Asia Pacific Digital Phase Shifters Market Size, Share & Trends Analysis Report, Forecast Period, 2024-2030

Report ID: MS-955 | IT and Telecom | Last updated: May, 2025 | Formats*:

A digital phase shifter is an electronic device that accurately controls the phase of an RF (radio frequency), microwave or millimetre wave signal without changing its amplitude. Unlike analogue phase shifters that offer continuous phase adjustment, digital phase shifters provide discreet and quantified phase changes, usually controlled by digital signals or a computer interface. This digital control allows high accuracy, repeatability and the ability to implement complex signal processing algorithms, making it crucial components in modern communication and detection systems. They are often characterised by the number of "bits" that offer (for example, 4 bits, 8 bits), which determines the number of distinct phase states and, therefore, phase adjustment resolution.

The digital phase shifters market covers the industry involved in research, development, manufacture and supply of these critical electronic components. This market is undergoing significant growth, driven by the growing demand for advanced wireless communication technologies, particularly the global launch of 5G networks, which depend strongly on precise phase control for beam formation and improved signal transmission. In addition to telecommunications, digital phase shifters are indispensable in radar systems to improve target detection and tracking, satellite communication, electronic war systems and various testing and measurement equipment.

Digital Phase Shifters Report Highlights

| Report Metrics | Details |

|---|---|

| Forecast period | 2019-2030 |

| Base Year Of Estimation | 2024 |

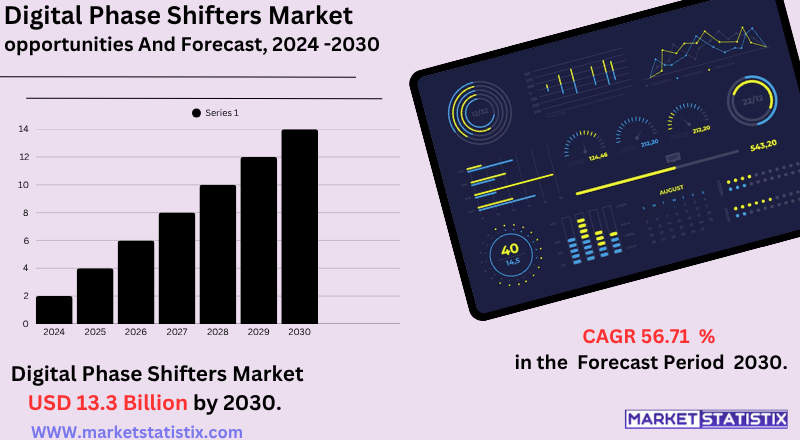

| Growth Rate | CAGR of 56.71% |

| Forecast Value (2030) | USD 13.3 Billion |

| By Product Type | Up to 7 dB, Up to 11 dB |

| Key Market Players |

|

| By Region |

|

Digital Phase Shifters Market Trends

The digital phase market is experiencing significant growth, mainly driven by the global expansion of 5G infrastructure. These components are critical for advanced beam shaping and phase-array antennas, which are fundamental to 5G's high-speed and low-latency communication skills. In addition to telecommunications, it increases to increase defence spending worldwide demand for digital phase changes in sophisticated radar systems, electronic warfare and satellite communication, where precise signal control is crucial for improved detection, tracking and countermeasures.

Emerging trends in this market include a strong focus on miniaturisation and the development of highly integrated solutions, providing more compact and energy-efficient units. There is also an increasing adoption of digital phase changes in higher frequency ranges (e.g., millimetre wave applications) and an emphasis on strengthening their power management skills. Furthermore, the increasing use of IoT units and smart technologies in different industries operates on the need for improved signal processing, which further drives the demand for high performance and reliable digital phase changes.

