Global Glufosinate Market Size, Share & Trends Analysis Report, Forecast Period, 2024-2030

Report ID: MS-747 | Food and Beverages | Agriculture | Last updated: Apr, 2025 | Formats*:

A glufosinate market refers to glufosinate, a non-selective contact herbicide generally used to control a whole range of annual and perennial grass and broadleaf weeds; it works by inhibiting glutamine synthetase, an invaluable enzyme in plant metabolism, leading to ammonia buildup and the shutdown of photosynthesis, causing the death of the plant. Glufosinate is often used in pre-plant or pre-emergence burial applications and also in post-emergence applications in GM crops engineered for tolerance to it (e.g., corn, soybeans, canola, and cotton). The enhancement of this herbicide becomes a driving force in favour of its importance in modern agricultural practices with the effectiveness of this compound against glyphosate-resistant weeds. Furthermore, the escalating occurrences of herbicide-resistant weeds, especially those resistant to glyphosate, warrant the use of alternative herbicides such as glufosinate in integrated weed management strategies. Additionally, broad-spectrum activity and contribution to higher crop yields to satisfy the demands of an increasing world population also result in the market expansion of glufosinate.

Glufosinate Report Highlights

| Report Metrics | Details |

|---|---|

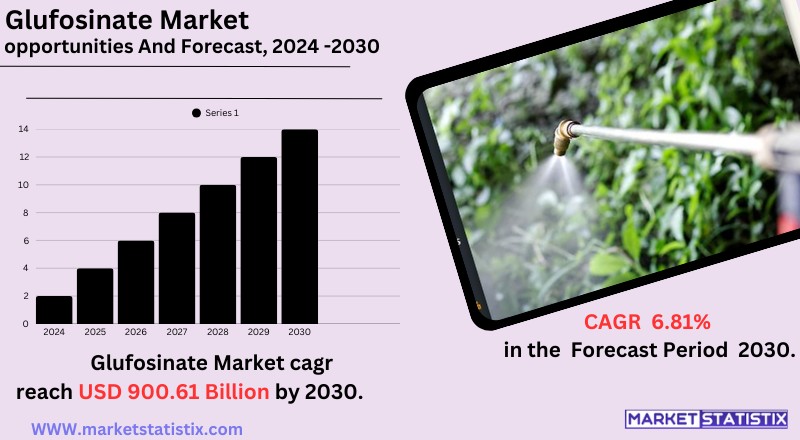

| Forecast period | 2019-2030 |

| Base Year Of Estimation | 2023 |

| Growth Rate | CAGR of 6.81% |

| Forecast Value (2030) | USD 900.61 Billion |

| Key Market Players |

|

| By Region |

|

Glufosinate Market Trends

At present, the glufosinate market is in a growth mode, thanks to the increasing use of genetically modified (GM) crops tolerant to glufosinate, which permits the herbicide to be sprayed for excellent weed control without affecting crop growth. In addition, increasing incidence of glyphosate-resistant weeds is pushing growers to adopt alternative herbicides such as glufosinate as part of integrated weed management programmes to safeguard their crop yields. Also, the agricultural expansion in developing nations, coupled with a rise in the demand for food production by the world's growing population, is providing additional fuel to the market for effective herbicides, such as glufosinate.

Glufosinate Market Leading Players

The key players profiled in the report are Jiangsu Huangma Agrochemicals Co., Ltd. (China), The DOW Chemical Company (United States), Jiangsu Seven Continent Green Chemical Co., Ltd.(China), Nufarm Limited (Australia), UPL (India), Syngenta AG (Switzerland), Bayer AG (Germany)E.I. Du Pont De Nemours and Company (UnitedStates), Hebei Veyong Bio-Chemical Co. Ltd (China), Zhejiang Yongnong Chem. Ind. Co., Ltd (China)Growth Accelerators

The growth of the glufosinate market is primarily fuelled by the rising application of genetically modified (GM) crops whose genetic alterations confer tolerance to glufosinate. These GM crops enable farmers to effectively manage the germination of all types of weeds after their emergence without injuring the crop plants, thus yielding good harvests with ease of weed control. Therefore, the ever-increasing native area under cultivation of GM crops – more particularly for soybeans, corn, cotton, and canola – brings along an ever-increasing demand for glufosinate as a compatible herbicide. The herbicide-resistant weed problem is another major market driver, particularly those herbicide-resistant populations found with glyphosate. Wherever these resistant weed populations are viable globally, farmers are fast resorting to alternative herbicides such as glufosinate, with its unique mode of action, as an important component of integrated weed management strategies to ensure successful weed control and prevent yield losses. Thus, this need for herbicides with diversified modes of action to respond to herbicide resistance is a strong and sustainable driver of the glufosinate market.

