Global Agriculture Customer Segmentation Market Size, Share & Trends Analysis Report, Forecast Period, 2025-2030

Report ID: MS-2598 | Agriculture | Last updated: May, 2025 | Formats*:

The agriculture customer segmentation market is concerned with segmenting farmers and other agricultural stakeholders into separate groups according to common characteristics and needs. This enables companies engaged in agriculture, including input suppliers, equipment makers, and service providers, to customise their products, services, marketing strategies, and overall approach to suit the unique needs of various customer segments. These segments may be differentiated by many factors, such as farm size, type of crop, geographic area, farming systems (conventional, organic, precision), income classes, rates of technology adoption, and even the age group of the farmer.

And by knowing all these various segments, agricultural companies can craft more focused strategies, which translate to higher customer satisfaction, better resource allocation, and eventually business expansion in the agricultural industry. For example, an enterprise selling sophisticated irrigation equipment can focus on massive commercial farmers operating in dry areas while selling cheaper and simpler devices to small farmers in other regions.

Agriculture Customer Segmentation Report Highlights

| Report Metrics | Details |

|---|---|

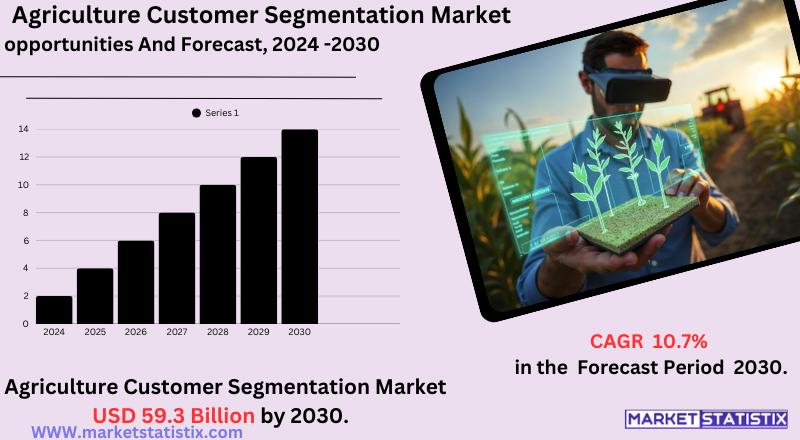

| Forecast period | 2019-2030 |

| Base Year Of Estimation | 2024 |

| Growth Rate | CAGR of 10.7% |

| Forecast Value (2030) | USD 59.3 Billion |

| Key Market Players |

|

| By Region |

|

Agriculture Customer Segmentation Market Trends

The agriculture customer segmentation industry is seeing a number of important trends that are influencing the way agricultural companies engage with their customers. To begin with, there is increasing focus on data-driven segmentation, using sophisticated analytics and technologies such as AI and IoT to capture in-depth data about farmers. This enables more accurate targeting of needs based on criteria such as real-time field information, usage of machinery, and past buying behaviour, shifting away from conventional demographic or geographic segmentation.

Sustainability is becoming a key driver of customer segmentation in agriculture. As more focus is being placed on sustainable farming practices, businesses are segmenting customers according to their adherence to environmentally friendly and resource-conserving farming practices. This not only addresses the rising demand for sustainable products but also supports global initiatives such as the EU Green Deal, which encourages environmental stewardship in agriculture.

Agriculture Customer Segmentation Market Leading Players

The key players profiled in the report are GAMAYA, Microsoft, LINK LABS., Orange Business Services, Decisive Farming, Iteris, Inc., SWIIM System, Ltd., Trimble Inc., Cisco Systems Inc., IBM Corporation, Ag Leader Technology, Iteris Inc.Growth Accelerators

The Agriculture Customer Segmentation Market Drivers Analysis identifies a number of important drivers propelling its growth. To begin with, the growing use of precision farming and high-tech farm equipment creates a need for a better understanding of various farmer segments according to their technology adoption and requirements. This enables companies to provide customized solutions, stimulating the need for segmentation solutions and services.

Second, increasing focus on environmentally friendly and sustainable agricultural practices is giving rise to differentiated customer groups with unique needs for organic products, climate-tolerant options, and ecologically friendly cultivation practices. This calls for segmentation to target such changing needs properly. Lastly, the emergence of digital platforms and online shopping in agriculture offers additional data and direct contact with farmers, allowing more precise and better customer segmentation efforts for companies to target particular farmer segments with specific offerings.

