Asia Pacific Superfood-based Packaged Snacks Market - Industry Dynamics, Market Size, And Opportunity Forecast To 2030

Report ID: MS-844 | Healthcare and Pharma | Last updated: May, 2025 | Formats*:

The superfood-based packaged snacks market includes ready-to-eat food products containing ingredients known to be highly dense in nutrients and possess potential health benefits, generally known as "superfoods". Such snacks look to offer customers a convenient, nutritious, and healthier alternative beyond conventional snacking by providing an intense source of vitamins, minerals, antioxidants, and other functional compounds. Popular superfood ingredients used in these snack foods are fruits such as berries and acai, vegetables such as spinach and kale, seeds such as flax and chia, nuts, ancient grains such as quinoa, and even spirulina and matcha.

This market segment has seen growth as consumers become more health and wellness aware, prefer quick on-the-go foods, and need snacks that are functional. Packaged snacking products based on superfoods appeal to consumers who want to enhance their nutrient consumption, control their weight, or satisfy specific nutritional requirements

Superfood-based Packaged Snacks Report Highlights

| Report Metrics | Details |

|---|---|

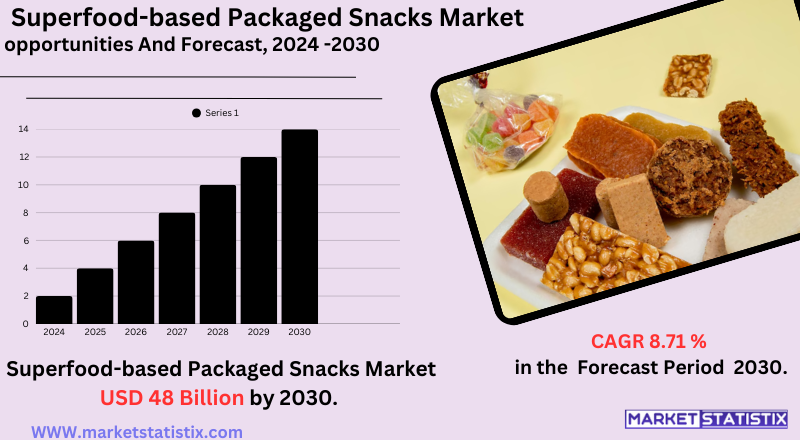

| Forecast period | 2019-2030 |

| Base Year Of Estimation | 2024 |

| Growth Rate | CAGR of 8.71% |

| Forecast Value (2030) | USD 48 Billion |

| By Product Type | seeds-based packaged superfood snacks, Edible seaweed-based packaged superfood snacks, Nuts, grains, Super fruit-based packaged superfood snacks, Others |

| Key Market Players |

|

| By Region |

|

Superfood-based Packaged Snacks Market Trends

One key trend is the growing demand for snacks made with "clean label" ingredients, indicating consumers want to see natural, recognisable, and minimally processed ingredients used in their snacks. This equates to more snacks that contain slightly less processed foods, such as whole fruits, vegetables, nuts, and seeds with fewer additives or preservatives. In addition, there's increasing focus on particular health benefits, resulting in fortified snacks containing ingredients with established functional properties, including probiotics for digestive health, adaptogens for stress reduction, and greater protein or fibre content for feelings of fullness.

Another dominant trend is the diversification of superfood ingredients being utilised in snacks. In addition to popular choices like berries and chia seeds, there is more usage of exotic, nutrient-dense ingredients like moringa, baobab, and ancient grains such as quinoa and amaranth. Plant and vegan superfood snacks are also increasingly popular, in line with the overall movement towards plant-based diets. Portability and ease of use remain a central trend driver, servicing busy lives and the need for on-the-move nutrition

Superfood-based Packaged Snacks Market Leading Players

The key players profiled in the report are Healthy Truth (United States), Navitas LLC (United States), Nutrisure Ltd. T/A Naturya (United Kingdom), Nature's Path Foods (Canada), Rhythm Superfoods (United States), Sunfood Corp. (United States), Superlife Co. Pte Ltd. (Singapore), Suncore Foods Inc. (United States), General Mills Inc. (United States), Creative Nature Ltd. (United Kingdom), Actspand Pte Ltd. (Singapore), OthersGrowth Accelerators

The packaged snacks market based on superfoods is heavily driven by heightened health awareness among consumers across the world. Consumers are increasingly recognising the connection between diet and health and going in search of foods that are rich in nutrients and provide functional advantages such as enhanced immunity, weight management, and overall health. This increased emphasis on wellness creates a drive for easy-to-consume snack foods that include ingredients that are thought of as healthier and more nutritious than conventional snacks.