Glufosinate Market Segmentation analysis

The Global Glufosinate is segmented by Application, and Region. . The Application segment categorizes the market based on its usage such as Defoliant, Desiccant, Herbicides, Fungicides, Others. Geographically, the market is assessed across key Regions like North America (United States, Canada, Mexico), South America (Brazil, Argentina, Chile, Rest of South America), Europe (Germany, France, Italy, United Kingdom, Benelux, Nordics, Rest of Europe), Asia Pacific (China, Japan, India, South Korea, Australia, Southeast Asia, Rest of Asia-Pacific), MEA (Middle East, Africa) and others, each presenting distinct growth opportunities and challenges influenced by the regions.Competitive Landscape

The glufosinate market is becoming more competitive due to several factors, such as the increasing number of regional manufacturers, specifically from the Asia-Pacific, and the presence of some global players. Most multinational companies have developed businesses around advanced research and development, a spectrum of products mostly of GM seeds, and global distribution networks established for many years predating competition between these leaders, wherein patent protection, innovations in formulation, and joint ventures for extension in market reach and applications are involved. Additionally, the demand for glufosinate in controlling herbicide-resistant weeds is now an area that attracts new entrants and compels expansion by existing players to increase their production capacity. The intensified competition will result in price changes resulting from increased and innovative formulation technologies and application methods in the long run, all benefitting end-users in the agricultural sector.

Challenges In Glufosinate Market

The glufosinate market faces many hindrances to its progress. Regulatory restrictions make one of the major barricades since stricter laws now govern its use because of concerns regarding environmental and health impacts. Weed resistance development from prolonged application has made the compound ineffective; moreover, the competition from other herbicides and weed-control techniques further limits market expansion. External environmental concerns, such as pollution of water sources and damage to non-target organisms, heavily influence public view and acceptance of glufosinate-based products. Volatile prices with very high costs in production provide the other burden of glufosinate not being operational in the global market. Trade barriers like tariffs and import and export issues complicate the process of international distribution. There is market saturation for glufosinate in developed regions, which also limits its growth opportunities further. The kind of negative public opinion on genetically modified crops resistant to glufosinate makes it more complex.

Risks & Prospects in Glufosinate Market

Key opportunities are rising adoption of GM (genetically modified) crops, improvements in herbicide formulations, and interfacing with precision agriculture technologies such as GPS-guided sprayers and drones. These innovations allow for targeted applications, minimising environmental impact and maximising crop productivity. Furthermore, the increasing demand for bioherbicides and organic farming solutions provides a fresh avenue for attaining market growth, especially in regions undergoing rapid population growth and those facing food security challenges. From a regional perspective, North America is expected to experience noteworthy growth due to the bio-based agro-solutions and a high rate of glufosinate-tolerant crop adoption. Asia-Pacific is also presenting ample opportunities due to the rising agricultural activities and changing farming practices toward climate-resilient ones. Meanwhile, Europe continues to play an active role backed by the regulatory landscape promoting sustainable agriculture.

Key Target Audience

The glufosinate market in itself is targeting agricultural stakeholders like farmers, agrochemical companies, and distributors. Farmers are able to use glufosinate herbicides as weed control measures, particularly where genetically modified (GM) corn, beans, and oilseed canola plants are created resistant to glufosinate. Agrochemical companies then look for avenues through which they will develop and market glufosinate formulations to meet demand in effective weed management. Also, these distributors and suppliers would help ensure that products are available to the end-user in all regions. The market is also characterised by regulatory bodies, research institutions, and environmental organizations. Regulatory agencies develop protocols that govern the approval and monitoring of new practices in the use of glufosinate in the environment. Research institutions evaluate and study efficacy and environmental impact through glufosinate approaches to ensure improvement in formulation design. Environmental organizations monitor use and advocate for sustainability in herbicide application.