Agriculture Customer Segmentation Market Segmentation analysis

The Global Agriculture Customer Segmentation is segmented by Application, and Region. . The Application segment categorizes the market based on its usage such as Pre-Production Management, In-Production Management, Post-Production Management. Geographically, the market is assessed across key Regions like North America (United States, Canada, Mexico), South America (Brazil, Argentina, Chile, Rest of South America), Europe (Germany, France, Italy, United Kingdom, Benelux, Nordics, Rest of Europe), Asia Pacific (China, Japan, India, South Korea, Australia, Southeast Asia, Rest of Asia-Pacific), MEA (Middle East, Africa) and others, each presenting distinct growth opportunities and challenges influenced by the regions.Competitive Landscape

The Competitive Landscape Analysis of the agriculture customer segmentation market shows an increasing but still emerging industry. Presently, the market is dominated by a combination of ag-tech firms, data analytics vendors, and consulting agencies. Some traditional players in the larger agricultural industry are also starting to incorporate customer segmentation into their products. Competition is based on the elegance of the segmentation models, the data correctness used, the ease of use of the platforms, and actionable insights that can be obtained for agricultural firms.

The most important competitive drivers are the capacity to aggregate disparate data points (e.g., farm size, crop yield, soil data, purchase history), advanced analytics and AI-enabled identification of impactful segments, and the ability to deliver personalised suggestions for product innovation, marketing, and sales tactics. With the farming sector increasingly turning to data-driven decision-making, demand for good customer segmentation tools and services will grow and lead to more innovation and perhaps clearer market leaders in the future.

Challenges In Agriculture Customer Segmentation Market

The market for agriculture customer segmentation is confronted with a number of significant challenges, most of which arise from the complexity and diversity of the agricultural industry. One of the most significant challenges is data collection and management: collecting accurate, complete, and current data on diverse farm sizes, crop types, geographic locations, and levels of technology adoption is both resource-constrained and logistically challenging. Farming practice diversity and increasingly transient customer demands further complicate segmentation, making it difficult to sustain segmentation models that continue to be relevant and actionable in the long term.

Moreover, the dynamic nature of agriculture – including changing commodity prices, shifting regulatory environments, and uncertain environmental conditions – can rapidly make current customer segments outmoded or less effective. The absence of standardised data and the large disparity in digital literacy among farmers also prevent effective segmentation, especially in areas with a prevalence of smallholder or traditional farms. Consequently, agribusinesses can fail to match marketing and product approaches with the true needs of various farmer groups, thereby diminishing the effectiveness of targeted solutions and limiting the overall advantage of segmentation initiatives.

Risks & Prospects in Agriculture Customer Segmentation Market

The key opportunities lie in the take-up of cutting-edge analytics and segmentation tools to segment and serve by farm size, crop type, age group, technology adoption, and ownership structure. This allows companies to create tailored solutions – such as precision agriculture products for technology-enabled farmers or cost-effective packages for smallholders – and thus maximise resource allocation, increase customer satisfaction, and facilitate the shift to sustainable practices.

Geographically, the market is experiencing high activity in North America, Europe, and Asia-Pacific, with nations like the U.S., Canada, Germany, France, China, India, and Australia leading adoption and innovation. North America and Europe enjoy well-developed digital infrastructure and regulatory encouragement for sustainable agriculture, while Asia-Pacific offers high growth prospects due to increasing agri-tech investments and a large, diverse farming population. Segmentation parameters differ across regions, as farm size, ownership structures, and technology adoption vary, with developing economies presenting sizeable growth and product customisation opportunities. With increasingly mature regional markets, the capability to successfully segment and address agricultural customers effectively will be a major catalyst for competitive momentum and market expansion.

Key Target Audience

Agriculture customer segmentation industry is based on grouping farmers and agribusinesses into various categories using common traits such as farm size, crop types, geographical position, farming style, income groups, and rate of technology adaptation. Segmentation helps stakeholders in providing products, services, and marketing strategies accordingly tailored to individual group needs. For example, smallholder farmers might need low-cost, low-tech products, whereas large-scale commercial farmers might need high-tech, high-efficiency products. Recognising these differences makes it possible to more effectively engage and support various agricultural communities. Secondary stakeholders in this market are agricultural input companies, technology providers, financial institutions, and policymakers.

