Global Pizza Market Dynamics, Market Size, And Opportunity Forecast To 2030

Report ID: MS-525 | Consumer Goods | Last updated: Mar, 2025 | Formats*:

Pizza Report Highlights

| Report Metrics | Details |

|---|---|

| Forecast period | 2019-2030 |

| Base Year Of Estimation | 2024 |

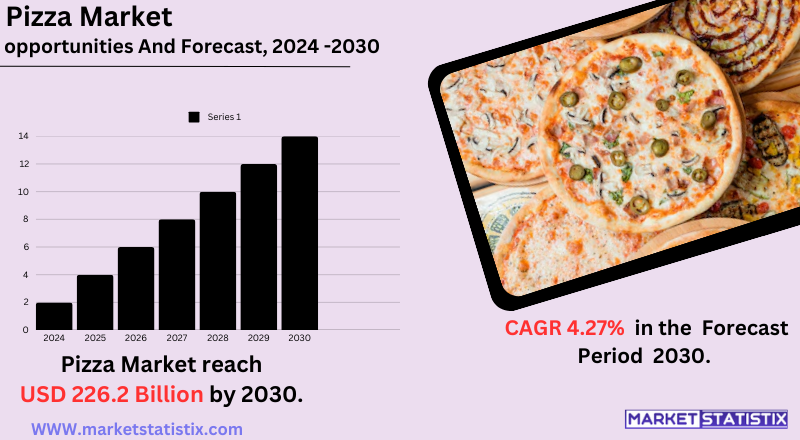

| Growth Rate | CAGR of 4.27% |

| Forecast Value (2030) | USD 226.2 Billion |

| By Product Type | Medium, Small, Large, Extra Large |

| Key Market Players |

|

| By Region |

Pizza Market Trends

Technological changes and changing consumer trends have been creating a terrific upheaval in the pizza market. A major trend of online ordering and delivery services with the help of mobile apps and third-party platforms is enhancing customer convenience and broadening market reach. The digital conversion, therefore, has challenged traditional pizzerias to adopt online ordering and efficient delivery logistics. Further market analysis indicates customization and unique food experiences are now at the forefront. The gourmet-and-artesian pizza crowd with outstanding flavours and top ingredients attracts consumers aiming for premium dining appeal. Along with that, ghost kitchens and virtual pizza brands operating only through delivery platforms are changing the Canadian pizza marketplace with cheap business models and fast scalability. The pizza market is therefore characterized by technological development, health-aware consumers, and culinary creativity.Pizza Market Leading Players

The key players profiled in the report are Domino's Pizza (United States), The Pizza Company (Thailand), Dodo Pizza (Russia), Easy Pizza (United Kingdom), Papa Murphy’s International (United States), Pizza Hut (United States), Speed Rabbit Pizza (France), Papa John's Pizza (United States), Pizza Express (United Kingdom), Prezzo (United Kingdom)Growth Accelerators

The growth in the pizza markets mainly stems from the various conveniences brought by the products to the lives of consumers. Delivery can be accessed almost anywhere, and online platforms are available to place orders with frozen and ready-to-eat products made available in the market to serve busy lifestyles and customers looking for quick, cheap meals. Pizza is also highly versatile by offering many kinds of toppings and crust varieties. Another important engine would be the whole cultural background of the consumption of pizza as a comfort food in society, making it very essentially a group-based eating activity. Market stability is hence established because many people eat pizza during parties, social gatherings, and family dinners. Also, marketing and promotion strategies such as loyalty programs and bundling tend to enhance sales and preserve customers. The globalization of pizza adapts it from locality to locality with its taste and ingredients; thus, this solidifies pizza as one of the few truly global food products, giving it an ever-broadening market.Pizza Market Segmentation analysis

The Global Pizza is segmented by Type, Application, and Region. By Type, the market is divided into Distributed Medium, Small, Large, Extra Large . The Application segment categorizes the market based on its usage such as Restaurant, Supermarket, Retail store. Geographically, the market is assessed across key Regions like {regionNms} and others, each presenting distinct growth opportunities and challenges influenced by the regions.Competitive Landscape

