3 Opportunities

4: Alternate Marine Power Market by Type

- 4.1 Overview

- 4.1.1 Market size and forecast

- 4.2 Battery Systems

- 4.2.1 Key market trends, factors driving growth, and opportunities

- 4.2.2 Market size and forecast, by region

- 4.2.3 Market share analysis by country

- 4.3 Hybrid Propulsion

- 4.3.1 Key market trends, factors driving growth, and opportunities

- 4.3.2 Market size and forecast, by region

- 4.3.3 Market share analysis by country

- 4.4 Fuel Cells

- 4.4.1 Key market trends, factors driving growth, and opportunities

- 4.4.2 Market size and forecast, by region

- 4.4.3 Market share analysis by country

- 4.5 Liquefied Natural Gas (LNG)

- 4.5.1 Key market trends, factors driving growth, and opportunities

- 4.5.2 Market size and forecast, by region

- 4.5.3 Market share analysis by country

- 4.6 Liquefied Biogas (LBG)

- 4.6.1 Key market trends, factors driving growth, and opportunities

- 4.6.2 Market size and forecast, by region

- 4.6.3 Market share analysis by country

- 4.7 Hydrotreated Vegetable Oil (HVO)

- 4.7.1 Key market trends, factors driving growth, and opportunities

- 4.7.2 Market size and forecast, by region

- 4.7.3 Market share analysis by country

- 4.8 Others

- 4.8.1 Key market trends, factors driving growth, and opportunities

- 4.8.2 Market size and forecast, by region

- 4.8.3 Market share analysis by country

5: Alternate Marine Power Market by Application / by End Use

- 5.1 Overview

- 5.1.1 Market size and forecast

- 5.2 Ships

- 5.2.1 Key market trends, factors driving growth, and opportunities

- 5.2.2 Market size and forecast, by region

- 5.2.3 Market share analysis by country

- 5.3 Bulk Carriers

- 5.3.1 Key market trends, factors driving growth, and opportunities

- 5.3.2 Market size and forecast, by region

- 5.3.3 Market share analysis by country

- 5.4 Cruise Ships

- 5.4.1 Key market trends, factors driving growth, and opportunities

- 5.4.2 Market size and forecast, by region

- 5.4.3 Market share analysis by country

- 5.5 Others

- 5.5.1 Key market trends, factors driving growth, and opportunities

- 5.5.2 Market size and forecast, by region

- 5.5.3 Market share analysis by country

6: Competitive Landscape

- 6.1 Overview

- 6.2 Key Winning Strategies

- 6.3 Top 10 Players: Product Mapping

- 6.4 Competitive Analysis Dashboard

- 6.5 Market Competition Heatmap

- 6.6 Leading Player Positions, 2022

7: Company Profiles

- 7.1 Kongsberg Gruppen

- 7.1.1 Company Overview

- 7.1.2 Key Executives

- 7.1.3 Company snapshot

- 7.1.4 Active Business Divisions

- 7.1.5 Product portfolio

- 7.1.6 Business performance

- 7.1.7 Major Strategic Initiatives and Developments

- 7.2 Parker Hannifin

- 7.2.1 Company Overview

- 7.2.2 Key Executives

- 7.2.3 Company snapshot

- 7.2.4 Active Business Divisions

- 7.2.5 Product portfolio

- 7.2.6 Business performance

- 7.2.7 Major Strategic Initiatives and Developments

- 7.3 Hempel

- 7.3.1 Company Overview

- 7.3.2 Key Executives

- 7.3.3 Company snapshot

- 7.3.4 Active Business Divisions

- 7.3.5 Product portfolio

- 7.3.6 Business performance

- 7.3.7 Major Strategic Initiatives and Developments

- 7.4 Rolls-Royce

- 7.4.1 Company Overview

- 7.4.2 Key Executives

- 7.4.3 Company snapshot

- 7.4.4 Active Business Divisions

- 7.4.5 Product portfolio

- 7.4.6 Business performance

- 7.4.7 Major Strategic Initiatives and Developments

- 7.5 MAN Energy Solutions

- 7.5.1 Company Overview

- 7.5.2 Key Executives

- 7.5.3 Company snapshot

- 7.5.4 Active Business Divisions

- 7.5.5 Product portfolio

- 7.5.6 Business performance