,

, Input companies and technology providers are able to create and provide products that meet each segment's specific requirements, increasing adoption and satisfaction. Financial institutions can contribute by providing customized financing packages that match the financial abilities and needs of various groups of farmers. Policymakers can leverage segmentation information to craft specific interventions and support programmes that cater to the specific problems of different segments in the agricultural sector.

Merger and acquisition

The agriculture customer segmentation market has seen significant mergers and acquisitions (M&A) activity during 2024, a reflection of strategic priorities around regional expansion, distribution channel integration, and technological innovation. For example, BASF's Agricultural Solutions division is gearing up for a stock market listing by 2027 to boost its share of seed revenue from 22% to 25%, buoyed by innovations like hybrid wheat and pest-resistant soybeans. This growth can include strategic partnerships and minor acquisitions, mainly in Asia, where the firm has minimal market share. Granite Creek Capital Partners also led a $50 million investment in Seedbox Solution, a firm that provides reusable seed boxes with smart-box technology to improve seed storage conditions. This investment will grow Seedbox's market share and enhance farming efficiency.

Moreover, the agrochemical sector has witnessed strong M&A action, especially across regional markets. Nutrien rolled out its global brand, Agroessence, by acquiring two historic input distributors in Brazil in an effort to achieve a countrywide agricultural distribution chain. Syngenta extended further its footprint in Brazil with the acquisition of an agricultural input’s distributor, its fourth distributor it has acquired in Brazil in three years. These moves are a signal towards increasing market penetration and improving distribution in major farming areas.

>

Analyst Comment

The agricultural customer segmentation market is a fast-growing industry that allows agribusinesses to segment farmers and stakeholders into specific groups on bases like farm size, type of crops, location, technology usage, and income levels. This segmentation enables businesses to specialise products, services, and marketing initiatives to the unique demands of every segment – for instance, providing high-tech precision farming equipment to technologically orientated commercial farmers or cost-effective options for smallholders. The use of segmentation tools, analytics, and consulting services is fuelling enhanced customer satisfaction, resource allocation optimisation, and increased innovation and enabling the general transition toward sustainable and climate-smart agriculture.

