Asia Pacific Sampling Valve Market Size, Share & Trends Analysis Report, Forecast Period, 2024-2030

Report ID: MS-954 | IT and Telecom | Last updated: May, 2025 | Formats*:

The sampling valve market refers to the global industry involved in the design, manufacture, and distribution of specialised valves used to extract representative fluid samples (gases, liquids, sludge or even fluidised solids) from process lines, tanks or boats. These valves are critical in a wide range of industrial applications, where quality control, process monitoring, and regulatory compliance are key. They are designed to ensure that the sample performed accurately reflects the composition of the bulk material, without contamination of anterior lots or the surrounding environment. This includes the prevention of "dead spots" where old material could remain and ensuring the operator's safety when dealing with dangerous substances.

Market growth is driven by the growing demand for precise process monitoring and quality guarantees in industries such as pharmaceutical products, biotechnology, food and beverages, chemicals, oil and gas, and water and wastewater treatment. Innovations in this market are usually focused on aseptic projects to avoid contamination, advanced materials that can support corrosive or extreme temperature environments and integration with automation and digital systems for remote monitoring and control. The continuous need for reliable and representative sampling to ensure product quality, optimise production processes, and meet the rigorous regulations of the industry drives constant expansion of the sampling valve market globally.

Sampling Valve Report Highlights

| Report Metrics | Details |

|---|---|

| Forecast period | 2019-2030 |

| Base Year Of Estimation | 2024 |

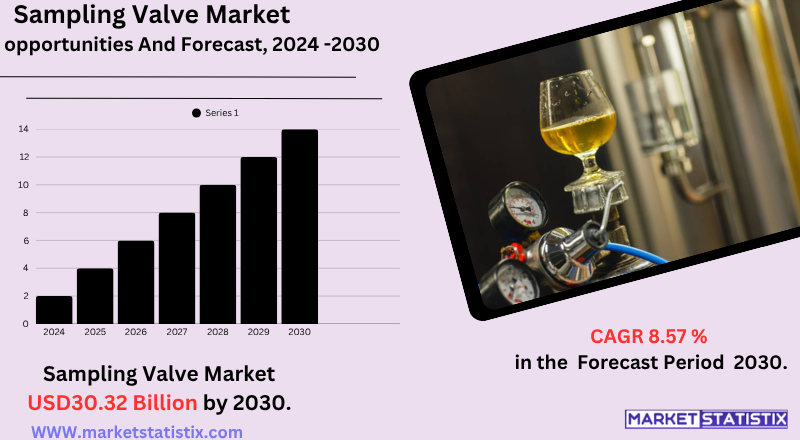

| Growth Rate | CAGR of 8.57% |

| Forecast Value (2030) | USD 30.32 Billion |

| By Product Type | Aseptic, Basic |

| Key Market Players |

|

| By Region |

|

Sampling Valve Market Trends

The sampling valve market is undergoing constant growth, driven by a growing need for precise process monitoring and quality control in various sectors. This growth is significantly influenced by the growing demand of sectors such as oil and gas, energy, pharmaceuticals, food and beverage and water and wastewater treatment, where acquisition needs without contamination are fundamental for efficiency, safety and regulatory compliance. In addition, the effort for industrial automation and the integration of intelligent technologies, including sensors and IoT for real-time data monitoring and automated control, are key trends that boost market expansion.

Technological advances are also playing a crucial role, with the development of more efficient and automated sampling systems, along with the adoption of advanced materials that offer greater durability and corrosion resistance, especially for severe environments. The market is seeing a remarkable trend for miniaturisation for space-restriction applications.

Sampling Valve Market Leading Players

The key players profiled in the report are KEOFITT A/S, Alfa Laval, Strahman Valves, Emerson Electric, Pfeiffer, Genebre Group, FAMAT SA, NEUMO-Ehrenberg-Group, GEA Group, RITAG, BIAR, Swissfluid AGGrowth Accelerators

The sampling valve market is experiencing significant growth driven by several key factors in various industries. A primary driver is the growing emphasis on quality control and regulatory compliance. Industries such as pharmaceutical products, food and beverage, chemicals and oil and gas require accurate and representative samples to ensure product quality, process optimisation and adherence to rigorous safety and environmental regulations. Sampling valves allow the collection of reliable and uncontaminated samples, which is crucial for these sectors to meet their respective standards and avoid expensive problems. Demand for precise analytical data to optimise processes and minimise waste further boosts the adoption of these valves.