Another major driver is the increasing popularity of plant-based diets and the increasing trend of veganism and vegetarianism. Superfoods like chia seeds, quinoa, spirulina, and other nuts and fruits are a perfect fit for these diets, driving demand for packaged snacks with these ingredients. In addition, the convenience and portability of packaged snacks suit busy lifestyles, with superfood-based snacks presenting an attractive option for consumers to have access to healthy nutrients in their lifestyles without extensive preparation requirements.

Superfood-based Packaged Snacks Market Segmentation analysis

The Asia Pacific Superfood-based Packaged Snacks is segmented by Type, Application, and Region. By Type, the market is divided into Distributed seeds-based packaged superfood snacks, Edible seaweed-based packaged superfood snacks, Nuts, grains, Super fruit-based packaged superfood snacks, Others . The Application segment categorizes the market based on its usage such as Hypermarket and Supermarket, Direct Selling, Premium Grocery Stores, Online Retail. Geographically, the market is assessed across key Regions like Asia Pacific (China, Japan, India, South Korea, Australia, Southeast Asia, Rest of Asia-Pacific) and others, each presenting distinct growth opportunities and challenges influenced by the regions.Competitive Landscape

The superfood-based packaged snack market's competitive landscape is dynamic and varied, with a combination of multinational food and beverage giants and niche, specialist health-orientated brands. Large players such as General Mills, PepsiCo (via brands such as Quaker), and Nestlé are increasingly adding superfoods to their snack portfolios to appeal to health-orientated consumers. Together with these titans, many smaller firms like Nature's Path, Navitas Organics, and KIND have constructed their brand on natural and superfood-based ingredients, promoting organic, non-GMO, and sustainable sources in many cases.

Sales competition in this sector revolves around product development, ingredient quality, and successful marketing of the nutritional quality and special qualities of the superfoods employed. Differentiation strategies such as distinctive flavour profiles, unique health claims (e.g., antioxidant-rich, fibre-rich), and addressing specific dietary needs such as gluten-free, vegan, or paleo have also heightened competition. The growth of e-commerce and direct-to-consumer models has further increased competition by enabling smaller brands to access more consumers. Overall, the terrain is marked by ongoing innovation and a high concentration on health and wellness trends in order to exploit the increasing consumer demand for healthy and convenient snacking.

Challenges In Superfood-based Packaged Snacks Market

The packaged snack market based on superfoods is plagued by a number of serious issues that may stifle its growth and acceptability. One of the main issues is the absence of standardised definitions and labelling requirements for "superfoods", creating confusion among customers over the nutritional content and genuineness of these products. This uncertainty, along with regionally inconsistent regulation, hinders brands from establishing trust and new players from making a name in the market. The industry also struggles with the high cost of production because superfood ingredients are premium and require specialised processing, which can restrict affordability and mass-market appeal.

Another key challenge is working through a sophisticated and changing regulatory environment. Companies have to adhere to high standards of food safety, truthful health claims, and labelling requirements, which are vastly different by country and region. In addition, the market is getting increasingly crowded, creating heightened competition not just between superfood snack brands but also against other wellness offerings such as supplements and probiotics, which complicates individual brands' ability to differentiate and continue growing.

Risks & Prospects in Superfood-based Packaged Snacks Market

Brands are able to benefit by expanding the product ranges with a wider number of superfoods and tastes in order to capture health-orientated groups like sports, fitness, and millennials. Other key tactics are to engage well-being influencers, invest in environmentally friendly packaging, and make strategic use of the e-commerce distribution channel.

Geographically, Europe will continue to show a high market share because of good consumer health consciousness, purchasing power, and climatic conditions for superfood production, with brand names and innovative farming technologies fuelling growth. Asia-Pacific is also on the verge of fast growth with changing food patterns, long working schedules, and mounting launches of products in emerging economies such as India and China. The U.S. is still a key market, worth $8.8 billion in 2024, and China is predicted to expand to $10.4 billion by 2030. Such regional behaviours, coupled with increased use of web-based retailing and the effects of social media, are anticipated to continue strong market expansion worldwide.