- 1.1 Report description

- 1.2 Key market segments

- 1.3 Key benefits to the stakeholders

2: Executive Summary

- 2.1 Agriculture Customer Segmentation- Snapshot

- 2.2 Agriculture Customer Segmentation- Segment Snapshot

- 2.3 Agriculture Customer Segmentation- Competitive Landscape Snapshot

3: Market Overview

- 3.1 Market definition and scope

- 3.2 Key findings

- 3.2.1 Top impacting factors

- 3.2.2 Top investment pockets

- 3.3 Porter’s five forces analysis

- 3.3.1 Low bargaining power of suppliers

- 3.3.2 Low threat of new entrants

- 3.3.3 Low threat of substitutes

- 3.3.4 Low intensity of rivalry

- 3.3.5 Low bargaining power of buyers

- 3.4 Market dynamics

- 3.4.1 Drivers

- 3.4.2 Restraints

- 3.4.3 Opportunities

4: Agriculture Customer Segmentation Market by Application / by End Use

- 4.1 Overview

- 4.1.1 Market size and forecast

- 4.2 Pre-Production Management

- 4.2.1 Key market trends, factors driving growth, and opportunities

- 4.2.2 Market size and forecast, by region

- 4.2.3 Market share analysis by country

- 4.3 In-Production Management

- 4.3.1 Key market trends, factors driving growth, and opportunities

- 4.3.2 Market size and forecast, by region

- 4.3.3 Market share analysis by country

- 4.4 Post-Production Management

- 4.4.1 Key market trends, factors driving growth, and opportunities

- 4.4.2 Market size and forecast, by region

- 4.4.3 Market share analysis by country

5: Agriculture Customer Segmentation Market by Region

- 5.1 Overview

- 5.1.1 Market size and forecast By Region

- 5.2 North America

- 5.2.1 Key trends and opportunities

- 5.2.2 Market size and forecast, by Type

- 5.2.3 Market size and forecast, by Application

- 5.2.4 Market size and forecast, by country

- 5.2.4.1 United States

- 5.2.4.1.1 Key market trends, factors driving growth, and opportunities

- 5.2.4.1.2 Market size and forecast, by Type

- 5.2.4.1.3 Market size and forecast, by Application

- 5.2.4.2 Canada

- 5.2.4.2.1 Key market trends, factors driving growth, and opportunities

- 5.2.4.2.2 Market size and forecast, by Type

- 5.2.4.2.3 Market size and forecast, by Application

- 5.2.4.3 Mexico

- 5.2.4.3.1 Key market trends, factors driving growth, and opportunities

- 5.2.4.3.2 Market size and forecast, by Type

- 5.2.4.3.3 Market size and forecast, by Application

- 5.2.4.1 United States

- 5.3 South America

- 5.3.1 Key trends and opportunities

- 5.3.2 Market size and forecast, by Type

- 5.3.3 Market size and forecast, by Application

- 5.3.4 Market size and forecast, by country

- 5.3.4.1 Brazil

- 5.3.4.1.1 Key market trends, factors driving growth, and opportunities

- 5.3.4.1.2 Market size and forecast, by Type

- 5.3.4.1.3 Market size and forecast, by Application

- 5.3.4.2 Argentina

- 5.3.4.2.1 Key market trends, factors driving growth, and opportunities

- 5.3.4.2.2 Market size and forecast, by Type

- 5.3.4.2.3 Market size and forecast, by Application

- 5.3.4.3 Chile

- 5.3.4.3.1 Key market trends, factors driving growth, and opportunities

- 5.3.4.3.2 Market size and forecast, by Type

- 5.3.4.3.3 Market size and forecast, by Application

- 5.3.4.4 Rest of South America

- 5.3.4.4.1 Key market trends, factors driving growth, and opportunities

- 5.3.4.4.2 Market size and forecast, by Type

- 5.3.4.4.3 Market size and forecast, by Application

- 5.3.4.1 Brazil

- 5.4 Europe

- 5.4.1 Key trends and opportunities

- 5.4.2 Market size and forecast, by Type

- 5.4.3 Market size and forecast, by Application

- 5.4.4 Market size and forecast, by country

- 5.4.4.1 Germany

- 5.4.4.1.1 Key market trends, factors driving growth, and opportunities

- 5.4.4.1.2 Market size and forecast, by Type

- 5.4.4.1.3 Market size and forecast, by Application

- 5.4.4.2 France

- 5.4.4.2.1 Key market trends, factors driving growth, and opportunities

- 5.4.4.2.2 Market size and forecast, by Type

- 5.4.4.2.3 Market size and forecast, by Application

- 5.4.4.3 Italy

- 5.4.4.3.1 Key market trends, factors driving growth, and opportunities

- 5.4.4.3.2 Market size and forecast, by Type

- 5.4.4.3.3 Market size and forecast, by Application

- 5.4.4.4 United Kingdom

- 5.4.4.4.1 Key market trends, factors driving growth, and opportunities

- 5.4.4.4.2 Market size and forecast, by Type