The pizza industry is highly competitive, with global chains such as Domino's, Pizza Hut, and Papa John's spearheading the charge against strong regional and local players. These big names use franchises, aggressive marketing, and digital innovations such as AI-based ordering and live delivery tracking to their advantage in keeping their market share. Independent pizzerias/artisanal brands counter these big ones by offering unique flavours and organic ingredients, specializing in diet-based options—gluten-free or plant-based pizzas. Competition has also gotten fierce with the emergence of ghost kitchens and third-party delivery apps, making convenience and speed critical factors in consumer choice.Challenges In Pizza Market

The challenges facing the pizza industry are numerous and detrimental to its growth. One critical challenge is the disruption of supply chain systems that can lead to irregular supply of raw ingredients and inefficient production. Another very important parameter for consideration is the haggling prices of raw materials that may increase the input costs, thus hampering profit margins. In addition to that, laws governing food safety and labelling are other hurdles in the market that require the allocation of resources. Competition is alarming in addition to inflation in some important international markets, necessitating strategic pricing and operational efficiency. Another foremost obstacle is the preferences of consumers as more and more demand for healthier and sustainable ways. Thus, the pizza business has to catch up with those trends, all the while managing other challenges such as the labor market, including hiring and retaining workers, the number-one headache for pizzeria owners. Nevertheless, the market is being propelled by the trends of online ordering and third-party delivery, which continue to gain momentum. To overcome these challenges, pizza companies will focus on innovation and quality and use technology to improve their operational efficiency and customer engagement.Risks & Prospects in Pizza Market

The pizza industry offers lucrative opportunities for growth with changing consumer preferences and innovations in flavours along with the increasing demand for convenience foods. The burgeoning online food delivery business, along with fast-growing QSRs, has also contributed to the growth of the market. The rise in demand for healthier options among health-conscious consumers offers even further opportunity, including gluten-free, plant-based, and organic pizzas. Regionally, North America is still the largest market, with the U.S. in the lead due to a vibrant pizza culture and the presence of major chains such as Domino's, Pizza Hut, and Little Caesars. Europe closely follows, with Italy, the United Kingdom, and Germany fuelling demand via traditional and innovative offerings. Meanwhile, the Asia-Pacific region is rapidly expanding owing to urbanization, rising disposable incomes, and increased adoption of Western foods in countries such as China, India, and Japan. Emerging opportunities also abound in Latin America and the Middle East, where expanding QSR chains and a rising middle class are seeking convenient, international cuisines.Key Target Audience

The pizza market indeed serves a wide market comprising family units, young adults, and working professionals, who generally want a meal that is convenient, inexpensive, and filling. Families love to savour pizza at reunions, celebrations, and informal dining, being a great shareable food, whereas young adults and college students prefer it for the economical price of pizza and availability for delivery or takeout. Moreover, with an added trend in customization for health-conscious and niche dietary consumers, gluten-free, plant-based, and gourmet options are all on the rise.,, Aside from individual consumers, the market also seeks out restaurants, fast-food chains, and food deliveries that capitalize on the popularity of pizza to generate sales. Quick-service restaurants, casual-dining restaurants, and cloud kitchens have added stores to capitalize on the popularity of pizza and generate better profits. Corporate clients and event planners keep contributing to this market by ordering pizzas for office lunches, meetings, and parties.Merger and acquisition

The mergers and acquisitions within the pizza industry seem to suggest further strategic expansion and market consolidation. In September 2024, private equity firm Brynwood Partners acquired Miracapo Pizza Co. LLC, a well-known Illinois frozen pizza manufacturer. The company specializes in creating frozen pizzas for the convenience store and branded retail customer segments, with three manufacturing facilities located in the Chicago area. Complementing the existing investment of Brynwood into the pizza sector, this acquisition coincides with Great Kitchens Food Co., one of its existing portfolio companies servicing private label retail customers in the take-and-bake pizza market. MBC Companies, known for its frozen breakfast products, acquired Nardone Brothers Baking Co., a Pennsylvania frozen pizza manufacturer, in January 2025, expanding into the pizza market. Nardone Brothers produces pizzas for K-12 schools, private-label retail, and foodservice customers. This acquisition therefore gives MBC a much broader portfolio, adding a third processing plant to its facilities, thereby increasing production capacity and product innovation opportunities >Analyst Comment