Another crucial market factor is the continuous tendency of industrial automation and technological advances. The integration of intelligent technologies, sensors and automation systems in sampling valves allows remote monitoring, real-time data collection and precise control over sampling processes. This not only increases efficiency and accuracy but also minimises human intervention and potential exposure risks for operators.

Sampling Valve Market Segmentation analysis

The Asia Pacific Sampling Valve is segmented by Type, Application, and Region. By Type, the market is divided into Distributed Aseptic, Basic . The Application segment categorizes the market based on its usage such as Food & Beverages, Chemicals, Water and Wastewater Treatment, Energy & Power, Oil & Gas, Pharmaceuticals. Geographically, the market is assessed across key Regions like North America (United States, Canada, Mexico), South America (Brazil, Argentina, Chile, Rest of South America), Europe (Germany, France, Italy, United Kingdom, Benelux, Nordics, Rest of Europe), Asia Pacific (China, Japan, India, South Korea, Australia, Southeast Asia, Rest of Asia-Pacific), MEA (Middle East, Africa) and others, each presenting distinct growth opportunities and challenges influenced by the regions.Competitive Landscape

The sampling valve market displays a moderately concentrated competitive scenario, characterised by a mixture of established global players and specialised niche manufacturers. The main players, such as Alfa Laval, GEA Group, Emerson Electric and Keofitt A/S, hold significant market share, particularly in the crucial aseptic sampling valve segment for industries such as pharmacists and food and beverage. Competition is driven by continuous innovation in valve design, materials (e.g., stainless steel for aseptic applications) and the integration of intelligent technologies such as IoT for real-time monitoring and automated control.

Competitive strategies revolve around product differentiation, focusing on meeting the industry-specific regulatory requirements, increasing efficiency and offering personalised solutions. Emerging trends such as miniaturisation and advanced materials for extreme environments also influence competitive dynamics. While North America and Europe currently represent substantial market parts due to established industrial sectors, the Asia-Pacific region is undergoing rapid growth, attracting existing and new players due to the expansion of industrialisation and infrastructure development, especially in countries such as China and India.

Challenges In Sampling Valve Market

The sampling valve market faces several remarkable challenges that affect its growth trajectory. One of the main obstacles is the high cost and initial complexity associated with advanced sampling valve technologies, which can prevent adoption, especially between small and medium enterprises (SMEs) with limited budgets. In addition, the integration of these sophisticated systems in existing industrial processes usually requires specialised training and experience, increasing operating costs and creating barriers for organizations without access to qualified personnel.

Another significant challenge is the need for continuous innovation and differentiation in a moderately fragmented and competitive market. Players and new participants must invest heavily in research and development to meet the standards and regulatory requirements of the evolving industry, especially as alternative sampling methods and technologies arise. The threat of substitutes can be low, but maintaining a competitive advantage requires continuous improvements in product reliability, automation and sustainability – factors that are increasingly required by industries seeking efficiency, quality assurance and environmental responsibility.

Risks & Prospects in Sampling Valve Market

The main supply sectors of the demand include oil and gas, petrochemicals, chemical processing, water treatment, pharmaceuticals and food and beverage. Market growth is even more driven by the adoption of automation, intelligent technologies and sustainable manufacturing practices, as well as the expansion of industrial hubs in emerging markets. Investment in infrastructure, government support and the integration of digital solutions, such as IoT and remote monitoring, are additional factors that create profitable perspectives for established and new market participants.

Regionally, Pacific Asia is leading the global sampling valve market due to rapid industrialisation, urbanisation and significant infrastructure development in countries such as China, India and Southeast Asia. North America and Europe also show robust growth, supported by the modernisation of ageing infrastructure, strict environmental regulations and high adoption of advanced valve technologies. Meanwhile, Latin America and the Middle East and Africa are emerging as promising regions, driven by new industrial projects and growing investments in water and energy sectors.

Key Target Audience

The main target audience of the sampling valve market includes the pharmaceutical, food and beverage, chemistry and biotechnology industries, where sampling needs without contamination are critical for quality control and compliance. Plant managers, process engineers, and quality warranty professionals rely on these valves to safely extract samples from pipelines, reactors and storage tanks without interrupting production. These users prioritize hygienic valves that are easy to clean and meet the industry's specific standards, such as FDA, EHEDG or ASME.