Merger and acquisition

The most recent mergers and acquisitions in the glufosinate market have been driven by a strategic urge of agrochemical companies seeking to expand portfolios and boost their market presence. The acquisition of Meiji Seika Pharma's agrochemicals business by Mitsui Chemicals Agro in January 2022 saw the latter acquire a formidable R&D pipeline and innovative products, including glufosinate-P, a non-selective herbicide engineered to be less harmful to the environment. Such acquisition is thus strengthening Mitsui's foothold in the glufosinate segment as the world moves towards sustainable and more efficient solutions for weed control in the industry. In addition, most of the key players, like BASF and UPL Limited, pursue specific acquisitions as well to become competent and broaden their markets. Increasing demand for efficient herbicides such as glufosinate using traditional and organic farming practices is driving these strategic efforts. As agricultural efficiency is brought to its peak and environmental sustainability becomes paramount, the players change according to these modifications, thereby influencing their growth profiles within the glufosinate market.

>Analyst Comment

The glufosinate market is steadily developing due to effective herbicide demand and the rising adoption of genetically modified (GM) crops. The market size was $2.6 billion in 2024 and is expected to grow from 2025 to 2033, when it is projected to reach $5.0 billion. The slew of glyphosate-resistant weeds and GM crops such as cotton, corn, and soybean being protected by glufosinate are major factors driving that expansion. Other equally important factors are regulations in favour of herbicide usage and the adoption of sustainable agricultural practices.