The pizza market is probably one of the most established and competitive markets in the industry, with continuous growth that derives its income and revenue from people who demand convenience in their meals as well as variety at affordable prices. Some of the key drivers of the market are the increased number of online ordering and delivery platforms, which have made pizza more accessible to people, and innovation in pizzas, including improving existing ones to become gourmet offerings or healthier alternatives. Other factors that are changing this market are shifts in consumer preferences, such as the growing demand for personalization and customization in pizzas, an increase in flexible customization options, or an increase in the demand for plant-based and gluten-free products. Also, the market has demonstrated great resilience by virtue of its flexibility in the dining opportunity—from quick service to fine dining.- 1.1 Report description

- 1.2 Key market segments

- 1.3 Key benefits to the stakeholders

2: Executive Summary

- 2.1 Pizza- Snapshot

- 2.2 Pizza- Segment Snapshot

- 2.3 Pizza- Competitive Landscape Snapshot

3: Market Overview

- 3.1 Market definition and scope

- 3.2 Key findings

- 3.2.1 Top impacting factors

- 3.2.2 Top investment pockets

- 3.3 Porter’s five forces analysis

- 3.3.1 Low bargaining power of suppliers

- 3.3.2 Low threat of new entrants

- 3.3.3 Low threat of substitutes

- 3.3.4 Low intensity of rivalry

- 3.3.5 Low bargaining power of buyers

- 3.4 Market dynamics

- 3.4.1 Drivers

- 3.4.2 Restraints

- 3.4.3 Opportunities

4: Pizza Market by Type

- 4.1 Overview

- 4.1.1 Market size and forecast

- 4.2 Small

- 4.2.1 Key market trends, factors driving growth, and opportunities

- 4.2.2 Market size and forecast, by region

- 4.2.3 Market share analysis by country

- 4.3 Medium

- 4.3.1 Key market trends, factors driving growth, and opportunities

- 4.3.2 Market size and forecast, by region

- 4.3.3 Market share analysis by country

- 4.4 Large

- 4.4.1 Key market trends, factors driving growth, and opportunities

- 4.4.2 Market size and forecast, by region

- 4.4.3 Market share analysis by country

- 4.5 Extra Large

- 4.5.1 Key market trends, factors driving growth, and opportunities

- 4.5.2 Market size and forecast, by region

- 4.5.3 Market share analysis by country

5: Pizza Market by Application / by End Use

- 5.1 Overview

- 5.1.1 Market size and forecast

- 5.2 Supermarket

- 5.2.1 Key market trends, factors driving growth, and opportunities

- 5.2.2 Market size and forecast, by region

- 5.2.3 Market share analysis by country

- 5.3 Restaurant

- 5.3.1 Key market trends, factors driving growth, and opportunities

- 5.3.2 Market size and forecast, by region

- 5.3.3 Market share analysis by country

- 5.4 Retail store

- 5.4.1 Key market trends, factors driving growth, and opportunities

- 5.4.2 Market size and forecast, by region

- 5.4.3 Market share analysis by country

6: Competitive Landscape

- 6.1 Overview

- 6.2 Key Winning Strategies

- 6.3 Top 10 Players: Product Mapping

- 6.4 Competitive Analysis Dashboard

- 6.5 Market Competition Heatmap

- 6.6 Leading Player Positions, 2022

7: Company Profiles

- 7.1 Easy Pizza (United Kingdom)