Key Target Audience

,,

The major target market for the packaged snacks market based on superfoods are health-conscious individuals from different age groups. This includes millennials and Gen Z consumers who are most interested in wellness and tend to look for easy yet healthy food options that complement their active lifestyle. These consumers are generally well-educated on health trends, proactively search for functional foods with targeted health benefits (such as high protein, fibre, or antioxidants), and are usually willing to pay a premium for items that are perceived as healthier and more natural.

, In addition to the primary health-orientated segment, the market also attracts consumers with particular dietary needs or restrictions, such as gluten-free, vegan, or paleo diet consumers. Active professionals and busy consumers seeking convenient and healthy snacking solutions are also an important segment. Additionally, parents interested in finding healthier options for children's snacks are increasingly interested. Psychographically, these consumers tend to value well-being, take an active approach to health, care about natural and clean labels, and are affected by social media and health and wellness trends.

Merger and acquisition

The packaged snacks market for superfood-based products has seen widespread mergers and acquisitions (M&A) in the last few years, indicating increasing consumer interest in healthy snacking. PepsiCo's acquisition of Siete Foods, a Texas-based firm popular for its grain-free and health-focused offerings, for $1.2 billion is one such instance indicating the direction of the industry towards healthier products. Likewise, the acquisition of the UK-based healthy eating firm Deliciously Ella by the Hero Group also points towards the strategic attention towards wellness-focused snack brands.

These deals represent an overall pattern in which large food companies acquire snack firms specialising in superfoods in order to strengthen their portfolios and address changing consumers' demands. The trend behind the M&A is a turn toward healthiness, sustainability, and clean label products as producers seek to join the burgeoning healthy and functional foods market. That trend will most likely be perpetuated, as increasingly more strategic partnerships and acquisitions should be made for superfood-snack companies going forward.

>

Analyst Comment

The market for packaged snacks based on superfoods is witnessing strong growth due to increasing consumer demand for healthier, high-nutrient-content snack foods that are coordinated with wellness trends and active lifestyles. Amid ongoing supply chain pressures and economic volatilities in 2024, the market is supported by economic recovery, digitalisation for resilience, and high Gen Z demand for "better-for-you" products. Superfood snacks – including ingredients such as quinoa, chia seeds, and spirulina – are growing in popularity due to their health benefits, convenience, and appeal to plant-based and clean-label trends. The market size reached $32.6 billion in 2024 and is expected to grow steadily with the support of food processing innovations, increased product portfolios, and the strong development of e-commerce and retail distribution channels.