- 1.1 Report description

- 1.2 Key market segments

- 1.3 Key benefits to the stakeholders

2: Executive Summary

- 2.1 Glufosinate- Snapshot

- 2.2 Glufosinate- Segment Snapshot

- 2.3 Glufosinate- Competitive Landscape Snapshot

3: Market Overview

- 3.1 Market definition and scope

- 3.2 Key findings

- 3.2.1 Top impacting factors

- 3.2.2 Top investment pockets

- 3.3 Porter’s five forces analysis

- 3.3.1 Low bargaining power of suppliers

- 3.3.2 Low threat of new entrants

- 3.3.3 Low threat of substitutes

- 3.3.4 Low intensity of rivalry

- 3.3.5 Low bargaining power of buyers

- 3.4 Market dynamics

- 3.4.1 Drivers

- 3.4.2 Restraints

- 3.4.3 Opportunities

4: Glufosinate Market by Application / by End Use

- 4.1 Overview

- 4.1.1 Market size and forecast

- 4.2 Herbicides

- 4.2.1 Key market trends, factors driving growth, and opportunities

- 4.2.2 Market size and forecast, by region

- 4.2.3 Market share analysis by country

- 4.3 Fungicides

- 4.3.1 Key market trends, factors driving growth, and opportunities

- 4.3.2 Market size and forecast, by region

- 4.3.3 Market share analysis by country

- 4.4 Desiccant

- 4.4.1 Key market trends, factors driving growth, and opportunities

- 4.4.2 Market size and forecast, by region

- 4.4.3 Market share analysis by country

- 4.5 Defoliant

- 4.5.1 Key market trends, factors driving growth, and opportunities

- 4.5.2 Market size and forecast, by region

- 4.5.3 Market share analysis by country

- 4.6 Others

- 4.6.1 Key market trends, factors driving growth, and opportunities

- 4.6.2 Market size and forecast, by region

- 4.6.3 Market share analysis by country

5: Glufosinate Market by Region

- 5.1 Overview

- 5.1.1 Market size and forecast By Region

- 5.2 North America

- 5.2.1 Key trends and opportunities

- 5.2.2 Market size and forecast, by Type

- 5.2.3 Market size and forecast, by Application

- 5.2.4 Market size and forecast, by country

- 5.2.4.1 United States

- 5.2.4.1.1 Key market trends, factors driving growth, and opportunities

- 5.2.4.1.2 Market size and forecast, by Type

- 5.2.4.1.3 Market size and forecast, by Application

- 5.2.4.2 Canada

- 5.2.4.2.1 Key market trends, factors driving growth, and opportunities

- 5.2.4.2.2 Market size and forecast, by Type

- 5.2.4.2.3 Market size and forecast, by Application

- 5.2.4.3 Mexico

- 5.2.4.3.1 Key market trends, factors driving growth, and opportunities

- 5.2.4.3.2 Market size and forecast, by Type

- 5.2.4.3.3 Market size and forecast, by Application

- 5.2.4.1 United States

- 5.3 South America

- 5.3.1 Key trends and opportunities

- 5.3.2 Market size and forecast, by Type

- 5.3.3 Market size and forecast, by Application

- 5.3.4 Market size and forecast, by country

- 5.3.4.1 Brazil

- 5.3.4.1.1 Key market trends, factors driving growth, and opportunities

- 5.3.4.1.2 Market size and forecast, by Type

- 5.3.4.1.3 Market size and forecast, by Application

- 5.3.4.2 Argentina

- 5.3.4.2.1 Key market trends, factors driving growth, and opportunities

- 5.3.4.2.2 Market size and forecast, by Type

- 5.3.4.2.3 Market size and forecast, by Application

- 5.3.4.3 Chile

- 5.3.4.3.1 Key market trends, factors driving growth, and opportunities

- 5.3.4.3.2 Market size and forecast, by Type

- 5.3.4.3.3 Market size and forecast, by Application

- 5.3.4.4 Rest of South America

- 5.3.4.4.1 Key market trends, factors driving growth, and opportunities

- 5.3.4.4.2 Market size and forecast, by Type

- 5.3.4.4.3 Market size and forecast, by Application

- 5.3.4.1 Brazil

- 5.4 Europe

- 5.4.1 Key trends and opportunities

- 5.4.2 Market size and forecast, by Type

- 5.4.3 Market size and forecast, by Application

- 5.4.4 Market size and forecast, by country

- 5.4.4.1 Germany

- 5.4.4.1.1 Key market trends, factors driving growth, and opportunities

- 5.4.4.1.2 Market size and forecast, by Type

- 5.4.4.1.3 Market size and forecast, by Application

- 5.4.4.2 France

- 5.4.4.2.1 Key market trends, factors driving growth, and opportunities

- 5.4.4.2.2 Market size and forecast, by Type

- 5.4.4.2.3 Market size and forecast, by Application

- 5.4.4.3 Italy

- 5.4.4.3.1 Key market trends, factors driving growth, and opportunities

- 5.4.4.3.2 Market size and forecast, by Type

- 5.4.4.3.3 Market size and forecast, by Application

