Global White Box Servers Market - Industry Dynamics, Market Size, And Opportunity Forecast To 2030

Report ID: MS-547 | Electronics and Semiconductors | Last updated: Mar, 2025 | Formats*:

White Box Servers Report Highlights

| Report Metrics | Details |

|---|---|

| Forecast period | 2019-2030 |

| Base Year Of Estimation | 2024 |

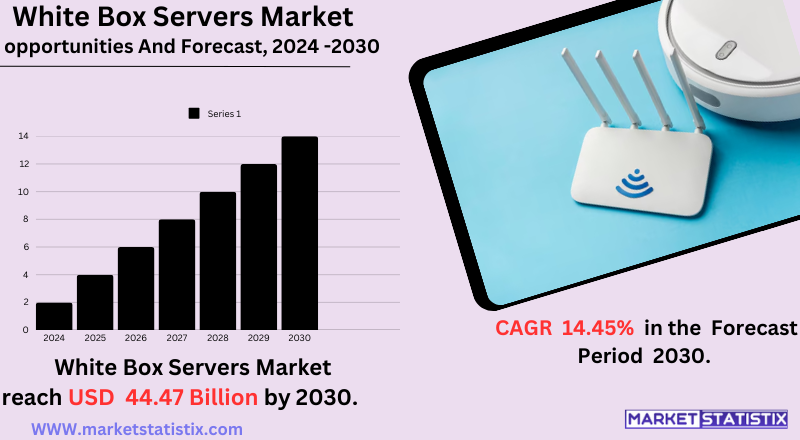

| Growth Rate | CAGR of 14.45% |

| Forecast Value (2030) | USD 44.47 Billion |

| By Product Type | Blade Server, Rack-mount Server, Whole Cabinet Server |

| Key Market Players |

|

| By Region |

White Box Servers Market Trends

The white box servers’ market is significantly growing, propelled by the increasing demands of hyperscale data centres and cloud service providers. One key trend is the rising adoption of open hardware and software initiatives, allowing more flexibility and innovation. This enables organizations to customise server configurations to specific workloads, thereby optimising performance and lowering costs. On the other hand, the rise of edge computing and decentralised data processing requirements are driving the demand for customized solutions and servers that can be deployed in completely different environments. Another important aspect being emphasised is energy efficiency and sustainability; organizations are searching for servers that minimise their power consumption and environmental impact.White Box Servers Market Leading Players

The key players profiled in the report are Inventec Corporation (Taiwan), Celestica Inc. (Canada), MiTAC Holdings Corporation (Taiwan), Super Micro Computer Inc. (United States), Pegatron Corporation (Taiwan), Quanta Computer Inc. (Taiwan), Compal Electronics Inc. (Taiwan), Foxconn Electronics Inc. (Taiwan), Wistron Corporation (Taiwan)Growth Accelerators

Hyperscale data centres and cloud computing settings will always demand white box servers primarily cost efficiently. Seeking to minimise their capital expenses, large organizations, especially cloud service providers and other internet entities, buy their servers directly from ODMs without having to pay the mark-ups that come from having to use branded vendors. It lets them save a lot more up front—especially when they are deploying thousands of servers. In addition, increased adoption of open hardware and viable software further accelerates innovation and standardisation in the white-box server market. These standards, such as the Open Compute Project (OCP), facilitate clear hardware designs that can be made interoperable, lowering system complexity and promoting easy maintenance. Finally, because of hardware evolution, like advanced processors and memory solutions, white box server manufacturers find it easy to pick the latest in state-of-the-art solutions from all available high-tech development.White Box Servers Market Segmentation analysis

The Global White Box Servers is segmented by Type, Application, and Region. By Type, the market is divided into Distributed Blade Server, Rack-mount Server, Whole Cabinet Server . The Application segment categorizes the market based on its usage such as X 86 servers, Non-X86 servers. Geographically, the market is assessed across key Regions like {regionNms} and others, each presenting distinct growth opportunities and challenges influenced by the regions.Competitive Landscape

The competitive landscape of the white box server market is governed by large ODMs (Original Design Manufacturers) like Quanta Computer, Wistron, Inventec, and Foxconn, which cater to cost-efficient and highly customizable server solutions for hyperscale data centres, cloud providers, and large enterprises. In essence, these corporations compete on flexible and modular designs, which are very high performance and energy-efficient considering the cost versus traditional OEM vendors like Dell, HPE, and Lenovo. The market is mainly driven by the adoption of cloud computing, AI workloads, and enterprise digital transformation, thereby driving the demand for scale with open hardware architecture.Challenges In White Box Servers Market