- 1.1 Report description

- 1.2 Key market segments

- 1.3 Key benefits to the stakeholders

2: Executive Summary

- 2.1 Superfood-based Packaged Snacks- Snapshot

- 2.2 Superfood-based Packaged Snacks- Segment Snapshot

- 2.3 Superfood-based Packaged Snacks- Competitive Landscape Snapshot

3: Market Overview

- 3.1 Market definition and scope

- 3.2 Key findings

- 3.2.1 Top impacting factors

- 3.2.2 Top investment pockets

- 3.3 Porter’s five forces analysis

- 3.3.1 Low bargaining power of suppliers

- 3.3.2 Low threat of new entrants

- 3.3.3 Low threat of substitutes

- 3.3.4 Low intensity of rivalry

- 3.3.5 Low bargaining power of buyers

- 3.4 Market dynamics

- 3.4.1 Drivers

- 3.4.2 Restraints

- 3.4.3 Opportunities

4: Superfood-based Packaged Snacks Market by Type

- 4.1 Overview

- 4.1.1 Market size and forecast

- 4.2 Super fruit-based packaged superfood snacks

- 4.2.1 Key market trends, factors driving growth, and opportunities

- 4.2.2 Market size and forecast, by region

- 4.2.3 Market share analysis by country

- 4.3 Edible seaweed-based packaged superfood snacks

- 4.3.1 Key market trends, factors driving growth, and opportunities

- 4.3.2 Market size and forecast, by region

- 4.3.3 Market share analysis by country

- 4.4 Nuts

- 4.4.1 Key market trends, factors driving growth, and opportunities

- 4.4.2 Market size and forecast, by region

- 4.4.3 Market share analysis by country

- 4.5 grains

- 4.5.1 Key market trends, factors driving growth, and opportunities

- 4.5.2 Market size and forecast, by region

- 4.5.3 Market share analysis by country

- 4.6 seeds-based packaged superfood snacks

- 4.6.1 Key market trends, factors driving growth, and opportunities

- 4.6.2 Market size and forecast, by region

- 4.6.3 Market share analysis by country

- 4.7 Others

- 4.7.1 Key market trends, factors driving growth, and opportunities

- 4.7.2 Market size and forecast, by region

- 4.7.3 Market share analysis by country

5: Superfood-based Packaged Snacks Market by Application / by End Use

- 5.1 Overview

- 5.1.1 Market size and forecast

- 5.2 Hypermarket and Supermarket

- 5.2.1 Key market trends, factors driving growth, and opportunities

- 5.2.2 Market size and forecast, by region

- 5.2.3 Market share analysis by country

- 5.3 Premium Grocery Stores

- 5.3.1 Key market trends, factors driving growth, and opportunities

- 5.3.2 Market size and forecast, by region

- 5.3.3 Market share analysis by country

- 5.4 Direct Selling

- 5.4.1 Key market trends, factors driving growth, and opportunities

- 5.4.2 Market size and forecast, by region

- 5.4.3 Market share analysis by country

- 5.5 Online Retail

- 5.5.1 Key market trends, factors driving growth, and opportunities

- 5.5.2 Market size and forecast, by region

- 5.5.3 Market share analysis by country

6: Superfood-based Packaged Snacks Market by Region

- 6.1 Overview

- 6.1.1 Market size and forecast By Region

- 6.2 China

- 6.2.1 Key trends and opportunities

- 6.2.2 Market size and forecast, by Type

- 6.2.3 Market size and forecast, by Application

- 6.2.4 Market size and forecast, by country

- 6.3 Japan

- 6.3.1 Key trends and opportunities

- 6.3.2 Market size and forecast, by Type

- 6.3.3 Market size and forecast, by Application

- 6.3.4 Market size and forecast, by country

- 6.4 India

- 6.4.1 Key trends and opportunities

- 6.4.2 Market size and forecast, by Type

- 6.4.3 Market size and forecast, by Application

- 6.4.4 Market size and forecast, by country

- 6.5 South Korea

- 6.5.1 Key trends and opportunities

- 6.5.2 Market size and forecast, by Type

- 6.5.3 Market size and forecast, by Application

- 6.5.4 Market size and forecast, by country

- 6.6 Australia

- 6.6.1 Key trends and opportunities

- 6.6.2 Market size and forecast, by Type

- 6.6.3 Market size and forecast, by Application

- 6.6.4 Market size and forecast, by country

- 6.7 Southeast Asia

- 6.7.1 Key trends and opportunities

- 6.7.2 Market size and forecast, by Type

- 6.7.3 Market size and forecast, by Application

- 6.7.4 Market size and forecast, by country

- 6.8 Rest of Asia-Pacific

- 6.8.1 Key trends and opportunities

- 6.8.2 Market size and forecast, by Type

- 6.8.3 Market size and forecast, by Application

- 6.8.4 Market size and forecast, by country

- 7.1 Overview

- 7.2 Key Winning Strategies

- 7.3 Top 10 Players: Product Mapping

- 7.4 Competitive Analysis Dashboard

- 7.5 Market Competition Heatmap

- 7.6 Leading Player Positions, 2022

8: Company Profiles

- 8.1 Actspand Pte Ltd. (Singapore)

- 8.1.1 Company Overview

- 8.1.2 Key Executives

- 8.1.3 Company snapshot

- 8.1.4 Active Business Divisions

- 8.1.5 Product portfolio

- 8.1.6 Business performance

- 8.1.7 Major Strategic Initiatives and Developments

- 8.2 Creative Nature Ltd. (United Kingdom)

- 8.2.1 Company Overview

- 8.2.2 Key Executives

- 8.2.3 Company snapshot

- 8.2.4 Active Business Divisions

- 8.2.5 Product portfolio

- 8.2.6 Business performance

- 8.2.7 Major Strategic Initiatives and Developments

- 8.3 General Mills Inc. (United States)

- 8.3.1 Company Overview

- 8.3.2 Key Executives

- 8.3.3 Company snapshot

- 8.3.4 Active Business Divisions

- 8.3.5 Product portfolio

- 8.3.6 Business performance

- 8.3.7 Major Strategic Initiatives and Developments

- 8.4 Healthy Truth (United States)