- 5.4.4.4 United Kingdom

- 5.4.4.4.1 Key market trends, factors driving growth, and opportunities

- 5.4.4.4.2 Market size and forecast, by Type

- 5.4.4.4.3 Market size and forecast, by Application

- 5.4.4.5 Benelux

- 5.4.4.5.1 Key market trends, factors driving growth, and opportunities

- 5.4.4.5.2 Market size and forecast, by Type

- 5.4.4.5.3 Market size and forecast, by Application

- 5.4.4.6 Nordics

- 5.4.4.6.1 Key market trends, factors driving growth, and opportunities

- 5.4.4.6.2 Market size and forecast, by Type

- 5.4.4.6.3 Market size and forecast, by Application

- 5.4.4.7 Rest of Europe

- 5.4.4.7.1 Key market trends, factors driving growth, and opportunities

- 5.4.4.7.2 Market size and forecast, by Type

- 5.4.4.7.3 Market size and forecast, by Application

- 5.4.4.1 Germany

- 5.5 Asia Pacific

- 5.5.1 Key trends and opportunities

- 5.5.2 Market size and forecast, by Type

- 5.5.3 Market size and forecast, by Application

- 5.5.4 Market size and forecast, by country

- 5.5.4.1 China

- 5.5.4.1.1 Key market trends, factors driving growth, and opportunities

- 5.5.4.1.2 Market size and forecast, by Type

- 5.5.4.1.3 Market size and forecast, by Application

- 5.5.4.2 Japan

- 5.5.4.2.1 Key market trends, factors driving growth, and opportunities

- 5.5.4.2.2 Market size and forecast, by Type

- 5.5.4.2.3 Market size and forecast, by Application

- 5.5.4.3 India

- 5.5.4.3.1 Key market trends, factors driving growth, and opportunities

- 5.5.4.3.2 Market size and forecast, by Type

- 5.5.4.3.3 Market size and forecast, by Application

- 5.5.4.4 South Korea

- 5.5.4.4.1 Key market trends, factors driving growth, and opportunities

- 5.5.4.4.2 Market size and forecast, by Type

- 5.5.4.4.3 Market size and forecast, by Application

- 5.5.4.5 Australia

- 5.5.4.5.1 Key market trends, factors driving growth, and opportunities

- 5.5.4.5.2 Market size and forecast, by Type

- 5.5.4.5.3 Market size and forecast, by Application

- 5.5.4.6 Southeast Asia

- 5.5.4.6.1 Key market trends, factors driving growth, and opportunities

- 5.5.4.6.2 Market size and forecast, by Type

- 5.5.4.6.3 Market size and forecast, by Application

- 5.5.4.7 Rest of Asia-Pacific

- 5.5.4.7.1 Key market trends, factors driving growth, and opportunities

- 5.5.4.7.2 Market size and forecast, by Type

- 5.5.4.7.3 Market size and forecast, by Application

- 5.5.4.1 China

- 5.6 MEA

- 5.6.1 Key trends and opportunities

- 5.6.2 Market size and forecast, by Type

- 5.6.3 Market size and forecast, by Application

- 5.6.4 Market size and forecast, by country

- 5.6.4.1 Middle East

- 5.6.4.1.1 Key market trends, factors driving growth, and opportunities

- 5.6.4.1.2 Market size and forecast, by Type

- 5.6.4.1.3 Market size and forecast, by Application

- 5.6.4.2 Africa

- 5.6.4.2.1 Key market trends, factors driving growth, and opportunities

- 5.6.4.2.2 Market size and forecast, by Type

- 5.6.4.2.3 Market size and forecast, by Application

- 5.6.4.1 Middle East

- 6.1 Overview

- 6.2 Key Winning Strategies

- 6.3 Top 10 Players: Product Mapping

- 6.4 Competitive Analysis Dashboard

- 6.5 Market Competition Heatmap

- 6.6 Leading Player Positions, 2022

7: Company Profiles

- 7.1 Bayer AG (Germany)E.I. Du Pont De Nemours and Company (UnitedStates)

- 7.1.1 Company Overview

- 7.1.2 Key Executives

- 7.1.3 Company snapshot

- 7.1.4 Active Business Divisions

- 7.1.5 Product portfolio

- 7.1.6 Business performance

- 7.1.7 Major Strategic Initiatives and Developments

- 7.2 Hebei Veyong Bio-Chemical Co. Ltd (China)

- 7.2.1 Company Overview

- 7.2.2 Key Executives

- 7.2.3 Company snapshot

- 7.2.4 Active Business Divisions

- 7.2.5 Product portfolio

- 7.2.6 Business performance

- 7.2.7 Major Strategic Initiatives and Developments

- 7.3 Jiangsu Huangma Agrochemicals Co.

- 7.3.1 Company Overview

- 7.3.2 Key Executives

- 7.3.3 Company snapshot

- 7.3.4 Active Business Divisions

- 7.3.5 Product portfolio

- 7.3.6 Business performance

- 7.3.7 Major Strategic Initiatives and Developments

- 7.4 Ltd. (China)

- 7.4.1 Company Overview

- 7.4.2 Key Executives

- 7.4.3 Company snapshot

- 7.4.4 Active Business Divisions

- 7.4.5 Product portfolio

- 7.4.6 Business performance

- 7.4.7 Major Strategic Initiatives and Developments

- 7.5 Jiangsu Seven Continent Green Chemical Co.

