Europe Lead Management Software Market - Industry Dynamics, Market Size, And Opportunity Forecast To 2030

Report ID: MS-1004 | IT and Telecom | Last updated: Jun, 2025 | Formats*:

The lead management software market consists of platforms that streamline the process of capturing, tracking, nurturing and converting, which leads to sales in various channels. These tools enable businesses to manage the entire lead life cycle – from initial contact to customer acquisition – by scoring leads based on behaviour and engagement. As digital marketing expands and customer journeys become more complicated, organizations rely on lead management solutions to improve rapid response time, personalise outreach and increase sales pipeline efficiency. The market is being shaped by integration with CRM, AI-operated insight and omnichannel marketing strategies to promote conversion rates and ROIs.

Lead Management Software Report Highlights

| Report Metrics | Details |

|---|---|

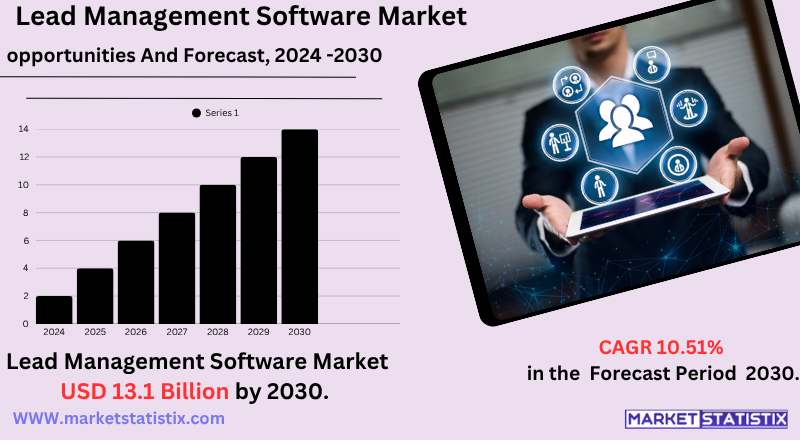

| Forecast period | 2019-2030 |

| Base Year Of Estimation | 2024 |

| Growth Rate | CAGR of 10.51% |

| Forecast Value (2030) | USD 13.1 Billion |

| By Product Type | Healthcare, Financial Services, Retail, Manufacturing, Other |

| Key Market Players |

|

| By Region |

Lead Management Software Market Trends

A significant trend is widespread integration of artificial intelligence (AI) and machine learning (ML), which enables advanced features such as predictive lead scoring and intelligent lead routing, substantially increasing conversion rates. There is also a clear movement towards omnichannel lead generation strategies, aiming at seamless interactions for customers at all points of contact. In addition, the market increasingly values privacy and data transparency, with the software adapting to regulations and offering resources for consent management. Finally, the sustained adoption of cloud-based solutions remains a dominant trend, valued for its scalability and accessibility as companies continue their digital transformation.

Lead Management Software Market Leading Players

The key players profiled in the report are Bonsai (Canada), Monday.Com (Israel), Leadsquared (India), Nocrm.Io (United States), Act! CRM (United States, Zendesk (United States), Cloudtask (United States), Pipedrive (United States), Hubspot Sales (United States), Activecampaign (United States), Freshsales (India), Hatchbuck (United States), Oxyleads (United States), Keap (United States), Salesforce (United States), Infusionsoft (United States), Quick Base (United States), Zoho CRM (United States)Growth Accelerators

- The growing demand for sales automation: companies seek to streamline lead tracking and follow-ups, increasing productivity and reducing manual errors in sales pipelines.

- Growth in digital marketing channels: Increased online campaigns and multichannel outreach increase the need for centralised platforms to manage and analyse incoming leads effectively.

- Focus on customer customisation: Companies use lead management software to segment the public and tailor involvement, improving conversion rates through targeted communication.

- Integration with CRM and Marketing Tools: Seamless integration with existing sales and marketing systems enhances data flow and allows unified customer relationship strategies.

