Asia Pacific Weight Loss Management Market - Industry Dynamics, Market Size, And Opportunity Forecast To 2030

Report ID: MS-875 | Healthcare and Pharma | Last updated: May, 2025 | Formats*:

The weight loss management market involves the broad range of products, services, and programmes intended to assist individuals in controlling their weight, generally with the aim of losing and keeping off a healthier body weight. This market caters to the needs of individuals who want to lose weight, stabilise their weight, or gain weight in a healthy way. It encompasses a range of methods, including foodstuffs (such as meal replacements, low-calorie foods, and supplements); exercise equipment (such as home exercise machines to bariatric surgery equipment); and services (such as fitness gyms, weight loss centres, and advisory services).

The expansion of this market is highly influenced by the rising global rates of overweight and obesity, combined with heightened awareness of the health risks associated with them, including diabetes, cardiovascular diseases, and some cancers. In addition, changing lifestyles, such as sedentary lifestyles and changes in diet, fuel the need for efficient weight management solutions. Technological innovations, increased social media and wellness trend influence, and an increase in disposable income across most regions also contribute significantly towards evolving and growing the Weight Loss Management Market, promoting innovation and diversification of products and services for addressing individual requirements and wants.

Weight Loss Management Report Highlights

| Report Metrics | Details |

|---|---|

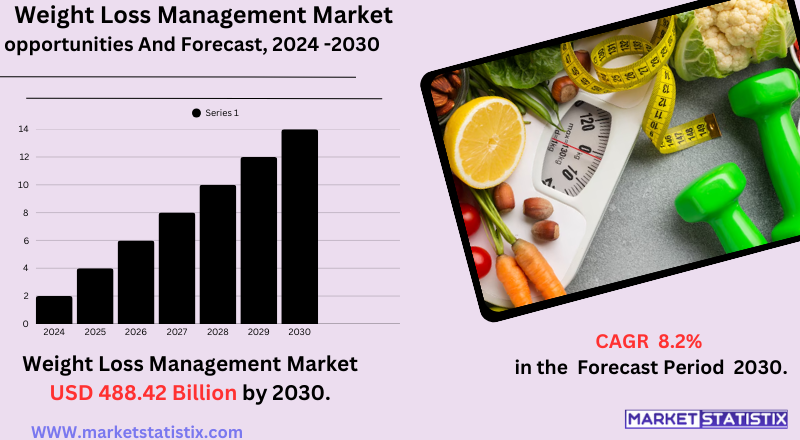

| Forecast period | 2019-2030 |

| Base Year Of Estimation | 2024 |

| Growth Rate | CAGR of 8.2% |

| Forecast Value (2030) | USD 488.42 Billion |

| By Product Type | Fitness Equipment, Weight Loss Diet, Surgical Equipment |

| Key Market Players |

|

| By Region |

|

Weight Loss Management Market Trends

The weight loss management market is under immense transformation today, being motivated by a number of important trends. A leading trend is the heightened demand for technology-based and personalised solutions. This comprises the growth in popularity of AI-based fitness applications, activity and calorie monitoring wearable devices, and internet-based weight loss programs providing customized meal plans and virtual guidance. Patients are demanding more personalised strategies that take into account their unique health information and lifestyle, prompting new opportunities for digital health platforms and tailored interventions.

Yet another major trend is increased focus on comprehensive wellness and sustainable weight control. This means a move away from fad diets towards more well-rounded methods that incorporate healthy eating patterns, consistent exercise, and psychological well-being. In addition, growing interest in natural and herbal weight-loss supplements and functional foods that are seen as safer and healthier also fuels the market's growth. The growing obesity rates worldwide and increased awareness of its related health risks also continue to drive the growth of the market, with pharmaceutical development, such as new weight-loss medications, also contributing significantly to determining treatment options.

Weight Loss Management Market Leading Players

The key players profiled in the report are Herbalife Ltd. (United States, Apollo Endosurgery, Inc. (United States), Equinox, Inc. (United States), Covidien PLC (Ireland), Atkins Nutritionals, Inc. (United States)Brunswick Corporation (United States), Cybex International (United States), Ediets.Com, Inc. (United States), Johnson Health Technology Co., Ltd. (Japan), Jenny Craig (United States), Nutrisystem, Inc. (United States)Growth Accelerators

The weight loss management market is driven by a few key factors. First, the rising global incidence of obesity and allied health conditions like diabetes and cardiovascular disorders presents a huge market for weight management solutions. With growing awareness of the health problems caused by excess weight, people actively hunt for products and services to solve these problems. Secondly, the increasing concern with health and wellbeing, promoted by media, doctors, and real-life experience, leads to motivating people to value weight management within a more overall healthy way of life. Increasing awareness motivates the consumption of numerous approaches to weight reduction as well as of products.