- 7.5.7 Major Strategic Initiatives and Developments

- 7.6 Cavotec

- 7.6.1 Company Overview

- 7.6.2 Key Executives

- 7.6.3 Company snapshot

- 7.6.4 Active Business Divisions

- 7.6.5 Product portfolio

- 7.6.6 Business performance

- 7.6.7 Major Strategic Initiatives and Developments

- 7.7 General Electric

- 7.7.1 Company Overview

- 7.7.2 Key Executives

- 7.7.3 Company snapshot

- 7.7.4 Active Business Divisions

- 7.7.5 Product portfolio

- 7.7.6 Business performance

- 7.7.7 Major Strategic Initiatives and Developments

- 7.8 Caterpillar

- 7.8.1 Company Overview

- 7.8.2 Key Executives

- 7.8.3 Company snapshot

- 7.8.4 Active Business Divisions

- 7.8.5 Product portfolio

- 7.8.6 Business performance

- 7.8.7 Major Strategic Initiatives and Developments

- 7.9 ABB

- 7.9.1 Company Overview

- 7.9.2 Key Executives

- 7.9.3 Company snapshot

- 7.9.4 Active Business Divisions

- 7.9.5 Product portfolio

- 7.9.6 Business performance

- 7.9.7 Major Strategic Initiatives and Developments

- 7.10 Wartsila

- 7.10.1 Company Overview

- 7.10.2 Key Executives

- 7.10.3 Company snapshot

- 7.10.4 Active Business Divisions

- 7.10.5 Product portfolio

- 7.10.6 Business performance

- 7.10.7 Major Strategic Initiatives and Developments

- 7.11 Schneider Electric

- 7.11.1 Company Overview

- 7.11.2 Key Executives

- 7.11.3 Company snapshot

- 7.11.4 Active Business Divisions

- 7.11.5 Product portfolio

- 7.11.6 Business performance

- 7.11.7 Major Strategic Initiatives and Developments

- 7.12 EcoMarine Power

- 7.12.1 Company Overview

- 7.12.2 Key Executives

- 7.12.3 Company snapshot

- 7.12.4 Active Business Divisions

- 7.12.5 Product portfolio

- 7.12.6 Business performance

- 7.12.7 Major Strategic Initiatives and Developments

- 7.13 Siemens

- 7.13.1 Company Overview

- 7.13.2 Key Executives

- 7.13.3 Company snapshot

- 7.13.4 Active Business Divisions

- 7.13.5 Product portfolio

- 7.13.6 Business performance

- 7.13.7 Major Strategic Initiatives and Developments

- 7.14 Hyundai Heavy Industries

- 7.14.1 Company Overview

- 7.14.2 Key Executives

- 7.14.3 Company snapshot

- 7.14.4 Active Business Divisions

- 7.14.5 Product portfolio

- 7.14.6 Business performance

- 7.14.7 Major Strategic Initiatives and Developments

- 7.15 DNV GL

- 7.15.1 Company Overview

- 7.15.2 Key Executives

- 7.15.3 Company snapshot

- 7.15.4 Active Business Divisions

- 7.15.5 Product portfolio

- 7.15.6 Business performance

- 7.15.7 Major Strategic Initiatives and Developments

8: Analyst Perspective and Conclusion

- 8.1 Concluding Recommendations and Analysis

- 8.2 Strategies for Market Potential

Scope of Report

| Aspects | Details |

|---|---|

By Type |

|

By Application |

|

Report Licenses

Our Team

Frequently Asked Questions (FAQ):

What is the projected market size of Alternate Marine Power in 2030?

+

-

Which application type is expected to remain the largest segment in the Global Alternate Marine Power market?

+

-

How big is the Global Alternate Marine Power market?

+

-

How do regulatory policies impact the Alternate Marine Power Market?

+

-

What major players in Alternate Marine Power Market?

+

-

What applications are categorized in the Alternate Marine Power market study?

+

-

Which product types are examined in the Alternate Marine Power Market Study?

+

-

Which regions are expected to show the fastest growth in the Alternate Marine Power market?

+

-

Which application holds the second-highest market share in the Alternate Marine Power market?

+

-

What are the major growth drivers in the Alternate Marine Power market?

+

-