Lead Management Software Market Segmentation analysis

The Europe Lead Management Software is segmented by Type, Application, and Region. By Type, the market is divided into Distributed Healthcare, Financial Services, Retail, Manufacturing, Other . The Application segment categorizes the market based on its usage such as Lead Scoring, Lead Nurturing, Sales Forecasting. Geographically, the market is assessed across key Regions like {regionNms} and others, each presenting distinct growth opportunities and challenges influenced by the regions.Competitive Landscape

The competitive scenario of the main management software market is characterised by a mixture of agile and innovative technology giants, all striving to improve customer acquisition and sales efficiency. Players – such as Salesforce, Adobe, Microsoft, Oracle, IBM, Hubspot, Zoho and Pipedrive – dominate the market, offering comprehensive solutions that integrate artificial intelligence, automation and CRM processes to transmit tracking processes and lead conversion. The market is witnessing a move to cloud-based platforms, favoured by their scalability and cost-effectiveness, meeting SME and large companies. As digital transformation accelerates in all industries, it is expected that the demand for sophisticated lead management solutions will grow, intensifying competition and promoting continuous innovation in the sector.

Challenges In Lead Management Software Market

- Data integration complexities: Integration of existing CRM lead management tools, marketing platforms and third-party systems often creates technical obstacles that delay implementation and reduce efficiency.

- Lead Quality and Duplication Issues: Poor data hygiene and inconsistent lead sources result in duplicate or low-quality leads, which is the sales of waste and lower conversion rates.

- User Adoption and Training Gaps: Many companies face internal resistance or lack of proper training, leading to the underuse of resources and the limited ROI of the software.

- Privacy and Compliance Constraints: Increased data privacy regulations such as GDPR and CCPA require rigorous lead data handling, presenting compliance challenges for companies using automated lead tools.

Risks & Prospects in Lead Management Software Market

The lead management software market is poised for substantial growth, driven by several important opportunities. The growing adoption of AI and machine learning technologies is improving the accuracy of the lead scoring and allowing personalised customer interactions, thus improving conversion rates. The move to cloud-based solutions offers scalability and flexibility, making advanced lead management tools more accessible to small and medium enterprises. Integration with CRM systems and marketing automation platforms is simplifying sales processes, allowing for more efficient lead nutrition and tracking. As business continue to prioritize data-orientated decision-making, the demand for robust analysis and real-time insights provided by lead management software is expected to have significant opportunities for market expansion.

Key Target Audience

,

- ,

- CRM and SAAS suppliers: These companies are part of lead management features to improve their offers and provide end-to-end life cycle solutions. ,

- Salesforce Acquires Informatica for $8 Billion: In May 2025, Salesforce announced its acquisition of the data management firm Informatica for approximately US $8 billion. This strategic movement aims to improve Salesforce's artificial intelligence resources and solidify its leadership in cloud-based corporate solutions.

- NICE Ltd. Acquires LiveVox Inc.: In December 2023, Nice finalised the acquisition of Livevox Inc., significantly expanding the Nice Cxone platform set of resources, particularly within the Outbound Contact Centre as a Service (CCaaS). This acquisition enhances NICE resources in customer involvement and lead management.

- Deel's Acquisition of Assemble: In December 2024, Deel, a global HR platform, completed its fifth acquisition of the year, acquiring Assemble, a compensation management startup. This acquisition aims to improve its resources in lead management and customer relationships.

Merger and acquisition

>

Analyst Comment

The lead management software market is experiencing robust growth, designed to expand from $10.12 billion by 2024 to $11.1 billion by 2025. This increase is driven by the growing adoption of digital transformation strategies and the need for efficient lead capturing and conversion tools. Cloud-based solutions are gaining prominence due to their scalability and accessibility, with the cloud-based segment that is expected to maintain an estimated 72.2% portion in 2025. The main players, such as Salesforce, Adobe and HubSpot, are continually innovating to meet the evolution of companies that seek to optimise their main management processes.