- 7.1.1 Company Overview

- 7.1.2 Key Executives

- 7.1.3 Company snapshot

- 7.1.4 Active Business Divisions

- 7.1.5 Product portfolio

- 7.1.6 Business performance

- 7.1.7 Major Strategic Initiatives and Developments

- 7.2 Pizza Express (United Kingdom)

- 7.2.1 Company Overview

- 7.2.2 Key Executives

- 7.2.3 Company snapshot

- 7.2.4 Active Business Divisions

- 7.2.5 Product portfolio

- 7.2.6 Business performance

- 7.2.7 Major Strategic Initiatives and Developments

- 7.3 Domino's Pizza (United States)

- 7.3.1 Company Overview

- 7.3.2 Key Executives

- 7.3.3 Company snapshot

- 7.3.4 Active Business Divisions

- 7.3.5 Product portfolio

- 7.3.6 Business performance

- 7.3.7 Major Strategic Initiatives and Developments

- 7.4 Papa John's Pizza (United States)

- 7.4.1 Company Overview

- 7.4.2 Key Executives

- 7.4.3 Company snapshot

- 7.4.4 Active Business Divisions

- 7.4.5 Product portfolio

- 7.4.6 Business performance

- 7.4.7 Major Strategic Initiatives and Developments

- 7.5 Pizza Hut (United States)

- 7.5.1 Company Overview

- 7.5.2 Key Executives

- 7.5.3 Company snapshot

- 7.5.4 Active Business Divisions

- 7.5.5 Product portfolio

- 7.5.6 Business performance

- 7.5.7 Major Strategic Initiatives and Developments

- 7.6 The Pizza Company (Thailand)

- 7.6.1 Company Overview

- 7.6.2 Key Executives

- 7.6.3 Company snapshot

- 7.6.4 Active Business Divisions

- 7.6.5 Product portfolio

- 7.6.6 Business performance

- 7.6.7 Major Strategic Initiatives and Developments

- 7.7 Dodo Pizza (Russia)

- 7.7.1 Company Overview

- 7.7.2 Key Executives

- 7.7.3 Company snapshot

- 7.7.4 Active Business Divisions

- 7.7.5 Product portfolio

- 7.7.6 Business performance

- 7.7.7 Major Strategic Initiatives and Developments

- 7.8 Papa Murphy’s International (United States)

- 7.8.1 Company Overview

- 7.8.2 Key Executives

- 7.8.3 Company snapshot

- 7.8.4 Active Business Divisions

- 7.8.5 Product portfolio

- 7.8.6 Business performance

- 7.8.7 Major Strategic Initiatives and Developments

- 7.9 Speed Rabbit Pizza (France)

- 7.9.1 Company Overview

- 7.9.2 Key Executives

- 7.9.3 Company snapshot

- 7.9.4 Active Business Divisions

- 7.9.5 Product portfolio

- 7.9.6 Business performance

- 7.9.7 Major Strategic Initiatives and Developments

- 7.10 Prezzo (United Kingdom)

- 7.10.1 Company Overview

- 7.10.2 Key Executives

- 7.10.3 Company snapshot

- 7.10.4 Active Business Divisions

- 7.10.5 Product portfolio

- 7.10.6 Business performance

- 7.10.7 Major Strategic Initiatives and Developments

8: Analyst Perspective and Conclusion

- 8.1 Concluding Recommendations and Analysis

- 8.2 Strategies for Market Potential

Scope of Report

| Aspects | Details |

|---|---|

By Type |

|

By Application |

|

Report Licenses

Our Team

Frequently Asked Questions (FAQ):

What is the projected market size of Pizza in 2030?

+

-

Which application type is expected to remain the largest segment in the Global Pizza market?

+

-

How big is the Global Pizza market?

+

-

How do regulatory policies impact the Pizza Market?

+

-

What major players in Pizza Market?

+

-

What applications are categorized in the Pizza market study?

+

-

Which product types are examined in the Pizza Market Study?

+

-

Which regions are expected to show the fastest growth in the Pizza market?

+

-

Which application holds the second-highest market share in the Pizza market?

+

-

What are the major growth drivers in the Pizza market?

+

-