Finally, increased disposable income, especially in emerging economies, allows consumers to purchase weight loss products, services, and fitness expenses, further boosting the market growth. Increased access to and affordability of bariatric surgeries also boost the growth of the market.

Weight Loss Management Market Segmentation analysis

The Asia Pacific Weight Loss Management is segmented by Type, Application, and Region. By Type, the market is divided into Distributed Fitness Equipment, Weight Loss Diet, Surgical Equipment . The Application segment categorizes the market based on its usage such as Fitness Centers, Consulting Services, Slimming Centers, Online Weight Loss Programs. Geographically, the market is assessed across key Regions like Asia Pacific (China, Japan, India, South Korea, Australia, Southeast Asia, Rest of Asia-Pacific) and others, each presenting distinct growth opportunities and challenges influenced by the regions.Competitive Landscape

The competitive scenario in the weight loss management market is dominated by a wide variety of players, ranging from big multinational companies to small, niche firms. 1 These players compete in different segments, such as diet foods (meal substitutes, supplements, reduced-calorie foods), fitness gear (home and commercial), surgical equipment (used in bariatric surgeries), and services (fitness clubs, weight loss clinics, digital health platforms). The industry witness’s stiff competition on the basis of innovation, effectiveness, brand, price, and distribution.

Major strategies utilised by firms to establish a competitive advantage involve creating new and scientifically supported weight management solutions, using digital technologies to provide customized programs and home-based monitoring, and strategic partnerships or acquisitions to increase their product offerings and geographical reach. Additionally, mounting consumer consciousness, along with the growing incidence of obesity, drives demand for varied and effective weight management choices, heightening competition in this dynamic and continuously evolving market.

Challenges In Weight Loss Management Market

The weight management industry is beset with major challenges centred on the mismatch between customer aspirations and result sustainability. Most customers are looking for fast weight reduction using fad diets or drastic actions, which in some cases results in quick success but high relapse rates and frustration. The pattern erodes confidence in weight management products and services, which creates challenges for companies to provide solutions that guarantee long-term change. Consequently, businesses lose customers and credibility in a marketplace in which long-term lifestyle change is required for lasting outcomes.

Another significant challenge lies in the fragmentation of the market and the availability of unregulated or unsafe products, especially in the supplement category. The sheer number of choices – available from supplements and eating plans to exercise programmes and surgical procedures – can overwhelm consumers and make decision-making more difficult. The arrival of unsubstantiated and possibly dangerous products not only threatens health but also harms the industry's general reputation. Regulation and the necessity for scientifically supported, open solutions are essential in establishing consumer confidence and a positive market trend.

Risks & Prospects in Weight Loss Management Market

Major market opportunities are the increasing incidence of obesity and obesity-related chronic diseases, enhanced understanding of the health consequences of excess weight, and rising interest in both medical (e.g., bariatric procedures and drug treatments like GLP-1 drugs) and non-medical interventions (such as customized diet plans, web-based weight loss programmes, and low-calorie drinks).

At a regional level, North America leads in the weight loss management market with the highest share because of high rates of obesity, well-developed healthcare infrastructure, and extensive usage of both medical and digital weight loss solutions. The U.S. weight loss industry alone is approximately $90 billion, with immense growth fuelled by medical procedures and coverage under insurance. Europe is the second-largest region, fuelled by comparable trends. The Asia-Pacific market is the best positioned for the most rapid growth, driven by growing disposable incomes, rising health consciousness, and expanding obese populations, especially in India and China. 15. This regional trend indicates the global character of the obesity issue and the enormous opportunities for market development, particularly in emerging markets.

Key Target Audience

The most important target consumers for the weight loss management market are mainly those who are in the overweight or obese category and are actively in pursuit of solutions to their health and wellbeing. This group are generally motivated by fear of what they believe are the health consequences of carrying extra weight, including diabetes, cardiovascular disease, and joint issues, in addition to a desire for increased quality of life and physical beauty. The global incidence of overweight and obesity continues to grow, creating a large and expanding segment in this case.