- 1.1 Report description

- 1.2 Key market segments

- 1.3 Key benefits to the stakeholders

2: Executive Summary

- 2.1 Lead Management Software- Snapshot

- 2.2 Lead Management Software- Segment Snapshot

- 2.3 Lead Management Software- Competitive Landscape Snapshot

3: Market Overview

- 3.1 Market definition and scope

- 3.2 Key findings

- 3.2.1 Top impacting factors

- 3.2.2 Top investment pockets

- 3.3 Porter’s five forces analysis

- 3.3.1 Low bargaining power of suppliers

- 3.3.2 Low threat of new entrants

- 3.3.3 Low threat of substitutes

- 3.3.4 Low intensity of rivalry

- 3.3.5 Low bargaining power of buyers

- 3.4 Market dynamics

- 3.4.1 Drivers

- 3.4.2 Restraints

- 3.4.3 Opportunities

4: Lead Management Software Market by Type

- 4.1 Overview

- 4.1.1 Market size and forecast

- 4.2 Healthcare

- 4.2.1 Key market trends, factors driving growth, and opportunities

- 4.2.2 Market size and forecast, by region

- 4.2.3 Market share analysis by country

- 4.3 Financial Services

- 4.3.1 Key market trends, factors driving growth, and opportunities

- 4.3.2 Market size and forecast, by region

- 4.3.3 Market share analysis by country

- 4.4 Manufacturing

- 4.4.1 Key market trends, factors driving growth, and opportunities

- 4.4.2 Market size and forecast, by region

- 4.4.3 Market share analysis by country

- 4.5 Retail

- 4.5.1 Key market trends, factors driving growth, and opportunities

- 4.5.2 Market size and forecast, by region

- 4.5.3 Market share analysis by country

- 4.6 Other

- 4.6.1 Key market trends, factors driving growth, and opportunities

- 4.6.2 Market size and forecast, by region

- 4.6.3 Market share analysis by country

5: Lead Management Software Market by Application / by End Use

- 5.1 Overview

- 5.1.1 Market size and forecast

- 5.2 Lead Scoring

- 5.2.1 Key market trends, factors driving growth, and opportunities

- 5.2.2 Market size and forecast, by region

- 5.2.3 Market share analysis by country

- 5.3 Lead Nurturing

- 5.3.1 Key market trends, factors driving growth, and opportunities

- 5.3.2 Market size and forecast, by region

- 5.3.3 Market share analysis by country

- 5.4 Sales Forecasting

- 5.4.1 Key market trends, factors driving growth, and opportunities

- 5.4.2 Market size and forecast, by region

- 5.4.3 Market share analysis by country

6: Competitive Landscape

- 6.1 Overview

- 6.2 Key Winning Strategies

- 6.3 Top 10 Players: Product Mapping

- 6.4 Competitive Analysis Dashboard

- 6.5 Market Competition Heatmap

- 6.6 Leading Player Positions, 2022

7: Company Profiles

- 7.1 Act! CRM (United States

- 7.1.1 Company Overview

- 7.1.2 Key Executives

- 7.1.3 Company snapshot

- 7.1.4 Active Business Divisions

- 7.1.5 Product portfolio

- 7.1.6 Business performance

- 7.1.7 Major Strategic Initiatives and Developments

- 7.2 Activecampaign (United States)

- 7.2.1 Company Overview

- 7.2.2 Key Executives

- 7.2.3 Company snapshot

- 7.2.4 Active Business Divisions

- 7.2.5 Product portfolio

- 7.2.6 Business performance

- 7.2.7 Major Strategic Initiatives and Developments

- 7.3 Bonsai (Canada)

- 7.3.1 Company Overview

- 7.3.2 Key Executives

- 7.3.3 Company snapshot

- 7.3.4 Active Business Divisions

- 7.3.5 Product portfolio

- 7.3.6 Business performance

- 7.3.7 Major Strategic Initiatives and Developments

- 7.4 Cloudtask (United States)

- 7.4.1 Company Overview

- 7.4.2 Key Executives

- 7.4.3 Company snapshot

- 7.4.4 Active Business Divisions

- 7.4.5 Product portfolio

- 7.4.6 Business performance

- 7.4.7 Major Strategic Initiatives and Developments

- 7.5 Freshsales (India)

- 7.5.1 Company Overview

- 7.5.2 Key Executives

- 7.5.3 Company snapshot

- 7.5.4 Active Business Divisions

- 7.5.5 Product portfolio

- 7.5.6 Business performance

- 7.5.7 Major Strategic Initiatives and Developments

- 7.6 Hatchbuck (United States)

- 7.6.1 Company Overview

- 7.6.2 Key Executives

- 7.6.3 Company snapshot

- 7.6.4 Active Business Divisions

- 7.6.5 Product portfolio

- 7.6.6 Business performance

- 7.6.7 Major Strategic Initiatives and Developments

- 7.7 Hubspot Sales (United States)

- 7.7.1 Company Overview

- 7.7.2 Key Executives

- 7.7.3 Company snapshot

- 7.7.4 Active Business Divisions

- 7.7.5 Product portfolio

- 7.7.6 Business performance

- 7.7.7 Major Strategic Initiatives and Developments

- 7.8 Infusionsoft (United States)

- 7.8.1 Company Overview

- 7.8.2 Key Executives

- 7.8.3 Company snapshot

- 7.8.4 Active Business Divisions

- 7.8.5 Product portfolio

- 7.8.6 Business performance

- 7.8.7 Major Strategic Initiatives and Developments

- 7.9 Keap (United States)