Digital Phase Shifters Market Leading Players

The key players profiled in the report are Custom MMIC (United States), MACOM (United States), Lorch Microwave (United States), Aelius Semiconductors (Singapore), G.T. Microwave, Inc. (United States), Fairview Microwave (United States), Analog Devices (United States), DS Instruments (United States), Crane Aerospace & Electronics (United States), Qorvo (United States)Growth Accelerators

The digital phase shifters market is driven mainly by the growing demand for reliable and high-speed communication systems, especially the widespread launch of 5G and early 6G networks. These next-generation wireless technologies depend strongly on advanced antenna systems, such as Phased Matrix Antennas, to get a beam and direction for higher data rates, lower latency and greater capacity. Digital phase shifters are indispensable components on these antennas, allowing precise control of the electromagnetic signals necessary for efficient and directed wireless communication. The increasing adoption of IoT devices and the need for improved signal processing on several connected systems also contribute significantly to market growth.

In addition, the expansion of defence and aerospace applications is one of the main catalysts of the digital phase shifters market. Modern radar systems, electronic war platforms and satellite communication systems require highly accurate and versatile phase control to improve detection, tracking and target interference. As defence budgets increase globally and military technologies advance, the demand for high-performance digital phase shifters in these critical applications should continue their upward trajectory.

Digital Phase Shifters Market Segmentation analysis

The Asia Pacific Digital Phase Shifters is segmented by Type, Application, and Region. By Type, the market is divided into Distributed Up to 7 dB, Up to 11 dB . The Application segment categorizes the market based on its usage such as Mobile and Broadband, Weather Forecast, Satellite, Telecommunication, Aerospace, Defense. Geographically, the market is assessed across key Regions like Asia Pacific (China, Japan, India, South Korea, Australia, Southeast Asia, Rest of Asia-Pacific) and others, each presenting distinct growth opportunities and challenges influenced by the regions.Competitive Landscape

The digital phase shifters market has a competitive scenario dominated by some important participants, along with a dispersion of specialised manufacturers. Industry leaders, such as Analogue Devices, Macom, Qorvo and Mercury Systems, have substantial market share, particularly in high-growth segments such as 5G infrastructure and advanced radar systems. These companies take advantage of their extensive R&D features and several product and relationship portfolios established with the main contractors and telecommunications giants to keep their advantage competitive.

Strategic initiatives in this market include continuous innovation in semiconductor technologies (such as GaN and SiGe for higher frequencies and energy efficiency), miniaturisation for integration in compact systems and development of integrated solutions. The high cost of manufacturing and the technical complexities involved in the creation of high-performance digital phase shifters remain significant barriers to new players, thus favouring companies established with robust R&D and manufacturing features.

Challenges In Digital Phase Shifters Market

The digital phase shifter market faces remarkable challenges despite its strong growth prospects. High production costs are a primary obstacle and limit widespread adoption, especially in cost-sensitive industries such as consumer electronics and some telecommunications applications. In addition, the complexity of integrating digital phase changes in existing systems requires significant investments in research, development and strict testing, which can slow the implementation and increase the overall project expenses.

Disorders of the supply chain and the availability of raw materials and semiconductor components further deteriorate these challenges, which potentially lead to delays in production and higher costs. Intensifying competition among manufacturers also pushes companies to innovate quickly while maintaining cost-effectiveness, creating a dynamic but challenging environment for both established players and new participants. These factors present overall obstacles that need to be carefully controlled to maintain market growth and adoption.

Risks & Prospects in Digital Phase Shifters Market

The market benefits from increased investments in research and development, which is expected to reduce production costs and improve performance, thus opening doors to new players and expanding the addressable market.

Regionally, North America is currently leading the market for digital phase changes due to strong state funds for defence and satellite communication projects, as well as the presence of major technology companies. However, the Asia Pacific region is estimated to experience the fastest growth, supported by aggressive investments in 5G infrastructure and expansion of telecommunications and defence sectors in countries such as China and Japan. Other regions such as Europe and the Middle East are also expected to contribute to market growth, albeit at a slower pace.

Key Target Audience

,

The main audience of the digital phase shifters market includes aerospace and defense organizations, particularly those involved in radar, electronic warfare and satellite communications systems. Systems engineers and designers in these sectors depend on digital phase shifters for beam direction, signal modulation and high-frequency performance in matrix antenna phases. These users require devices that offer high accuracy, low insertion loss and robust performance in severe environments.

