Asia Pacific Chocolate Market – Industry Trends and Forecast to 2030

Report ID: MS-848 | Healthcare and Pharma | Last updated: May, 2025 | Formats*:

The chocolate market includes the diversified businesses engaged in the production of cocoa beans, their processing into different forms of chocolate (such as bars, confectionery, coatings, and ingredients), and the final distribution and sale of these products to consumers and businesses across the globe. This industry is distinguished by a broad range of product varieties that vary from mass-market milk chocolate bars to high-end, single-origin dark chocolates to chocolate-based baking ingredients that go into desserts and beverages. It entails a sophisticated supply chain that stretches from tropical agriculture production to manufacturing plants and stores all over the world.

Chocolate demand is triggered by its cross-cultural popularity as a treat, snack, and ingredient, inspired by cultural conventions, seasonal occurrences, and shifting consumer tastes. Consumer buying determinants include factors such as flavour, texture, cocoa content, added ingredients (nuts, caramel, fruit), packaging, and branding. The market also experiences growing focus on ethical sourcing of cocoa beans, sustainability initiatives, and the health effects of chocolate consumption, creating a growing category of organic, fair-trade, and high-cocoa-content products.

Chocolate Report Highlights

| Report Metrics | Details |

|---|---|

| Forecast period | 2019-2030 |

| Base Year Of Estimation | 2024 |

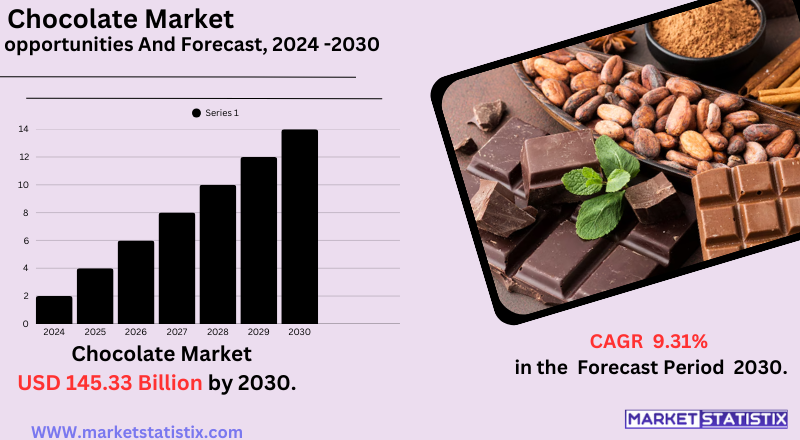

| Growth Rate | CAGR of 9.31% |

| Forecast Value (2030) | USD 145.33 Billion |

| By Product Type | Dark Chocolate, Milk Chocolate, White Chocolate, Others |

| Key Market Players |

|

| By Region |

|

Chocolate Market Trends

There is a high demand for high-end and craft chocolates, where consumers are ready to pay a premium for novel flavours, good-quality ingredients, and transparent production, frequently focusing on "bean-to-bar" principles. Health awareness is another major driver, which results in increased demand for dark chocolate with greater cocoa solids and less sugar, as well as growing demand for organic, vegan, sugar-free, and gluten-free products.

Another major trend is the increasing significance of sustainability and ethical sourcing. Consumers are becoming more and more interested in the environmental and social consequences of their food consumption, leading manufacturers to emphasise fair-trade practices, sustainable cocoa production, and environmentally friendly packaging. The online shopping channel is also growing very quickly, providing consumers with more convenience and access to a broader range of chocolate products, including niche and international players.

Chocolate Market Leading Players

The key players profiled in the report are August Storck KG (Germany), Chocoladefabriken Lindt & Sprüngli AG(Switzerland), Meiji Co. Ltd. (Japan), Ezaki Glico Co. Ltd. (Japan), Bourbon Corp. (Japan), Hershey Company (United States), Nestlé (Switzerland), Ferrero Group (Italy), Haribo GmbH & Co. K.G. (Germany), Pladis (United Kingdom)Growth Accelerators

The growth of the chocolate market is driven by a range of major drivers that mirror changing consumer behaviour and international trends. First, with rising disposable incomes, especially within emerging economies such as India and China, a greater number of people can enjoy and spend money on chocolate goods, moving from an occasional treat to a frequent indulgence. This is in addition to the impact of urbanisation and exposure to Western cultures, which introduce new forms and consumption patterns for chocolate to the local population.

Second, increased consciousness towards the health properties related to the moderate intake of certain forms of chocolate, notably dark chocolate high in cocoa, is a critical motivator. Buyers are opting more for chocolate high in flavonoids and antioxidants, identifying with possible cardio-protective and mood benefits. This motivates the drive for dark chocolate and premium categories. Lastly, the deep cultural importance of chocolate in gift-giving and celebrations across the globe guarantees steady demand, especially during holidays. Creative packaging and product lines specifically designed for gift-giving add to this driver.