,, ,,

Another important audience comprises equipment manufacturers, system integrators, and maintenance service providers that support the design, installation and maintenance of process systems involving sampling valves. In addition, regulatory bodies and certification agencies indirectly influence market demand, applying strict security and hygiene regulations between the sectors. By segmenting these groups, manufacturers can align their product development and marketing strategies with industry needs, ensuring reliability, compliance and operational efficiency.

Merger and acquisition

Recent merger and acquisition activity (M&A) in the sampling valve market has been moderate, with larger industrial valve manufacturers occasionally acquiring smaller companies to expand their product portfolios or geographical reach. This trend is consistent with broader patterns observed in the industrial valve sector, where established players such as Emerson, Alfa Laval and Ingersoll Rand have historically pursued acquisitions to improve their technological abilities and market presence. Although the sampling valve itself is not dominated by frequent large-scale agreements, the general valve market has recorded remarkable transactions, such as the acquisition of the Harbour Group specialised valve group and the purchase of Indian pump and Ingersoll filter companies.

In addition, the market is characterised by collaborations and strategic partnerships among major players, facilitating the sharing of technological advances and expansion of distribution networks. Such cooperative efforts are essential to meet the complex demands of global industrial processes and for the penetration of emerging markets with personalised and high-performance solutions. The competitive scenario also includes niche and medium-sized companies that focus on specialised applications and regional markets, leveraging their agility to offer personalised solutions and promote innovation.

Analyst Comment

The global sampling valve market is undergoing constant growth, driven by increased demand in industries such as pharmaceuticals, food and beverage, chemicals, water and wastewater treatment and oil and gas. The market has been valued at about $1.2-1.3 billion in recent years and is expected to reach up to $2.1 billion in the early 2030s. Main growth factors include rigorous quality and safety regulatory standards, increased process automation and technological advances in project and valve materials, which increase reliability and efficiency.

