Asia Pacific Travel Management Software Market - Industry Dynamics, Market Size, And Opportunity Forecast To 2030

Report ID: MS-1024 | IT and Telecom | Last updated: Jun, 2025 | Formats*:

The Travel Management Software market covers digital platforms designed to optimize and automate corporate travel planning, expenses tracking, reservations and compliance management. These solutions help companies optimize travel costs, apply travel policies, and gain visibility of travel -related spending. With integration features in reserve engines, accounting systems and mobile applications, they provide end -to -to -end control over employee trips. As hybrid work and global mobility trends continue to increase, organizations increasingly adopt these tools to improve efficiency, improve travel experience, and ensure real -time reports and policy adherence.

Travel Management Software Report Highlights

| Report Metrics | Details |

|---|---|

| Forecast period | 2019-2030 |

| Base Year Of Estimation | 2024 |

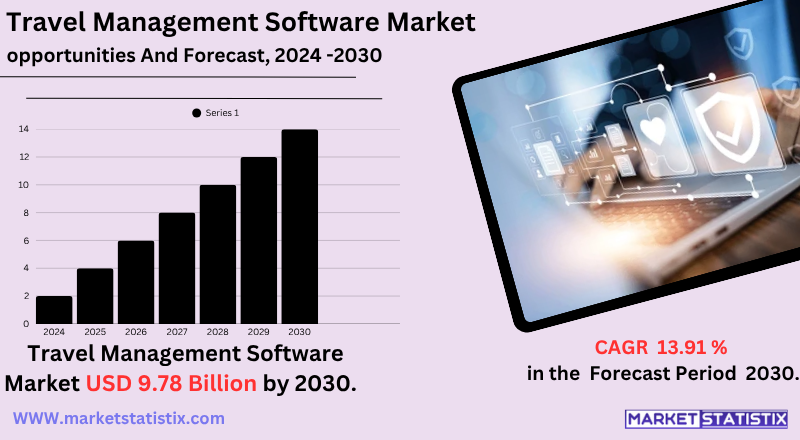

| Growth Rate | CAGR of 13.91% |

| Forecast Value (2030) | USD 9.78 Billion |

| By Product Type | Cab, Bus, Food, Hotel, Flight,, Others |

| Key Market Players |

|

| By Region |

|

Travel Management Software Market Trends

The main trends that shape this evolution include the broad adoption of cloud-based solutions, offering greater flexibility, scalability and accessibility to managing travel programmes from anywhere. There is a strong emphasis on artificial intelligence (AI) and machine learning (ML) to provide custom travel recommendations, automate expenses tracking, and provide predictive information for travel planning and optimised cost control. In addition, the market is seeing a wave in demand for mobile-first platforms, allowing travellers and managers to deal with reserves and approvals without problems. Focus on sustainability tracking in travel management software is also gaining strength, as companies intend to monitor and reduce their environmental impact. Overall, the market is adapting to the evolving scenario of business travel, emphasising the efficiency, cost savings and a superior experience of travellers through advanced technological integration.

Travel Management Software Market Leading Players

The key players profiled in the report are Oracle Corporation (California), Netsuite (United States), Basware (Finland), Databasic (United States), Ariett (United States), Fraedom (United Kingdom), Appricity Corporation (United States), Expense 8 (Australia), Trippeo Technologies (Canada)Growth Accelerators

- Recovery of business travel & globalisation: As international travel rebounds and companies expand between borders, companies seek centralised platforms to manage itineraries, approvals and complex expenses across regions.

- AI-powered personalisation and automation: Use of AI in TMS is revolutionising the reserve experience, offering personalised travel options, automatic filling requests and using chatbots for instant support. Automation helps reduce human error, accelerates workflows and ensures that travellers receive recommendations aligned with company policies and personal preferences.

- Mobile and real-time analytics demand: The shift to a mobile workforce has boosted the need for applications that allow reservations, itinerary changes and approvals on the move.