, In addition, telecommunications companies, RF component manufacturers and research institutions are vital public as they are part of 5G infrastructure shifters, wireless communication systems and advanced test equipment. Product developers and R&D teams seek compact, economic and economic solutions to meet the growing demand for high-speed and high-frequency applications. Understanding these groups helps manufacturers adapt offers to meet emerging performance requirements and technology standards in various high-frequency domains.

Merger and acquisition

Recent merger and acquisition activities (M&A) in the digital phase shifters market have been limited, with large companies focusing more on strategic partnerships and internal development to improve their product offerings. The main players, such as Analogue Devices, Qorvo and Macom Technology Solutions, prioritised innovation and strategic collaborations to strengthen their market positions. For example, Analogue Devices has invested in the development of high-precision 8-bit phase shifters for satellite and radar applications, while Qorvo has introduced low-power adapted 5G-powered phase shifters, improving network efficiency.

These strategic movements reflect a broader trend in the industry, where companies are focusing on technological advances and partnerships, rather than seeking mergers and acquisitions. This approach allows companies to quickly adapt to evolving market demands, particularly in sectors such as telecommunications and defence, where the need for advanced, reliable and efficient shifter technologies is critical. By focusing on innovation and collaboration, companies intend to meet increasing application requirements such as 5G networks, satellite communications and advanced radar systems.

Analyst Comment

The digital phase shifters market is undergoing robust growth, driven by the rapid expansion of 5G/6G infrastructure, satellite mega-control and advanced radar and automotive radar systems. The market was valued at approximately US $847 million by 2025 and is expected to reach nearly $2.9 billion in 2035. The main factors that boost this expansion include the need for precise phase control in telecommunications and defence and aerospace applications, as well as GaN migration and SiGe-BiCMOS.