- 1.1 Report description

- 1.2 Key market segments

- 1.3 Key benefits to the stakeholders

2: Executive Summary

- 2.1 Sampling Valve- Snapshot

- 2.2 Sampling Valve- Segment Snapshot

- 2.3 Sampling Valve- Competitive Landscape Snapshot

3: Market Overview

- 3.1 Market definition and scope

- 3.2 Key findings

- 3.2.1 Top impacting factors

- 3.2.2 Top investment pockets

- 3.3 Porter’s five forces analysis

- 3.3.1 Low bargaining power of suppliers

- 3.3.2 Low threat of new entrants

- 3.3.3 Low threat of substitutes

- 3.3.4 Low intensity of rivalry

- 3.3.5 Low bargaining power of buyers

- 3.4 Market dynamics

- 3.4.1 Drivers

- 3.4.2 Restraints

- 3.4.3 Opportunities

4: Sampling Valve Market by Type

- 4.1 Overview

- 4.1.1 Market size and forecast

- 4.2 Aseptic

- 4.2.1 Key market trends, factors driving growth, and opportunities

- 4.2.2 Market size and forecast, by region

- 4.2.3 Market share analysis by country

- 4.3 Basic

- 4.3.1 Key market trends, factors driving growth, and opportunities

- 4.3.2 Market size and forecast, by region

- 4.3.3 Market share analysis by country

5: Sampling Valve Market by Application / by End Use

- 5.1 Overview

- 5.1.1 Market size and forecast

- 5.2 Oil & Gas

- 5.2.1 Key market trends, factors driving growth, and opportunities

- 5.2.2 Market size and forecast, by region

- 5.2.3 Market share analysis by country

- 5.3 Energy & Power

- 5.3.1 Key market trends, factors driving growth, and opportunities

- 5.3.2 Market size and forecast, by region

- 5.3.3 Market share analysis by country

- 5.4 Water and Wastewater Treatment

- 5.4.1 Key market trends, factors driving growth, and opportunities

- 5.4.2 Market size and forecast, by region

- 5.4.3 Market share analysis by country

- 5.5 Food & Beverages

- 5.5.1 Key market trends, factors driving growth, and opportunities

- 5.5.2 Market size and forecast, by region

- 5.5.3 Market share analysis by country

- 5.6 Chemicals

- 5.6.1 Key market trends, factors driving growth, and opportunities

- 5.6.2 Market size and forecast, by region

- 5.6.3 Market share analysis by country

- 5.7 Pharmaceuticals

- 5.7.1 Key market trends, factors driving growth, and opportunities

- 5.7.2 Market size and forecast, by region

- 5.7.3 Market share analysis by country

6: Sampling Valve Market by Region

- 6.1 Overview

- 6.1.1 Market size and forecast By Region

- 6.2 North America

- 6.2.1 Key trends and opportunities

- 6.2.2 Market size and forecast, by Type

- 6.2.3 Market size and forecast, by Application

- 6.2.4 Market size and forecast, by country

- 6.2.4.1 United States

- 6.2.4.1.1 Key market trends, factors driving growth, and opportunities

- 6.2.4.1.2 Market size and forecast, by Type

- 6.2.4.1.3 Market size and forecast, by Application

- 6.2.4.2 Canada

- 6.2.4.2.1 Key market trends, factors driving growth, and opportunities

- 6.2.4.2.2 Market size and forecast, by Type

- 6.2.4.2.3 Market size and forecast, by Application

- 6.2.4.3 Mexico

- 6.2.4.3.1 Key market trends, factors driving growth, and opportunities

- 6.2.4.3.2 Market size and forecast, by Type

- 6.2.4.3.3 Market size and forecast, by Application

- 6.2.4.1 United States

- 6.3 South America

- 6.3.1 Key trends and opportunities

- 6.3.2 Market size and forecast, by Type

- 6.3.3 Market size and forecast, by Application

- 6.3.4 Market size and forecast, by country

- 6.3.4.1 Brazil

- 6.3.4.1.1 Key market trends, factors driving growth, and opportunities

- 6.3.4.1.2 Market size and forecast, by Type

- 6.3.4.1.3 Market size and forecast, by Application

- 6.3.4.2 Argentina

- 6.3.4.2.1 Key market trends, factors driving growth, and opportunities

- 6.3.4.2.2 Market size and forecast, by Type

- 6.3.4.2.3 Market size and forecast, by Application

- 6.3.4.3 Chile

- 6.3.4.3.1 Key market trends, factors driving growth, and opportunities

- 6.3.4.3.2 Market size and forecast, by Type

- 6.3.4.3.3 Market size and forecast, by Application

- 6.3.4.4 Rest of South America

- 6.3.4.4.1 Key market trends, factors driving growth, and opportunities

- 6.3.4.4.2 Market size and forecast, by Type

- 6.3.4.4.3 Market size and forecast, by Application

- 6.3.4.1 Brazil

- 6.4 Europe

- 6.4.1 Key trends and opportunities

- 6.4.2 Market size and forecast, by Type

- 6.4.3 Market size and forecast, by Application

- 6.4.4 Market size and forecast, by country

- 6.4.4.1 Germany