,

, In addition to those individuals who have important weight problems, the target also comprises health-minded consumers seeking to preserve a normal weight or implement modest changes in their body structure. This individual can be prompted by fitness levels, preventive medical procedures, or wellness goals generally.

Merger and acquisition

The weight management market has witnessed strong merger and acquisition (M&A) activity in recent times, fuelled by rising demand for GLP-1-based treatments. Novo Nordisk in May 2025 formed a $2.2 billion alliance with biotech company Septerna to create oral obesity medicines that act on GPCRs such as GLP-1, GIP, and glucagon receptors. This is in line with Novo's plans to expand from injectables such as Wegovy and Ozempic. Similarly, Eli Lilly and Novo Nordisk are about to engage in an $80 billion M&A showdown, inspired by the fortunes of their obesity-reducing pills, both bidding to secure deals to help support growth through intensified competition and looming patent cliffs. In contrast, legacy weight-loss firms are struggling.

WeightWatchers went into Chapter 11 bankruptcy in May 2025, citing its fall to the success of diet drugs such as GLP-1s and social media endorsements supporting other weight-loss strategies. Although WeightWatchers bought telehealth startup Sequence in 2023 to venture into the prescription drug space, it was unable to counteract falling subscriber counts and revenues. Also, Glanbia has placed its weight-loss brand SlimFast on the market because it is losing popularity as consumers turn more and more to injectable weight-loss therapy instead of meal replacements.

>

Analyst Comment

The worldwide weight loss management market is witnessing strong growth, fuelled by the growing health awareness, rising obesity levels, and expanding incidence of chronic conditions associated with obesity. The market, in 2025, is approximated to be around USD 427.5 billion and is expected to grow almost twice, to USD 896.5 billion, by 2035, showcasing a strong compound annual growth rate. It covers an extensive range of products and services, such as dietary supplements, meal replacements, exercise equipment, weight loss drugs, bariatric procedures, digital health platforms, and customized coaching solutions.