- 1.1 Report description

- 1.2 Key market segments

- 1.3 Key benefits to the stakeholders

2: Executive Summary

- 2.1 Digital Phase Shifters- Snapshot

- 2.2 Digital Phase Shifters- Segment Snapshot

- 2.3 Digital Phase Shifters- Competitive Landscape Snapshot

3: Market Overview

- 3.1 Market definition and scope

- 3.2 Key findings

- 3.2.1 Top impacting factors

- 3.2.2 Top investment pockets

- 3.3 Porter’s five forces analysis

- 3.3.1 Low bargaining power of suppliers

- 3.3.2 Low threat of new entrants

- 3.3.3 Low threat of substitutes

- 3.3.4 Low intensity of rivalry

- 3.3.5 Low bargaining power of buyers

- 3.4 Market dynamics

- 3.4.1 Drivers

- 3.4.2 Restraints

- 3.4.3 Opportunities

4: Digital Phase Shifters Market by Type

- 4.1 Overview

- 4.1.1 Market size and forecast

- 4.2 Up to 7 dB

- 4.2.1 Key market trends, factors driving growth, and opportunities

- 4.2.2 Market size and forecast, by region

- 4.2.3 Market share analysis by country

- 4.3 Up to 11 dB

- 4.3.1 Key market trends, factors driving growth, and opportunities

- 4.3.2 Market size and forecast, by region

- 4.3.3 Market share analysis by country

5: Digital Phase Shifters Market by Application / by End Use

- 5.1 Overview

- 5.1.1 Market size and forecast

- 5.2 Telecommunication

- 5.2.1 Key market trends, factors driving growth, and opportunities

- 5.2.2 Market size and forecast, by region

- 5.2.3 Market share analysis by country

- 5.3 Weather Forecast

- 5.3.1 Key market trends, factors driving growth, and opportunities

- 5.3.2 Market size and forecast, by region

- 5.3.3 Market share analysis by country

- 5.4 Mobile and Broadband

- 5.4.1 Key market trends, factors driving growth, and opportunities

- 5.4.2 Market size and forecast, by region

- 5.4.3 Market share analysis by country

- 5.5 Satellite

- 5.5.1 Key market trends, factors driving growth, and opportunities

- 5.5.2 Market size and forecast, by region

- 5.5.3 Market share analysis by country

- 5.6 Aerospace

- 5.6.1 Key market trends, factors driving growth, and opportunities

- 5.6.2 Market size and forecast, by region

- 5.6.3 Market share analysis by country

- 5.7 Defense

- 5.7.1 Key market trends, factors driving growth, and opportunities

- 5.7.2 Market size and forecast, by region

- 5.7.3 Market share analysis by country

6: Digital Phase Shifters Market by Region

- 6.1 Overview

- 6.1.1 Market size and forecast By Region

- 6.2 China

- 6.2.1 Key trends and opportunities

- 6.2.2 Market size and forecast, by Type

- 6.2.3 Market size and forecast, by Application

- 6.2.4 Market size and forecast, by country

- 6.3 Japan

- 6.3.1 Key trends and opportunities

- 6.3.2 Market size and forecast, by Type

- 6.3.3 Market size and forecast, by Application

- 6.3.4 Market size and forecast, by country

- 6.4 India

- 6.4.1 Key trends and opportunities

- 6.4.2 Market size and forecast, by Type

- 6.4.3 Market size and forecast, by Application

- 6.4.4 Market size and forecast, by country

- 6.5 South Korea

- 6.5.1 Key trends and opportunities

- 6.5.2 Market size and forecast, by Type

- 6.5.3 Market size and forecast, by Application

- 6.5.4 Market size and forecast, by country

- 6.6 Australia

- 6.6.1 Key trends and opportunities

- 6.6.2 Market size and forecast, by Type

- 6.6.3 Market size and forecast, by Application

- 6.6.4 Market size and forecast, by country

- 6.7 Southeast Asia

- 6.7.1 Key trends and opportunities

- 6.7.2 Market size and forecast, by Type

- 6.7.3 Market size and forecast, by Application

- 6.7.4 Market size and forecast, by country

- 6.8 Rest of Asia-Pacific

- 6.8.1 Key trends and opportunities

- 6.8.2 Market size and forecast, by Type

- 6.8.3 Market size and forecast, by Application

- 6.8.4 Market size and forecast, by country

- 7.1 Overview

- 7.2 Key Winning Strategies

- 7.3 Top 10 Players: Product Mapping

- 7.4 Competitive Analysis Dashboard

- 7.5 Market Competition Heatmap

- 7.6 Leading Player Positions, 2022

8: Company Profiles

- 8.1 Aelius Semiconductors (Singapore)

- 8.1.1 Company Overview

- 8.1.2 Key Executives

- 8.1.3 Company snapshot

- 8.1.4 Active Business Divisions

- 8.1.5 Product portfolio

- 8.1.6 Business performance

- 8.1.7 Major Strategic Initiatives and Developments

- 8.2 Analog Devices (United States)

- 8.2.1 Company Overview

- 8.2.2 Key Executives

- 8.2.3 Company snapshot

- 8.2.4 Active Business Divisions

- 8.2.5 Product portfolio

- 8.2.6 Business performance

- 8.2.7 Major Strategic Initiatives and Developments

- 8.3 Crane Aerospace & Electronics (United States)

- 8.3.1 Company Overview

- 8.3.2 Key Executives

- 8.3.3 Company snapshot

- 8.3.4 Active Business Divisions

- 8.3.5 Product portfolio

- 8.3.6 Business performance

- 8.3.7 Major Strategic Initiatives and Developments

- 8.4 Custom MMIC (United States)

- 8.4.1 Company Overview

- 8.4.2 Key Executives

- 8.4.3 Company snapshot

- 8.4.4 Active Business Divisions

- 8.4.5 Product portfolio

- 8.4.6 Business performance

- 8.4.7 Major Strategic Initiatives and Developments

- 8.5 DS Instruments (United States)