The serious issues pertaining to the feasible future progress of the market for white box servers range from reliability and quality control, as these servers are assembled from various off-the-shelf components without established brands. This absence of brand recognition mostly raises questions relating to their performance consistency, durability, and support after selling. The other challenge raised in this regard is that the support and maintenance options available for white box servers are limited when compared to branded solutions. Many organizations need to turn to their in-house IT teams or a third-party service provider in handling these problems, which further adds to the complexity and cost of operations. The negative perception that goes about as one who is less trustworthy, given that they have neither warranty nor comprehensive service packages, adds to the barriers in adopting white-box solutions. To address this, one should manage market education, develop better quality assurance measures, and build pre-configured solutions integrated seamlessly within existing infrastructure but coupled with reliable support services.Risks & Prospects in White Box Servers Market

The white box server market presents significant opportunities arising from increased demand for cost-effective, customizable, and scalable server solutions. Some of the major opportunity areas include hyperscale data centres expanding concurrently with the growth of cloud computing, AI, and big data analytics. Open-source hardware and software platforms support advanced customisability, while energy-efficient technology development captures the interest of sustainability-orientated businesses. New applications such as edge computing and 5G networks are furthering demand for small form-factor, high-performance white box servers. Regionally, the Asia-Pacific (APAC) region is expected to grow at the fastest rate due to rapid digital transformation and increased cloud adoption and the expansion of data centres in countries such as China and India. North America is presently the largest market, with key drivers being advanced technological infrastructure and an increase in the uptake of advanced computing solutions. With increasing data privacy regulations such as GDPR and cloud service adoption, Europe is becoming an attractive market. With growing investments in advancing IT infrastructure, Latin America and the Middle East are equally emerging for growth. This paints a picture of the global potential of white box servers across various industries and regions.Key Target Audience

The white box server’s market's primary audience includes hyperscale cloud providers, big data centres, and telecommunications firms. These organizations require extreme computing, plus cost-effectiveness, scalability, and customisation. For example, cloud providers of Infrastructure as a Service, Platform as a Service, Application as a Service, and others build their infrastructure and expand it through white box servers, while data centres conducting high-performance computing, supporting AI and machine learning workloads, discover the attraction of white box servers as they allow the organisation to configure the hardware to its specific needs. Ministers of telecommunications, who develop their networks and services, enter into a contract with these servers to manage the increasing levels of data traffic and processing needs.Merger and acquisition

There has been an increasing trend of mergers and acquisitions in the white box sector, with companies considering these actions as a means of technological capability enhancement and market expansion. In March 2021, Inspur Group, a Chinese IT company, acquired from ASRock Inc.'s subsidiary ASRock Rack the white box server business, including the design and manufacturing capability of ASRock Rack with respect to white box servers and its customer base. An expected continued trend of M&A activity is a consistent feature of the white box server market in companies' efforts to stay competitive in a dynamically changing landscape. Companies, through M&A, attempt to pool resources, technologies, and customer bases to see enhanced economies of scale and broaden reach into new geographical markets or new customer segments. This approach has also demonstrated an ability to provide a pull for accelerated growth and responsiveness to market needs, a key component of agility and adaptability in a fast-paced environment posed by rapidly changing technologies. >Analyst Comment

Hyper-scalable data centres are expanding rapidly, hence giving impetus to the white box server market. White box servers have large cloud service-providing companies and internet companies opting for them in realisation of cost efficiencies and better control over their infrastructures. The trend drives server form factors towards being custom and optimised. Supporting massive data volume and demanding workloads has heightened the dependence on optimal solutions because most companies are turning to open-source hardware and software.- 1.1 Report description