- 7.5.1 Company Overview

- 7.5.2 Key Executives

- 7.5.3 Company snapshot

- 7.5.4 Active Business Divisions

- 7.5.5 Product portfolio

- 7.5.6 Business performance

- 7.5.7 Major Strategic Initiatives and Developments

- 7.6 Ltd.(China)

- 7.6.1 Company Overview

- 7.6.2 Key Executives

- 7.6.3 Company snapshot

- 7.6.4 Active Business Divisions

- 7.6.5 Product portfolio

- 7.6.6 Business performance

- 7.6.7 Major Strategic Initiatives and Developments

- 7.7 Nufarm Limited (Australia)

- 7.7.1 Company Overview

- 7.7.2 Key Executives

- 7.7.3 Company snapshot

- 7.7.4 Active Business Divisions

- 7.7.5 Product portfolio

- 7.7.6 Business performance

- 7.7.7 Major Strategic Initiatives and Developments

- 7.8 Syngenta AG (Switzerland)

- 7.8.1 Company Overview

- 7.8.2 Key Executives

- 7.8.3 Company snapshot

- 7.8.4 Active Business Divisions

- 7.8.5 Product portfolio

- 7.8.6 Business performance

- 7.8.7 Major Strategic Initiatives and Developments

- 7.9 The DOW Chemical Company (United States)

- 7.9.1 Company Overview

- 7.9.2 Key Executives

- 7.9.3 Company snapshot

- 7.9.4 Active Business Divisions

- 7.9.5 Product portfolio

- 7.9.6 Business performance

- 7.9.7 Major Strategic Initiatives and Developments

- 7.10 UPL (India)

- 7.10.1 Company Overview

- 7.10.2 Key Executives

- 7.10.3 Company snapshot

- 7.10.4 Active Business Divisions

- 7.10.5 Product portfolio

- 7.10.6 Business performance

- 7.10.7 Major Strategic Initiatives and Developments

- 7.11 Zhejiang Yongnong Chem. Ind. Co.

- 7.11.1 Company Overview

- 7.11.2 Key Executives

- 7.11.3 Company snapshot

- 7.11.4 Active Business Divisions

- 7.11.5 Product portfolio

- 7.11.6 Business performance

- 7.11.7 Major Strategic Initiatives and Developments

- 7.12 Ltd (China)

- 7.12.1 Company Overview

- 7.12.2 Key Executives

- 7.12.3 Company snapshot

- 7.12.4 Active Business Divisions

- 7.12.5 Product portfolio

- 7.12.6 Business performance

- 7.12.7 Major Strategic Initiatives and Developments

8: Analyst Perspective and Conclusion

- 8.1 Concluding Recommendations and Analysis

- 8.2 Strategies for Market Potential

Scope of Report

| Aspects | Details |

|---|---|

By Application |

|

Report Licenses

Our Team

Frequently Asked Questions (FAQ):

What is the projected market size of Glufosinate in 2030?

+

-

How big is the Global Glufosinate market?

+

-

How do regulatory policies impact the Glufosinate Market?

+

-

What major players in Glufosinate Market?

+

-

What applications are categorized in the Glufosinate market study?

+

-

Which product types are examined in the Glufosinate Market Study?

+

-

Which regions are expected to show the fastest growth in the Glufosinate market?

+

-

What are the major growth drivers in the Glufosinate market?

+

-

The growth of the glufosinate market is primarily fuelled by the rising application of genetically modified (GM) crops whose genetic alterations confer tolerance to glufosinate. These GM crops enable farmers to effectively manage the germination of all types of weeds after their emergence without injuring the crop plants, thus yielding good harvests with ease of weed control. Therefore, the ever-increasing native area under cultivation of GM crops – more particularly for soybeans, corn, cotton, and canola – brings along an ever-increasing demand for glufosinate as a compatible herbicide. The herbicide-resistant weed problem is another major market driver, particularly those herbicide-resistant populations found with glyphosate. Wherever these resistant weed populations are viable globally, farmers are fast resorting to alternative herbicides such as glufosinate, with its unique mode of action, as an important component of integrated weed management strategies to ensure successful weed control and prevent yield losses. Thus, this need for herbicides with diversified modes of action to respond to herbicide resistance is a strong and sustainable driver of the glufosinate market.

Is the study period of the Glufosinate flexible or fixed?

+

-

How do economic factors influence the Glufosinate market?

+

-