- 6.4.4.1.1 Key market trends, factors driving growth, and opportunities

- 6.4.4.1.2 Market size and forecast, by Type

- 6.4.4.1.3 Market size and forecast, by Application

- 6.4.4.2 France

- 6.4.4.2.1 Key market trends, factors driving growth, and opportunities

- 6.4.4.2.2 Market size and forecast, by Type

- 6.4.4.2.3 Market size and forecast, by Application

- 6.4.4.3 Italy

- 6.4.4.3.1 Key market trends, factors driving growth, and opportunities

- 6.4.4.3.2 Market size and forecast, by Type

- 6.4.4.3.3 Market size and forecast, by Application

- 6.4.4.4 United Kingdom

- 6.4.4.4.1 Key market trends, factors driving growth, and opportunities

- 6.4.4.4.2 Market size and forecast, by Type

- 6.4.4.4.3 Market size and forecast, by Application

- 6.4.4.5 Benelux

- 6.4.4.5.1 Key market trends, factors driving growth, and opportunities

- 6.4.4.5.2 Market size and forecast, by Type

- 6.4.4.5.3 Market size and forecast, by Application

- 6.4.4.6 Nordics

- 6.4.4.6.1 Key market trends, factors driving growth, and opportunities

- 6.4.4.6.2 Market size and forecast, by Type

- 6.4.4.6.3 Market size and forecast, by Application

- 6.4.4.7 Rest of Europe

- 6.4.4.7.1 Key market trends, factors driving growth, and opportunities

- 6.4.4.7.2 Market size and forecast, by Type

- 6.4.4.7.3 Market size and forecast, by Application

- 6.4.4.1 Germany

- 6.5 Asia Pacific

- 6.5.1 Key trends and opportunities

- 6.5.2 Market size and forecast, by Type

- 6.5.3 Market size and forecast, by Application

- 6.5.4 Market size and forecast, by country

- 6.5.4.1 China

- 6.5.4.1.1 Key market trends, factors driving growth, and opportunities

- 6.5.4.1.2 Market size and forecast, by Type

- 6.5.4.1.3 Market size and forecast, by Application

- 6.5.4.2 Japan

- 6.5.4.2.1 Key market trends, factors driving growth, and opportunities

- 6.5.4.2.2 Market size and forecast, by Type

- 6.5.4.2.3 Market size and forecast, by Application

- 6.5.4.3 India

- 6.5.4.3.1 Key market trends, factors driving growth, and opportunities

- 6.5.4.3.2 Market size and forecast, by Type

- 6.5.4.3.3 Market size and forecast, by Application

- 6.5.4.4 South Korea

- 6.5.4.4.1 Key market trends, factors driving growth, and opportunities

- 6.5.4.4.2 Market size and forecast, by Type

- 6.5.4.4.3 Market size and forecast, by Application

- 6.5.4.5 Australia

- 6.5.4.5.1 Key market trends, factors driving growth, and opportunities

- 6.5.4.5.2 Market size and forecast, by Type

- 6.5.4.5.3 Market size and forecast, by Application

- 6.5.4.6 Southeast Asia

- 6.5.4.6.1 Key market trends, factors driving growth, and opportunities

- 6.5.4.6.2 Market size and forecast, by Type

- 6.5.4.6.3 Market size and forecast, by Application

- 6.5.4.7 Rest of Asia-Pacific

- 6.5.4.7.1 Key market trends, factors driving growth, and opportunities

- 6.5.4.7.2 Market size and forecast, by Type

- 6.5.4.7.3 Market size and forecast, by Application

- 6.5.4.1 China

- 6.6 MEA

- 6.6.1 Key trends and opportunities

- 6.6.2 Market size and forecast, by Type

- 6.6.3 Market size and forecast, by Application

- 6.6.4 Market size and forecast, by country

- 6.6.4.1 Middle East

- 6.6.4.1.1 Key market trends, factors driving growth, and opportunities

- 6.6.4.1.2 Market size and forecast, by Type

- 6.6.4.1.3 Market size and forecast, by Application

- 6.6.4.2 Africa

- 6.6.4.2.1 Key market trends, factors driving growth, and opportunities

- 6.6.4.2.2 Market size and forecast, by Type

- 6.6.4.2.3 Market size and forecast, by Application

- 6.6.4.1 Middle East

- 7.1 Overview

- 7.2 Key Winning Strategies

- 7.3 Top 10 Players: Product Mapping

- 7.4 Competitive Analysis Dashboard

- 7.5 Market Competition Heatmap

- 7.6 Leading Player Positions, 2022

8: Company Profiles

- 8.1 Alfa Laval

- 8.1.1 Company Overview

- 8.1.2 Key Executives

- 8.1.3 Company snapshot

- 8.1.4 Active Business Divisions

- 8.1.5 Product portfolio

- 8.1.6 Business performance

- 8.1.7 Major Strategic Initiatives and Developments

- 8.2 BIAR

- 8.2.1 Company Overview

- 8.2.2 Key Executives

- 8.2.3 Company snapshot

- 8.2.4 Active Business Divisions

- 8.2.5 Product portfolio

- 8.2.6 Business performance

- 8.2.7 Major Strategic Initiatives and Developments

- 8.3 Emerson Electric

- 8.3.1 Company Overview

- 8.3.2 Key Executives

- 8.3.3 Company snapshot

- 8.3.4 Active Business Divisions

- 8.3.5 Product portfolio

- 8.3.6 Business performance