Travel Management Software Market Segmentation analysis

The Asia Pacific Travel Management Software is segmented by Type, Application, and Region. By Type, the market is divided into Distributed Cab, Bus, Food, Hotel, Flight,, Others . The Application segment categorizes the market based on its usage such as Cloud-Based, On-Premise. Geographically, the market is assessed across key Regions like Asia Pacific (China, Japan, India, South Korea, Australia, Southeast Asia, Rest of Asia-Pacific) and others, each presenting distinct growth opportunities and challenges influenced by the regions.Competitive Landscape

The competitive scenario of the Travel Management Software (TMS) market is marked by a mixture of well-entrenched global platforms and disruptive cloud-native challengers. Established leaders such as SAP Concur, Amadeus, Sabre and Travelport dominate through deep integrations with corporate systems and vast distribution networks. At the same time, pure cloud innovators such as TripActions/Navan, TravelPerk, Lola, Rydoo, Certify and TravelBank are expanding rapidly, offering enhanced AI booking, first-rate experiences, and seamless expense convergence. These first cloud vendors are aggressive in R&D, directing SMBs with intuitive and flexible platforms, while holders contradict acquisitions and enhanced analysis to maintain corporate footprints.

Challenges In Travel Management Software Market

The main opportunities are accelerating cloud-based platform adoption by companies of all sizes, offering scalability and remote accessibility to manage complex travel programmes. Focus increased on traveller safety, particularly in the post-pandemic scenario, and the demand fuels advanced risk management and real-time support resources. Asia Pacific is emerging rapidly as a high-growth region, driven by expanding economies, increasing international travel and growing digital transformation initiatives in companies. In addition, the incorporation of ecological carbon tracking resources aligns with corporate ESG goals, attracting customers focused on sustainable business travel. These trends collectively open ways for software providers to provide efficient, environmentally responsible and personalised corporate travel solutions in real time.

Risks & Prospects in Travel Management Software Market

The main opportunities are accelerating cloud-based platform adoption by companies of all sizes, offering scalability and remote accessibility to manage complex travel programmes. Focus increased on traveller safety, particularly in the post-pandemic scenario, and the demand fuels advanced risk management and real-time support resources. Asia Pacific is emerging rapidly as a high-growth region, driven by expanding economies, increasing international travel and growing digital transformation initiatives in companies. In addition, the incorporation of ecological carbon tracking resources aligns with corporate ESG goals, attracting customers focused on sustainable business travel. These trends collectively open ways for software providers to provide efficient, environmentally responsible and personalised corporate travel solutions in real time.

Key Target Audience

The competitive scenario of the Travel Management Software (TMS) market is marked by a mixture of well-entrenched global platforms and disruptive cloud-native challengers. Established leaders such as SAP Concur, Amadeus, Sabre and Travelport dominate through deep integrations with corporate systems and vast distribution networks. At the same time, pure cloud innovators such as TripActions/Navan, TravelPerk, Lola, Rydoo, Certify and TravelBank are expanding rapidly, offering enhanced AI booking, first-rate experiences, and seamless expense convergence. These first cloud vendors are aggressive in R&D, directing SMBs with intuitive and flexible platforms, while holders contradict acquisitions and enhanced analysis to maintain corporate footprints.

Merger and acquisition

- American Express GBT revises merger terms with CWT: In April 2025, the American Express Global Business Travel revised its $540 million acquisition agreement for rival CWT, extending the deadline to December 31, 2025. This merger aims to consolidate leadership in the global sector of corporate travel management.

- Regulatory scrutiny on Amex GBT–CWT deal: The US Department of Justice filed a lawsuit in January 2025 to block the merger, citing competition concerns and possible price increases for corporate travel customers. Meanwhile, the UK Competition and Markets Authority (CMA) provisionally approved the merger after concluding that the combined company would still face adequate competition. This reflects the growing regulatory sensitivity to consolidation in digital travel markets.

Analyst Comment

The travel management software market is expanding rapidly – growing from $9 to $10 billion in 2024 with robust CAGR. This growth is fuelled by increased global and corporate travel, digital transformation fuelling cloud and mobile adoption, and demand for cost control, travellers' safety and compliance. The main technological trends – contactless reserves, first mobile platforms and predictive tools – are accelerating adoption, especially between large companies and younger workforce segments. North America currently leads in market share, while Asia Pacific is emerging as the fastest-growing region.