- 8.4.1 Company Overview

- 8.4.2 Key Executives

- 8.4.3 Company snapshot

- 8.4.4 Active Business Divisions

- 8.4.5 Product portfolio

- 8.4.6 Business performance

- 8.4.7 Major Strategic Initiatives and Developments

- 8.5 Navitas LLC (United States)

- 8.5.1 Company Overview

- 8.5.2 Key Executives

- 8.5.3 Company snapshot

- 8.5.4 Active Business Divisions

- 8.5.5 Product portfolio

- 8.5.6 Business performance

- 8.5.7 Major Strategic Initiatives and Developments

- 8.6 Nature's Path Foods (Canada)

- 8.6.1 Company Overview

- 8.6.2 Key Executives

- 8.6.3 Company snapshot

- 8.6.4 Active Business Divisions

- 8.6.5 Product portfolio

- 8.6.6 Business performance

- 8.6.7 Major Strategic Initiatives and Developments

- 8.7 Nutrisure Ltd. T/A Naturya (United Kingdom)

- 8.7.1 Company Overview

- 8.7.2 Key Executives

- 8.7.3 Company snapshot

- 8.7.4 Active Business Divisions

- 8.7.5 Product portfolio

- 8.7.6 Business performance

- 8.7.7 Major Strategic Initiatives and Developments

- 8.8 Rhythm Superfoods (United States)

- 8.8.1 Company Overview

- 8.8.2 Key Executives

- 8.8.3 Company snapshot

- 8.8.4 Active Business Divisions

- 8.8.5 Product portfolio

- 8.8.6 Business performance

- 8.8.7 Major Strategic Initiatives and Developments

- 8.9 Suncore Foods Inc. (United States)

- 8.9.1 Company Overview

- 8.9.2 Key Executives

- 8.9.3 Company snapshot

- 8.9.4 Active Business Divisions

- 8.9.5 Product portfolio

- 8.9.6 Business performance

- 8.9.7 Major Strategic Initiatives and Developments

- 8.10 Sunfood Corp. (United States)

- 8.10.1 Company Overview

- 8.10.2 Key Executives

- 8.10.3 Company snapshot

- 8.10.4 Active Business Divisions

- 8.10.5 Product portfolio

- 8.10.6 Business performance

- 8.10.7 Major Strategic Initiatives and Developments

- 8.11 Superlife Co. Pte Ltd. (Singapore)

- 8.11.1 Company Overview

- 8.11.2 Key Executives

- 8.11.3 Company snapshot

- 8.11.4 Active Business Divisions

- 8.11.5 Product portfolio

- 8.11.6 Business performance

- 8.11.7 Major Strategic Initiatives and Developments

- 8.12 Others

- 8.12.1 Company Overview

- 8.12.2 Key Executives

- 8.12.3 Company snapshot

- 8.12.4 Active Business Divisions

- 8.12.5 Product portfolio

- 8.12.6 Business performance

- 8.12.7 Major Strategic Initiatives and Developments

9: Analyst Perspective and Conclusion

- 9.1 Concluding Recommendations and Analysis

- 9.2 Strategies for Market Potential

Scope of Report

| Aspects | Details |

|---|---|

By Type |

|

By Application |

|

Report Licenses

Our Team

Frequently Asked Questions (FAQ):

What is the estimated market size of Superfood-based Packaged Snacks in 2030?

+

-

Which type of Superfood-based Packaged Snacks is widely popular?

+

-

What is the growth rate of Superfood-based Packaged Snacks Market?

+

-

What are the latest trends influencing the Superfood-based Packaged Snacks Market?

+

-

Who are the key players in the Superfood-based Packaged Snacks Market?

+

-

How is the Superfood-based Packaged Snacks } industry progressing in scaling its end-use implementations?

+

-

What product types are analyzed in the Superfood-based Packaged Snacks Market Study?

+

-

What geographic breakdown is available in Asia Pacific Superfood-based Packaged Snacks Market Study?

+

-

Which region holds the second position by market share in the Superfood-based Packaged Snacks market?

+

-

How are the key players in the Superfood-based Packaged Snacks market targeting growth in the future?

+

-

,,

,

The packaged snacks market based on superfoods is heavily driven by heightened health awareness among consumers across the world. Consumers are increasingly recognising the connection between diet and health and going in search of foods that are rich in nutrients and provide functional advantages such as enhanced immunity, weight management, and overall health. This increased emphasis on wellness creates a drive for easy-to-consume snack foods that include ingredients that are thought of as healthier and more nutritious than conventional snacks.

,