- 1.1 Report description

- 1.2 Key market segments

- 1.3 Key benefits to the stakeholders

2: Executive Summary

- 2.1 Weight Loss Management- Snapshot

- 2.2 Weight Loss Management- Segment Snapshot

- 2.3 Weight Loss Management- Competitive Landscape Snapshot

3: Market Overview

- 3.1 Market definition and scope

- 3.2 Key findings

- 3.2.1 Top impacting factors

- 3.2.2 Top investment pockets

- 3.3 Porter’s five forces analysis

- 3.3.1 Low bargaining power of suppliers

- 3.3.2 Low threat of new entrants

- 3.3.3 Low threat of substitutes

- 3.3.4 Low intensity of rivalry

- 3.3.5 Low bargaining power of buyers

- 3.4 Market dynamics

- 3.4.1 Drivers

- 3.4.2 Restraints

- 3.4.3 Opportunities

4: Weight Loss Management Market by Type

- 4.1 Overview

- 4.1.1 Market size and forecast

- 4.2 Weight Loss Diet

- 4.2.1 Key market trends, factors driving growth, and opportunities

- 4.2.2 Market size and forecast, by region

- 4.2.3 Market share analysis by country

- 4.3 Fitness Equipment

- 4.3.1 Key market trends, factors driving growth, and opportunities

- 4.3.2 Market size and forecast, by region

- 4.3.3 Market share analysis by country

- 4.4 Surgical Equipment

- 4.4.1 Key market trends, factors driving growth, and opportunities

- 4.4.2 Market size and forecast, by region

- 4.4.3 Market share analysis by country

5: Weight Loss Management Market by Application / by End Use

- 5.1 Overview

- 5.1.1 Market size and forecast

- 5.2 Fitness Centers

- 5.2.1 Key market trends, factors driving growth, and opportunities

- 5.2.2 Market size and forecast, by region

- 5.2.3 Market share analysis by country

- 5.3 Slimming Centers

- 5.3.1 Key market trends, factors driving growth, and opportunities

- 5.3.2 Market size and forecast, by region

- 5.3.3 Market share analysis by country

- 5.4 Consulting Services

- 5.4.1 Key market trends, factors driving growth, and opportunities

- 5.4.2 Market size and forecast, by region

- 5.4.3 Market share analysis by country

- 5.5 Online Weight Loss Programs

- 5.5.1 Key market trends, factors driving growth, and opportunities

- 5.5.2 Market size and forecast, by region

- 5.5.3 Market share analysis by country

6: Weight Loss Management Market by Region

- 6.1 Overview

- 6.1.1 Market size and forecast By Region

- 6.2 China

- 6.2.1 Key trends and opportunities

- 6.2.2 Market size and forecast, by Type

- 6.2.3 Market size and forecast, by Application

- 6.2.4 Market size and forecast, by country

- 6.3 Japan

- 6.3.1 Key trends and opportunities

- 6.3.2 Market size and forecast, by Type

- 6.3.3 Market size and forecast, by Application

- 6.3.4 Market size and forecast, by country

- 6.4 India

- 6.4.1 Key trends and opportunities

- 6.4.2 Market size and forecast, by Type

- 6.4.3 Market size and forecast, by Application

- 6.4.4 Market size and forecast, by country

- 6.5 South Korea

- 6.5.1 Key trends and opportunities

- 6.5.2 Market size and forecast, by Type

- 6.5.3 Market size and forecast, by Application

- 6.5.4 Market size and forecast, by country

- 6.6 Australia

- 6.6.1 Key trends and opportunities

- 6.6.2 Market size and forecast, by Type

- 6.6.3 Market size and forecast, by Application

- 6.6.4 Market size and forecast, by country

- 6.7 Southeast Asia

- 6.7.1 Key trends and opportunities

- 6.7.2 Market size and forecast, by Type

- 6.7.3 Market size and forecast, by Application

- 6.7.4 Market size and forecast, by country

- 6.8 Rest of Asia-Pacific

- 6.8.1 Key trends and opportunities

- 6.8.2 Market size and forecast, by Type

- 6.8.3 Market size and forecast, by Application

- 6.8.4 Market size and forecast, by country

- 7.1 Overview

- 7.2 Key Winning Strategies

- 7.3 Top 10 Players: Product Mapping

- 7.4 Competitive Analysis Dashboard

- 7.5 Market Competition Heatmap

- 7.6 Leading Player Positions, 2022

8: Company Profiles

- 8.1 Apollo Endosurgery

- 8.1.1 Company Overview

- 8.1.2 Key Executives

- 8.1.3 Company snapshot

- 8.1.4 Active Business Divisions

- 8.1.5 Product portfolio

- 8.1.6 Business performance

- 8.1.7 Major Strategic Initiatives and Developments

- 8.2 Inc. (United States)

- 8.2.1 Company Overview

- 8.2.2 Key Executives

- 8.2.3 Company snapshot

- 8.2.4 Active Business Divisions

- 8.2.5 Product portfolio

- 8.2.6 Business performance

- 8.2.7 Major Strategic Initiatives and Developments

- 8.3 Atkins Nutritionals

- 8.3.1 Company Overview

- 8.3.2 Key Executives

- 8.3.3 Company snapshot

- 8.3.4 Active Business Divisions

- 8.3.5 Product portfolio

- 8.3.6 Business performance

- 8.3.7 Major Strategic Initiatives and Developments

- 8.4 Inc. (United States)Brunswick Corporation (United States)

- 8.4.1 Company Overview

- 8.4.2 Key Executives

- 8.4.3 Company snapshot

- 8.4.4 Active Business Divisions

- 8.4.5 Product portfolio

- 8.4.6 Business performance

- 8.4.7 Major Strategic Initiatives and Developments

- 8.5 Covidien PLC (Ireland)

- 8.5.1 Company Overview

- 8.5.2 Key Executives

- 8.5.3 Company snapshot

- 8.5.4 Active Business Divisions

- 8.5.5 Product portfolio

- 8.5.6 Business performance

- 8.5.7 Major Strategic Initiatives and Developments

- 8.6 Cybex International (United States)

- 8.6.1 Company Overview

- 8.6.2 Key Executives

- 8.6.3 Company snapshot

- 8.6.4 Active Business Divisions

- 8.6.5 Product portfolio

- 8.6.6 Business performance

- 8.6.7 Major Strategic Initiatives and Developments

- 8.7 Ediets.Com

- 8.7.1 Company Overview

- 8.7.2 Key Executives

- 8.7.3 Company snapshot

- 8.7.4 Active Business Divisions

- 8.7.5 Product portfolio

- 8.7.6 Business performance

- 8.7.7 Major Strategic Initiatives and Developments

- 8.8 Inc. (United States)