- 1.1 Report description

- 1.2 Key market segments

- 1.3 Key benefits to the stakeholders

2: Executive Summary

- 2.1 Travel Management Software- Snapshot

- 2.2 Travel Management Software- Segment Snapshot

- 2.3 Travel Management Software- Competitive Landscape Snapshot

3: Market Overview

- 3.1 Market definition and scope

- 3.2 Key findings

- 3.2.1 Top impacting factors

- 3.2.2 Top investment pockets

- 3.3 Porter’s five forces analysis

- 3.3.1 Low bargaining power of suppliers

- 3.3.2 Low threat of new entrants

- 3.3.3 Low threat of substitutes

- 3.3.4 Low intensity of rivalry

- 3.3.5 Low bargaining power of buyers

- 3.4 Market dynamics

- 3.4.1 Drivers

- 3.4.2 Restraints

- 3.4.3 Opportunities

4: Travel Management Software Market by Type

- 4.1 Overview

- 4.1.1 Market size and forecast

- 4.2 Flight

- 4.2.1 Key market trends, factors driving growth, and opportunities

- 4.2.2 Market size and forecast, by region

- 4.2.3 Market share analysis by country

- 4.3 Bus

- 4.3.1 Key market trends, factors driving growth, and opportunities

- 4.3.2 Market size and forecast, by region

- 4.3.3 Market share analysis by country

- 4.4 Cab

- 4.4.1 Key market trends, factors driving growth, and opportunities

- 4.4.2 Market size and forecast, by region

- 4.4.3 Market share analysis by country

- 4.5 Hotel

- 4.5.1 Key market trends, factors driving growth, and opportunities

- 4.5.2 Market size and forecast, by region

- 4.5.3 Market share analysis by country

- 4.6 Food

- 4.6.1 Key market trends, factors driving growth, and opportunities

- 4.6.2 Market size and forecast, by region

- 4.6.3 Market share analysis by country

- 4.7 Others

- 4.7.1 Key market trends, factors driving growth, and opportunities

- 4.7.2 Market size and forecast, by region

- 4.7.3 Market share analysis by country

5: Travel Management Software Market by Application / by End Use

- 5.1 Overview

- 5.1.1 Market size and forecast

- 5.2 Cloud-Based

- 5.2.1 Key market trends, factors driving growth, and opportunities

- 5.2.2 Market size and forecast, by region

- 5.2.3 Market share analysis by country

- 5.3 On-Premise

- 5.3.1 Key market trends, factors driving growth, and opportunities

- 5.3.2 Market size and forecast, by region

- 5.3.3 Market share analysis by country

6: Travel Management Software Market by Region

- 6.1 Overview

- 6.1.1 Market size and forecast By Region

- 6.2 China

- 6.2.1 Key trends and opportunities

- 6.2.2 Market size and forecast, by Type

- 6.2.3 Market size and forecast, by Application

- 6.2.4 Market size and forecast, by country

- 6.3 Japan

- 6.3.1 Key trends and opportunities

- 6.3.2 Market size and forecast, by Type

- 6.3.3 Market size and forecast, by Application

- 6.3.4 Market size and forecast, by country

- 6.4 India

- 6.4.1 Key trends and opportunities

- 6.4.2 Market size and forecast, by Type

- 6.4.3 Market size and forecast, by Application

- 6.4.4 Market size and forecast, by country

- 6.5 South Korea

- 6.5.1 Key trends and opportunities

- 6.5.2 Market size and forecast, by Type

- 6.5.3 Market size and forecast, by Application

- 6.5.4 Market size and forecast, by country

- 6.6 Australia

- 6.6.1 Key trends and opportunities

- 6.6.2 Market size and forecast, by Type

- 6.6.3 Market size and forecast, by Application

- 6.6.4 Market size and forecast, by country

- 6.7 Southeast Asia

- 6.7.1 Key trends and opportunities

- 6.7.2 Market size and forecast, by Type

- 6.7.3 Market size and forecast, by Application

- 6.7.4 Market size and forecast, by country

- 6.8 Rest of Asia-Pacific

- 6.8.1 Key trends and opportunities

- 6.8.2 Market size and forecast, by Type

- 6.8.3 Market size and forecast, by Application

- 6.8.4 Market size and forecast, by country

- 7.1 Overview

- 7.2 Key Winning Strategies

- 7.3 Top 10 Players: Product Mapping

- 7.4 Competitive Analysis Dashboard

- 7.5 Market Competition Heatmap

- 7.6 Leading Player Positions, 2022

8: Company Profiles

- 8.1 Appricity Corporation (United States)