- 1.2 Key market segments

- 1.3 Key benefits to the stakeholders

2: Executive Summary

- 2.1 White Box Servers- Snapshot

- 2.2 White Box Servers- Segment Snapshot

- 2.3 White Box Servers- Competitive Landscape Snapshot

3: Market Overview

- 3.1 Market definition and scope

- 3.2 Key findings

- 3.2.1 Top impacting factors

- 3.2.2 Top investment pockets

- 3.3 Porter’s five forces analysis

- 3.3.1 Low bargaining power of suppliers

- 3.3.2 Low threat of new entrants

- 3.3.3 Low threat of substitutes

- 3.3.4 Low intensity of rivalry

- 3.3.5 Low bargaining power of buyers

- 3.4 Market dynamics

- 3.4.1 Drivers

- 3.4.2 Restraints

- 3.4.3 Opportunities

4: White Box Servers Market by Type

- 4.1 Overview

- 4.1.1 Market size and forecast

- 4.2 Rack-mount Server

- 4.2.1 Key market trends, factors driving growth, and opportunities

- 4.2.2 Market size and forecast, by region

- 4.2.3 Market share analysis by country

- 4.3 Blade Server

- 4.3.1 Key market trends, factors driving growth, and opportunities

- 4.3.2 Market size and forecast, by region

- 4.3.3 Market share analysis by country

- 4.4 Whole Cabinet Server

- 4.4.1 Key market trends, factors driving growth, and opportunities

- 4.4.2 Market size and forecast, by region

- 4.4.3 Market share analysis by country

5: White Box Servers Market by Application / by End Use

- 5.1 Overview

- 5.1.1 Market size and forecast

- 5.2 X 86 servers

- 5.2.1 Key market trends, factors driving growth, and opportunities

- 5.2.2 Market size and forecast, by region

- 5.2.3 Market share analysis by country

- 5.3 Non-X86 servers

- 5.3.1 Key market trends, factors driving growth, and opportunities

- 5.3.2 Market size and forecast, by region

- 5.3.3 Market share analysis by country

6: Competitive Landscape

- 6.1 Overview

- 6.2 Key Winning Strategies

- 6.3 Top 10 Players: Product Mapping

- 6.4 Competitive Analysis Dashboard

- 6.5 Market Competition Heatmap

- 6.6 Leading Player Positions, 2022

7: Company Profiles

- 7.1 Celestica Inc. (Canada)

- 7.1.1 Company Overview

- 7.1.2 Key Executives

- 7.1.3 Company snapshot

- 7.1.4 Active Business Divisions

- 7.1.5 Product portfolio

- 7.1.6 Business performance

- 7.1.7 Major Strategic Initiatives and Developments

- 7.2 Compal Electronics Inc. (Taiwan)

- 7.2.1 Company Overview

- 7.2.2 Key Executives

- 7.2.3 Company snapshot

- 7.2.4 Active Business Divisions

- 7.2.5 Product portfolio

- 7.2.6 Business performance

- 7.2.7 Major Strategic Initiatives and Developments

- 7.3 Foxconn Electronics Inc. (Taiwan)

- 7.3.1 Company Overview

- 7.3.2 Key Executives

- 7.3.3 Company snapshot

- 7.3.4 Active Business Divisions

- 7.3.5 Product portfolio

- 7.3.6 Business performance

- 7.3.7 Major Strategic Initiatives and Developments

- 7.4 Inventec Corporation (Taiwan)

- 7.4.1 Company Overview

- 7.4.2 Key Executives

- 7.4.3 Company snapshot

- 7.4.4 Active Business Divisions

- 7.4.5 Product portfolio

- 7.4.6 Business performance

- 7.4.7 Major Strategic Initiatives and Developments

- 7.5 MiTAC Holdings Corporation (Taiwan)

- 7.5.1 Company Overview

- 7.5.2 Key Executives

- 7.5.3 Company snapshot

- 7.5.4 Active Business Divisions

- 7.5.5 Product portfolio

- 7.5.6 Business performance

- 7.5.7 Major Strategic Initiatives and Developments

- 7.6 Pegatron Corporation (Taiwan)

- 7.6.1 Company Overview

- 7.6.2 Key Executives

- 7.6.3 Company snapshot

- 7.6.4 Active Business Divisions

- 7.6.5 Product portfolio

- 7.6.6 Business performance

- 7.6.7 Major Strategic Initiatives and Developments

- 7.7 Quanta Computer Inc. (Taiwan)

- 7.7.1 Company Overview

- 7.7.2 Key Executives

- 7.7.3 Company snapshot

- 7.7.4 Active Business Divisions

- 7.7.5 Product portfolio

- 7.7.6 Business performance

- 7.7.7 Major Strategic Initiatives and Developments

- 7.8 Super Micro Computer Inc. (United States)

- 7.8.1 Company Overview

- 7.8.2 Key Executives

- 7.8.3 Company snapshot

- 7.8.4 Active Business Divisions

- 7.8.5 Product portfolio

- 7.8.6 Business performance

- 7.8.7 Major Strategic Initiatives and Developments

- 7.9 Wistron Corporation (Taiwan)

- 7.9.1 Company Overview

- 7.9.2 Key Executives

- 7.9.3 Company snapshot

- 7.9.4 Active Business Divisions

- 7.9.5 Product portfolio

- 7.9.6 Business performance

- 7.9.7 Major Strategic Initiatives and Developments

8: Analyst Perspective and Conclusion

- 8.1 Concluding Recommendations and Analysis

- 8.2 Strategies for Market Potential

Scope of Report

| Aspects | Details |

|---|---|

By Type |

|

By Application |

|

Report Licenses

Our Team

Frequently Asked Questions (FAQ):

What is the projected market size of White Box Servers in 2030?

+

-

Which application type is expected to remain the largest segment in the Global White Box Servers market?

+

-

How big is the Global White Box Servers market?

+

-

How do regulatory policies impact the White Box Servers Market?

+

-

What major players in White Box Servers Market?

+

-

What applications are categorized in the White Box Servers market study?

+

-

Which product types are examined in the White Box Servers Market Study?

+

-

Which regions are expected to show the fastest growth in the White Box Servers market?

+

-

Which application holds the second-highest market share in the White Box Servers market?

+

-

What are the major growth drivers in the White Box Servers market?

+

-