- 8.8.1 Company Overview

- 8.8.2 Key Executives

- 8.8.3 Company snapshot

- 8.8.4 Active Business Divisions

- 8.8.5 Product portfolio

- 8.8.6 Business performance

- 8.8.7 Major Strategic Initiatives and Developments

- 8.9 Equinox

- 8.9.1 Company Overview

- 8.9.2 Key Executives

- 8.9.3 Company snapshot

- 8.9.4 Active Business Divisions

- 8.9.5 Product portfolio

- 8.9.6 Business performance

- 8.9.7 Major Strategic Initiatives and Developments

- 8.10 Inc. (United States)

- 8.10.1 Company Overview

- 8.10.2 Key Executives

- 8.10.3 Company snapshot

- 8.10.4 Active Business Divisions

- 8.10.5 Product portfolio

- 8.10.6 Business performance

- 8.10.7 Major Strategic Initiatives and Developments

- 8.11 Herbalife Ltd. (United States

- 8.11.1 Company Overview

- 8.11.2 Key Executives

- 8.11.3 Company snapshot

- 8.11.4 Active Business Divisions

- 8.11.5 Product portfolio

- 8.11.6 Business performance

- 8.11.7 Major Strategic Initiatives and Developments

- 8.12 Jenny Craig (United States)

- 8.12.1 Company Overview

- 8.12.2 Key Executives

- 8.12.3 Company snapshot

- 8.12.4 Active Business Divisions

- 8.12.5 Product portfolio

- 8.12.6 Business performance

- 8.12.7 Major Strategic Initiatives and Developments

- 8.13 Johnson Health Technology Co.

- 8.13.1 Company Overview

- 8.13.2 Key Executives

- 8.13.3 Company snapshot

- 8.13.4 Active Business Divisions

- 8.13.5 Product portfolio

- 8.13.6 Business performance

- 8.13.7 Major Strategic Initiatives and Developments

- 8.14 Ltd. (Japan)

- 8.14.1 Company Overview

- 8.14.2 Key Executives

- 8.14.3 Company snapshot

- 8.14.4 Active Business Divisions

- 8.14.5 Product portfolio

- 8.14.6 Business performance

- 8.14.7 Major Strategic Initiatives and Developments

- 8.15 Nutrisystem

- 8.15.1 Company Overview

- 8.15.2 Key Executives

- 8.15.3 Company snapshot

- 8.15.4 Active Business Divisions

- 8.15.5 Product portfolio

- 8.15.6 Business performance

- 8.15.7 Major Strategic Initiatives and Developments

- 8.16 Inc. (United States)

- 8.16.1 Company Overview

- 8.16.2 Key Executives

- 8.16.3 Company snapshot

- 8.16.4 Active Business Divisions

- 8.16.5 Product portfolio

- 8.16.6 Business performance

- 8.16.7 Major Strategic Initiatives and Developments

9: Analyst Perspective and Conclusion

- 9.1 Concluding Recommendations and Analysis

- 9.2 Strategies for Market Potential

Scope of Report

| Aspects | Details |

|---|---|

By Type |

|

By Application |

|

Report Licenses

Our Team

Frequently Asked Questions (FAQ):

What is the projected market size of Weight Loss Management in 2030?

+

-

Which application type is expected to remain the largest segment in the Asia Pacific Weight Loss Management market?

+

-

How big is the Asia Pacific Weight Loss Management market?

+

-

How do regulatory policies impact the Weight Loss Management Market?

+

-

What major players in Weight Loss Management Market?

+

-

What applications are categorized in the Weight Loss Management market study?

+

-

Which product types are examined in the Weight Loss Management Market Study?

+

-

Which regions are expected to show the fastest growth in the Weight Loss Management market?

+

-

Which application holds the second-highest market share in the Weight Loss Management market?

+

-

What are the major growth drivers in the Weight Loss Management market?

+

-

The weight loss management market is driven by a few key factors. First, the rising global incidence of obesity and allied health conditions like diabetes and cardiovascular disorders presents a huge market for weight management solutions. With growing awareness of the health problems caused by excess weight, people actively hunt for products and services to solve these problems. Secondly, the increasing concern with health and wellbeing, promoted by media, doctors, and real-life experience, leads to motivating people to value weight management within a more overall healthy way of life. Increasing awareness motivates the consumption of numerous approaches to weight reduction as well as of products.

Finally, increased disposable income, especially in emerging economies, allows consumers to purchase weight loss products, services, and fitness expenses, further boosting the market growth. Increased access to and affordability of bariatric surgeries also boost the growth of the market.