- 8.1.1 Company Overview

- 8.1.2 Key Executives

- 8.1.3 Company snapshot

- 8.1.4 Active Business Divisions

- 8.1.5 Product portfolio

- 8.1.6 Business performance

- 8.1.7 Major Strategic Initiatives and Developments

- 8.2 Ariett (United States)

- 8.2.1 Company Overview

- 8.2.2 Key Executives

- 8.2.3 Company snapshot

- 8.2.4 Active Business Divisions

- 8.2.5 Product portfolio

- 8.2.6 Business performance

- 8.2.7 Major Strategic Initiatives and Developments

- 8.3 Basware (Finland)

- 8.3.1 Company Overview

- 8.3.2 Key Executives

- 8.3.3 Company snapshot

- 8.3.4 Active Business Divisions

- 8.3.5 Product portfolio

- 8.3.6 Business performance

- 8.3.7 Major Strategic Initiatives and Developments

- 8.4 Databasic (United States)

- 8.4.1 Company Overview

- 8.4.2 Key Executives

- 8.4.3 Company snapshot

- 8.4.4 Active Business Divisions

- 8.4.5 Product portfolio

- 8.4.6 Business performance

- 8.4.7 Major Strategic Initiatives and Developments

- 8.5 Expense 8 (Australia)

- 8.5.1 Company Overview

- 8.5.2 Key Executives

- 8.5.3 Company snapshot

- 8.5.4 Active Business Divisions

- 8.5.5 Product portfolio

- 8.5.6 Business performance

- 8.5.7 Major Strategic Initiatives and Developments

- 8.6 Fraedom (United Kingdom)

- 8.6.1 Company Overview

- 8.6.2 Key Executives

- 8.6.3 Company snapshot

- 8.6.4 Active Business Divisions

- 8.6.5 Product portfolio

- 8.6.6 Business performance

- 8.6.7 Major Strategic Initiatives and Developments

- 8.7 Netsuite (United States)

- 8.7.1 Company Overview

- 8.7.2 Key Executives

- 8.7.3 Company snapshot

- 8.7.4 Active Business Divisions

- 8.7.5 Product portfolio

- 8.7.6 Business performance

- 8.7.7 Major Strategic Initiatives and Developments

- 8.8 Oracle Corporation (California)

- 8.8.1 Company Overview

- 8.8.2 Key Executives

- 8.8.3 Company snapshot

- 8.8.4 Active Business Divisions

- 8.8.5 Product portfolio

- 8.8.6 Business performance

- 8.8.7 Major Strategic Initiatives and Developments

- 8.9 Trippeo Technologies (Canada)

- 8.9.1 Company Overview

- 8.9.2 Key Executives

- 8.9.3 Company snapshot

- 8.9.4 Active Business Divisions

- 8.9.5 Product portfolio

- 8.9.6 Business performance

- 8.9.7 Major Strategic Initiatives and Developments

9: Analyst Perspective and Conclusion

- 9.1 Concluding Recommendations and Analysis

- 9.2 Strategies for Market Potential

Scope of Report

| Aspects | Details |

|---|---|

By Type |

|

By Application |

|

Report Licenses

Our Team

Frequently Asked Questions (FAQ):

What is the estimated market size of Travel Management Software in 2030?

+

-

Which type of Travel Management Software is widely popular?

+

-

What is the growth rate of Travel Management Software Market?

+

-

What are the latest trends influencing the Travel Management Software Market?

+

-

Who are the key players in the Travel Management Software Market?

+

-

How is the Travel Management Software } industry progressing in scaling its end-use implementations?

+

-

What product types are analyzed in the Travel Management Software Market Study?

+

-

What geographic breakdown is available in Asia Pacific Travel Management Software Market Study?

+

-

Which region holds the second position by market share in the Travel Management Software market?

+

-

How are the key players in the Travel Management Software market targeting growth in the future?

+

-

- ,

,

- ,

- AI-powered personalisation and automation: Use of AI in TMS is revolutionising the reserve experience, offering personalised travel options, automatic filling requests and using chatbots for instant support. Automation helps reduce human error, accelerates workflows and ensures that travellers receive recommendations aligned with company policies and personal preferences. ,

- ,

,,

,