- 8.5.1 Company Overview

- 8.5.2 Key Executives

- 8.5.3 Company snapshot

- 8.5.4 Active Business Divisions

- 8.5.5 Product portfolio

- 8.5.6 Business performance

- 8.5.7 Major Strategic Initiatives and Developments

- 8.6 Fairview Microwave (United States)

- 8.6.1 Company Overview

- 8.6.2 Key Executives

- 8.6.3 Company snapshot

- 8.6.4 Active Business Divisions

- 8.6.5 Product portfolio

- 8.6.6 Business performance

- 8.6.7 Major Strategic Initiatives and Developments

- 8.7 G.T. Microwave

- 8.7.1 Company Overview

- 8.7.2 Key Executives

- 8.7.3 Company snapshot

- 8.7.4 Active Business Divisions

- 8.7.5 Product portfolio

- 8.7.6 Business performance

- 8.7.7 Major Strategic Initiatives and Developments

- 8.8 Inc. (United States)

- 8.8.1 Company Overview

- 8.8.2 Key Executives

- 8.8.3 Company snapshot

- 8.8.4 Active Business Divisions

- 8.8.5 Product portfolio

- 8.8.6 Business performance

- 8.8.7 Major Strategic Initiatives and Developments

- 8.9 Lorch Microwave (United States)

- 8.9.1 Company Overview

- 8.9.2 Key Executives

- 8.9.3 Company snapshot

- 8.9.4 Active Business Divisions

- 8.9.5 Product portfolio

- 8.9.6 Business performance

- 8.9.7 Major Strategic Initiatives and Developments

- 8.10 MACOM (United States)

- 8.10.1 Company Overview

- 8.10.2 Key Executives

- 8.10.3 Company snapshot

- 8.10.4 Active Business Divisions

- 8.10.5 Product portfolio

- 8.10.6 Business performance

- 8.10.7 Major Strategic Initiatives and Developments

- 8.11 Qorvo (United States)

- 8.11.1 Company Overview

- 8.11.2 Key Executives

- 8.11.3 Company snapshot

- 8.11.4 Active Business Divisions

- 8.11.5 Product portfolio

- 8.11.6 Business performance

- 8.11.7 Major Strategic Initiatives and Developments

9: Analyst Perspective and Conclusion

- 9.1 Concluding Recommendations and Analysis

- 9.2 Strategies for Market Potential

Scope of Report

| Aspects | Details |

|---|---|

By Type |

|

By Application |

|

Report Licenses

Our Team

Frequently Asked Questions (FAQ):

What is the projected market size of Digital Phase Shifters in 2030?

+

-

Which application type is expected to remain the largest segment in the Asia Pacific Digital Phase Shifters market?

+

-

How big is the Asia Pacific Digital Phase Shifters market?

+

-

How do regulatory policies impact the Digital Phase Shifters Market?

+

-

What major players in Digital Phase Shifters Market?

+

-

What applications are categorized in the Digital Phase Shifters market study?

+

-

Which product types are examined in the Digital Phase Shifters Market Study?

+

-

Which regions are expected to show the fastest growth in the Digital Phase Shifters market?

+

-

Which application holds the second-highest market share in the Digital Phase Shifters market?

+

-

What are the major growth drivers in the Digital Phase Shifters market?

+

-

The digital phase shifters market is driven mainly by the growing demand for reliable and high-speed communication systems, especially the widespread launch of 5G and early 6G networks. These next-generation wireless technologies depend strongly on advanced antenna systems, such as Phased Matrix Antennas, to get a beam and direction for higher data rates, lower latency and greater capacity. Digital phase shifters are indispensable components on these antennas, allowing precise control of the electromagnetic signals necessary for efficient and directed wireless communication. The increasing adoption of IoT devices and the need for improved signal processing on several connected systems also contribute significantly to market growth.

In addition, the expansion of defence and aerospace applications is one of the main catalysts of the digital phase shifters market. Modern radar systems, electronic war platforms and satellite communication systems require highly accurate and versatile phase control to improve detection, tracking and target interference. As defence budgets increase globally and military technologies advance, the demand for high-performance digital phase shifters in these critical applications should continue their upward trajectory.