- 7.9.1 Company Overview

- 7.9.2 Key Executives

- 7.9.3 Company snapshot

- 7.9.4 Active Business Divisions

- 7.9.5 Product portfolio

- 7.9.6 Business performance

- 7.9.7 Major Strategic Initiatives and Developments

- 7.10 Leadsquared (India)

- 7.10.1 Company Overview

- 7.10.2 Key Executives

- 7.10.3 Company snapshot

- 7.10.4 Active Business Divisions

- 7.10.5 Product portfolio

- 7.10.6 Business performance

- 7.10.7 Major Strategic Initiatives and Developments

- 7.11 Monday.Com (Israel)

- 7.11.1 Company Overview

- 7.11.2 Key Executives

- 7.11.3 Company snapshot

- 7.11.4 Active Business Divisions

- 7.11.5 Product portfolio

- 7.11.6 Business performance

- 7.11.7 Major Strategic Initiatives and Developments

- 7.12 Nocrm.Io (United States)

- 7.12.1 Company Overview

- 7.12.2 Key Executives

- 7.12.3 Company snapshot

- 7.12.4 Active Business Divisions

- 7.12.5 Product portfolio

- 7.12.6 Business performance

- 7.12.7 Major Strategic Initiatives and Developments

- 7.13 Oxyleads (United States)

- 7.13.1 Company Overview

- 7.13.2 Key Executives

- 7.13.3 Company snapshot

- 7.13.4 Active Business Divisions

- 7.13.5 Product portfolio

- 7.13.6 Business performance

- 7.13.7 Major Strategic Initiatives and Developments

- 7.14 Pipedrive (United States)

- 7.14.1 Company Overview

- 7.14.2 Key Executives

- 7.14.3 Company snapshot

- 7.14.4 Active Business Divisions

- 7.14.5 Product portfolio

- 7.14.6 Business performance

- 7.14.7 Major Strategic Initiatives and Developments

- 7.15 Quick Base (United States)

- 7.15.1 Company Overview

- 7.15.2 Key Executives

- 7.15.3 Company snapshot

- 7.15.4 Active Business Divisions

- 7.15.5 Product portfolio

- 7.15.6 Business performance

- 7.15.7 Major Strategic Initiatives and Developments

- 7.16 Salesforce (United States)

- 7.16.1 Company Overview

- 7.16.2 Key Executives

- 7.16.3 Company snapshot

- 7.16.4 Active Business Divisions

- 7.16.5 Product portfolio

- 7.16.6 Business performance

- 7.16.7 Major Strategic Initiatives and Developments

- 7.17 Zendesk (United States)

- 7.17.1 Company Overview

- 7.17.2 Key Executives

- 7.17.3 Company snapshot

- 7.17.4 Active Business Divisions

- 7.17.5 Product portfolio

- 7.17.6 Business performance

- 7.17.7 Major Strategic Initiatives and Developments

- 7.18 Zoho CRM (United States)

- 7.18.1 Company Overview

- 7.18.2 Key Executives

- 7.18.3 Company snapshot

- 7.18.4 Active Business Divisions

- 7.18.5 Product portfolio

- 7.18.6 Business performance

- 7.18.7 Major Strategic Initiatives and Developments

8: Analyst Perspective and Conclusion

- 8.1 Concluding Recommendations and Analysis

- 8.2 Strategies for Market Potential

Scope of Report

| Aspects | Details |

|---|---|

By Type |

|

By Application |

|

Report Licenses

Our Team

Frequently Asked Questions (FAQ):

What is the estimated market size of Lead Management Software in 2030?

+

-

Which type of Lead Management Software is widely popular?

+

-

What is the growth rate of Lead Management Software Market?

+

-

What are the latest trends influencing the Lead Management Software Market?

+

-

Who are the key players in the Lead Management Software Market?

+

-

How is the Lead Management Software } industry progressing in scaling its end-use implementations?

+

-

What product types are analyzed in the Lead Management Software Market Study?

+

-

What geographic breakdown is available in Europe Lead Management Software Market Study?

+

-

Which region holds the second position by market share in the Lead Management Software market?

+

-

How are the key players in the Lead Management Software market targeting growth in the future?

+

-

,,

,

,

- , ,

- The growing demand for sales automation: companies seek to streamline lead tracking and follow-ups, increasing productivity and reducing manual errors in sales pipelines.

, , ,