- 5.4.4.4.3 Market size and forecast, by Application

- 5.4.4.5 Benelux

- 5.4.4.5.1 Key market trends, factors driving growth, and opportunities

- 5.4.4.5.2 Market size and forecast, by Type

- 5.4.4.5.3 Market size and forecast, by Application

- 5.4.4.6 Nordics

- 5.4.4.6.1 Key market trends, factors driving growth, and opportunities

- 5.4.4.6.2 Market size and forecast, by Type

- 5.4.4.6.3 Market size and forecast, by Application

- 5.4.4.7 Rest of Europe

- 5.4.4.7.1 Key market trends, factors driving growth, and opportunities

- 5.4.4.7.2 Market size and forecast, by Type

- 5.4.4.7.3 Market size and forecast, by Application

- 5.4.4.1 Germany

- 5.5 Asia Pacific

- 5.5.1 Key trends and opportunities

- 5.5.2 Market size and forecast, by Type

- 5.5.3 Market size and forecast, by Application

- 5.5.4 Market size and forecast, by country

- 5.5.4.1 China

- 5.5.4.1.1 Key market trends, factors driving growth, and opportunities

- 5.5.4.1.2 Market size and forecast, by Type

- 5.5.4.1.3 Market size and forecast, by Application

- 5.5.4.2 Japan

- 5.5.4.2.1 Key market trends, factors driving growth, and opportunities

- 5.5.4.2.2 Market size and forecast, by Type

- 5.5.4.2.3 Market size and forecast, by Application

- 5.5.4.3 India

- 5.5.4.3.1 Key market trends, factors driving growth, and opportunities

- 5.5.4.3.2 Market size and forecast, by Type

- 5.5.4.3.3 Market size and forecast, by Application

- 5.5.4.4 South Korea

- 5.5.4.4.1 Key market trends, factors driving growth, and opportunities

- 5.5.4.4.2 Market size and forecast, by Type

- 5.5.4.4.3 Market size and forecast, by Application

- 5.5.4.5 Australia

- 5.5.4.5.1 Key market trends, factors driving growth, and opportunities

- 5.5.4.5.2 Market size and forecast, by Type

- 5.5.4.5.3 Market size and forecast, by Application

- 5.5.4.6 Southeast Asia

- 5.5.4.6.1 Key market trends, factors driving growth, and opportunities

- 5.5.4.6.2 Market size and forecast, by Type

- 5.5.4.6.3 Market size and forecast, by Application

- 5.5.4.7 Rest of Asia-Pacific

- 5.5.4.7.1 Key market trends, factors driving growth, and opportunities

- 5.5.4.7.2 Market size and forecast, by Type

- 5.5.4.7.3 Market size and forecast, by Application

- 5.5.4.1 China

- 5.6 MEA

- 5.6.1 Key trends and opportunities

- 5.6.2 Market size and forecast, by Type

- 5.6.3 Market size and forecast, by Application

- 5.6.4 Market size and forecast, by country

- 5.6.4.1 Middle East

- 5.6.4.1.1 Key market trends, factors driving growth, and opportunities

- 5.6.4.1.2 Market size and forecast, by Type

- 5.6.4.1.3 Market size and forecast, by Application

- 5.6.4.2 Africa

- 5.6.4.2.1 Key market trends, factors driving growth, and opportunities

- 5.6.4.2.2 Market size and forecast, by Type

- 5.6.4.2.3 Market size and forecast, by Application

- 5.6.4.1 Middle East

- 6.1 Overview

- 6.2 Key Winning Strategies

- 6.3 Top 10 Players: Product Mapping

- 6.4 Competitive Analysis Dashboard

- 6.5 Market Competition Heatmap

- 6.6 Leading Player Positions, 2022

7: Company Profiles

- 7.1 IBM Corporation

- 7.1.1 Company Overview

- 7.1.2 Key Executives

- 7.1.3 Company snapshot

- 7.1.4 Active Business Divisions

- 7.1.5 Product portfolio

- 7.1.6 Business performance

- 7.1.7 Major Strategic Initiatives and Developments

- 7.2 Microsoft

- 7.2.1 Company Overview

- 7.2.2 Key Executives

- 7.2.3 Company snapshot

- 7.2.4 Active Business Divisions

- 7.2.5 Product portfolio

- 7.2.6 Business performance

- 7.2.7 Major Strategic Initiatives and Developments

- 7.3 Cisco Systems Inc.

- 7.3.1 Company Overview

- 7.3.2 Key Executives

- 7.3.3 Company snapshot

- 7.3.4 Active Business Divisions

- 7.3.5 Product portfolio

- 7.3.6 Business performance

- 7.3.7 Major Strategic Initiatives and Developments

- 7.4 Iteris

- 7.4.1 Company Overview

- 7.4.2 Key Executives

- 7.4.3 Company snapshot

- 7.4.4 Active Business Divisions

- 7.4.5 Product portfolio

- 7.4.6 Business performance

- 7.4.7 Major Strategic Initiatives and Developments

- 7.5 Inc.

- 7.5.1 Company Overview

- 7.5.2 Key Executives

- 7.5.3 Company snapshot

- 7.5.4 Active Business Divisions

- 7.5.5 Product portfolio

- 7.5.6 Business performance

- 7.5.7 Major Strategic Initiatives and Developments

- 7.6 Trimble Inc.