- 8.3.7 Major Strategic Initiatives and Developments

- 8.4 FAMAT SA

- 8.4.1 Company Overview

- 8.4.2 Key Executives

- 8.4.3 Company snapshot

- 8.4.4 Active Business Divisions

- 8.4.5 Product portfolio

- 8.4.6 Business performance

- 8.4.7 Major Strategic Initiatives and Developments

- 8.5 GEA Group

- 8.5.1 Company Overview

- 8.5.2 Key Executives

- 8.5.3 Company snapshot

- 8.5.4 Active Business Divisions

- 8.5.5 Product portfolio

- 8.5.6 Business performance

- 8.5.7 Major Strategic Initiatives and Developments

- 8.6 Genebre Group

- 8.6.1 Company Overview

- 8.6.2 Key Executives

- 8.6.3 Company snapshot

- 8.6.4 Active Business Divisions

- 8.6.5 Product portfolio

- 8.6.6 Business performance

- 8.6.7 Major Strategic Initiatives and Developments

- 8.7 KEOFITT A/S

- 8.7.1 Company Overview

- 8.7.2 Key Executives

- 8.7.3 Company snapshot

- 8.7.4 Active Business Divisions

- 8.7.5 Product portfolio

- 8.7.6 Business performance

- 8.7.7 Major Strategic Initiatives and Developments

- 8.8 NEUMO-Ehrenberg-Group

- 8.8.1 Company Overview

- 8.8.2 Key Executives

- 8.8.3 Company snapshot

- 8.8.4 Active Business Divisions

- 8.8.5 Product portfolio

- 8.8.6 Business performance

- 8.8.7 Major Strategic Initiatives and Developments

- 8.9 Pfeiffer

- 8.9.1 Company Overview

- 8.9.2 Key Executives

- 8.9.3 Company snapshot

- 8.9.4 Active Business Divisions

- 8.9.5 Product portfolio

- 8.9.6 Business performance

- 8.9.7 Major Strategic Initiatives and Developments

- 8.10 RITAG

- 8.10.1 Company Overview

- 8.10.2 Key Executives

- 8.10.3 Company snapshot

- 8.10.4 Active Business Divisions

- 8.10.5 Product portfolio

- 8.10.6 Business performance

- 8.10.7 Major Strategic Initiatives and Developments

- 8.11 Strahman Valves

- 8.11.1 Company Overview

- 8.11.2 Key Executives

- 8.11.3 Company snapshot

- 8.11.4 Active Business Divisions

- 8.11.5 Product portfolio

- 8.11.6 Business performance

- 8.11.7 Major Strategic Initiatives and Developments

- 8.12 Swissfluid AG

- 8.12.1 Company Overview

- 8.12.2 Key Executives

- 8.12.3 Company snapshot

- 8.12.4 Active Business Divisions

- 8.12.5 Product portfolio

- 8.12.6 Business performance

- 8.12.7 Major Strategic Initiatives and Developments

9: Analyst Perspective and Conclusion

- 9.1 Concluding Recommendations and Analysis

- 9.2 Strategies for Market Potential

Scope of Report

| Aspects | Details |

|---|---|

By Type |

|

By Application |

|

Report Licenses

Our Team

Frequently Asked Questions (FAQ):

What is the estimated market size of Sampling Valve in 2030?

+

-

Which type of Sampling Valve is widely popular?

+

-

What is the growth rate of Sampling Valve Market?

+

-

What are the latest trends influencing the Sampling Valve Market?

+

-

Who are the key players in the Sampling Valve Market?

+

-

How is the Sampling Valve } industry progressing in scaling its end-use implementations?

+

-

What product types are analyzed in the Sampling Valve Market Study?

+

-

What geographic breakdown is available in Asia Pacific Sampling Valve Market Study?

+

-

Which region holds the second position by market share in the Sampling Valve market?

+

-

How are the key players in the Sampling Valve market targeting growth in the future?

+

-

The sampling valve market is experiencing significant growth driven by several key factors in various industries. A primary driver is the growing emphasis on quality control and regulatory compliance. Industries such as pharmaceutical products, food and beverage, chemicals and oil and gas require accurate and representative samples to ensure product quality, process optimisation and adherence to rigorous safety and environmental regulations. Sampling valves allow the collection of reliable and uncontaminated samples, which is crucial for these sectors to meet their respective standards and avoid expensive problems. Demand for precise analytical data to optimise processes and minimise waste further boosts the adoption of these valves.

,

, Another crucial market factor is the continuous tendency of industrial automation and technological advances. The integration of intelligent technologies, sensors and automation systems in sampling valves allows remote monitoring, real-time data collection and precise control over sampling processes. This not only increases efficiency and accuracy but also minimises human intervention and potential exposure risks for operators.