- 7.6.1 Company Overview

- 7.6.2 Key Executives

- 7.6.3 Company snapshot

- 7.6.4 Active Business Divisions

- 7.6.5 Product portfolio

- 7.6.6 Business performance

- 7.6.7 Major Strategic Initiatives and Developments

- 7.7 Ag Leader Technology

- 7.7.1 Company Overview

- 7.7.2 Key Executives

- 7.7.3 Company snapshot

- 7.7.4 Active Business Divisions

- 7.7.5 Product portfolio

- 7.7.6 Business performance

- 7.7.7 Major Strategic Initiatives and Developments

- 7.8 Decisive Farming

- 7.8.1 Company Overview

- 7.8.2 Key Executives

- 7.8.3 Company snapshot

- 7.8.4 Active Business Divisions

- 7.8.5 Product portfolio

- 7.8.6 Business performance

- 7.8.7 Major Strategic Initiatives and Developments

- 7.9 GAMAYA

- 7.9.1 Company Overview

- 7.9.2 Key Executives

- 7.9.3 Company snapshot

- 7.9.4 Active Business Divisions

- 7.9.5 Product portfolio

- 7.9.6 Business performance

- 7.9.7 Major Strategic Initiatives and Developments

- 7.10 SWIIM System

- 7.10.1 Company Overview

- 7.10.2 Key Executives

- 7.10.3 Company snapshot

- 7.10.4 Active Business Divisions

- 7.10.5 Product portfolio

- 7.10.6 Business performance

- 7.10.7 Major Strategic Initiatives and Developments

- 7.11 Ltd.

- 7.11.1 Company Overview

- 7.11.2 Key Executives

- 7.11.3 Company snapshot

- 7.11.4 Active Business Divisions

- 7.11.5 Product portfolio

- 7.11.6 Business performance

- 7.11.7 Major Strategic Initiatives and Developments

- 7.12 Orange Business Services

- 7.12.1 Company Overview

- 7.12.2 Key Executives

- 7.12.3 Company snapshot

- 7.12.4 Active Business Divisions

- 7.12.5 Product portfolio

- 7.12.6 Business performance

- 7.12.7 Major Strategic Initiatives and Developments

- 7.13 LINK LABS.

- 7.13.1 Company Overview

- 7.13.2 Key Executives

- 7.13.3 Company snapshot

- 7.13.4 Active Business Divisions

- 7.13.5 Product portfolio

- 7.13.6 Business performance

- 7.13.7 Major Strategic Initiatives and Developments

- 7.14 Iteris Inc.

- 7.14.1 Company Overview

- 7.14.2 Key Executives

- 7.14.3 Company snapshot

- 7.14.4 Active Business Divisions

- 7.14.5 Product portfolio

- 7.14.6 Business performance

- 7.14.7 Major Strategic Initiatives and Developments

8: Analyst Perspective and Conclusion

- 8.1 Concluding Recommendations and Analysis

- 8.2 Strategies for Market Potential

Scope of Report

| Aspects | Details |

|---|---|

By Application |

|

Report Licenses

Our Team

Frequently Asked Questions (FAQ):

What is the estimated market size of Agriculture Customer Segmentation in 2030?

+

-

What is the growth rate of Agriculture Customer Segmentation Market?

+

-

What are the latest trends influencing the Agriculture Customer Segmentation Market?

+

-

Who are the key players in the Agriculture Customer Segmentation Market?

+

-

How is the Agriculture Customer Segmentation } industry progressing in scaling its end-use implementations?

+

-

What product types are analyzed in the Agriculture Customer Segmentation Market Study?

+

-

What geographic breakdown is available in Global Agriculture Customer Segmentation Market Study?

+

-

Which region holds the second position by market share in the Agriculture Customer Segmentation market?

+

-

How are the key players in the Agriculture Customer Segmentation market targeting growth in the future?

+

-

,

The Agriculture Customer Segmentation Market Drivers Analysis identifies a number of important drivers propelling its growth. To begin with, the growing use of precision farming and high-tech farm equipment creates a need for a better understanding of various farmer segments according to their technology adoption and requirements. This enables companies to provide customized solutions, stimulating the need for segmentation solutions and services.

,

What are the opportunities for new entrants in the Agriculture Customer Segmentation market?

+

-