Chocolate Market Segmentation analysis

The Asia Pacific Chocolate is segmented by Type, and Region. By Type, the market is divided into Distributed Dark Chocolate, Milk Chocolate, White Chocolate, Others . Geographically, the market is assessed across key Regions like Asia Pacific (China, Japan, India, South Korea, Australia, Southeast Asia, Rest of Asia-Pacific) and others, each presenting distinct growth opportunities and challenges influenced by the regions.Competitive Landscape

The global chocolate market's competitive environment is dominated by a mix of large multinational companies and smaller artisanal producers competing for consumer attention. Large companies like Nestlé, Mars, Ferrero, and Mondelez International use their large portfolios of brands, strong distribution networks, and large R&D capabilities to defend market share. They tend to compete on price, product innovation (new flavours and formats), and marketing campaigns that appeal to consumer aspirations for indulgence and tradition.

But the market is also seeing the increasing power of the smaller, premium, and craft chocolate producers. These brands tend to distinguish themselves by exceptional sourcing of cocoa beans (single-origin, ethical), creative use of combinations of flavours, and an emphasis on more cocoa content or use of organic ingredients, appealing to a more sophisticated consumer market that will pay more. Trends such as bean-to-bar manufacturing and sustainability are also influencing competitive forces, with consumers increasingly looking for transparency and ethical practices, presenting opportunities for brands emphasising these.

Challenges In Chocolate Market

The chocolate industry is confronted by a number of major challenges, with unstable cocoa prices being at the top. Cocoa cost volatilities, fuelled by supply chain disruptions, government interventions, and labour shortages, have a direct effect on manufacturers' margins and pricing models. Moreover, adherence to tighter regulations – including traceability mandates under the EU Deforestation Regulation (EUDR) and changing food safety and labelling norms – increases operational expenses, particularly for small and medium-sized businesses.

Evolving consumer tastes also present a challenge, as health-aware consumers increasingly require lower-sugar, vegan, and "free-from" chocolate products, which need manufacturers to be creative without sacrificing taste and quality. In addition, health claims on chocolate products are subject to strict regulation, which means requiring scientific substantiation and regulatory consent, which can slow product launches and add compliance costs. All these together combine to make chocolate manufacturing a challenging environment, reconciling cost constraints, regulatory requirements, and changing consumer expectations.

Risks & Prospects in Chocolate Market

With consumers looking for higher-quality chocolate with distinct flavours, health-friendly ingredients, and fair-trade practices, the market for dark chocolate, sugar-free, and functional chocolate has seen a dramatic upswing. New and innovative flavouring, packaging, and organic ingredient usage are broadening consumer bases, while the cult status of chocolate as a gift and indulgence item remains a driving force for demand, particularly during peak periods like festivals. Volatility in cocoa prices and supply chain disruptions remain major challenges for industry participants.

Regionally, Europe is the biggest chocolate market, boosted by high per capita consumption and a solid premium chocolate manufacturing tradition. North America is also quite large in terms of market share, fuelled by longstanding brands and a developed consumer base. The Asia Pacific market is the market growth leader, with economic growth, urbanisation, and increasing disposable incomes in nations such as India and China boosting chocolate consumption. India, for instance, is experiencing double-digit growth rates as Western snacking culture and gifting culture gain popularity. Latin America and the Middle East, on the other hand, offer emerging opportunities as urbanisation increases and dietary habits change.

Key Target Audience

The most important target consumer for the chocolate industry is mass consumers, from children to adults, who buy chocolate for daily consumption, gifting, and indulgence. This group is motivated by emotional connection, brand loyalty, and convenience, with age-group-specific preferences—children tend to prefer sweeter, milk-based chocolates, while adults prefer darker, more sophisticated flavours. Peak seasonal demand during holiday periods such as Valentine's Day, Easter, and Christmas further underscores the significance of packaging, branding, and promotional strategies.

,,Another significant target group consists of consumers who care about health and high-end consumers interested in superior quality, artisanal, or functional chocolate offerings. They are drawn to products like organic, sugar-free, vegan, or high-cocoa-concentration chocolates, reflecting wellness and responsible consumption patterns. This consumer is interested in open sourcing, eco-friendliness, and exclusive taste profiles and challenges companies to experiment with foreign ingredients, sustainable sourcing badges, and sustainable packaging.

,,, ,

Merger and acquisition

The chocolate sector has seen substantial merger and acquisition (M&A) activity over the past few years, with companies looking to diversify portfolios and increase global presence. Of particular note was Mars Inc.'s January 2024 purchase of British premium chocolatier Hotel Chocolat for £534 million, strengthening its luxury chocolate presence. Mars also announced a $35.9 billion purchase of snack giant Kellanova, with the goal of diversifying into savoury snacks and increasing its global food sector presence.

Cadbury owner Mondelez International is said to be considering the possible takeover of Hershey, which would be one of the world's largest confectioners. In addition, Nestlé strengthened its presence in the premium chocolate business by taking a majority stake in Brazil-based Grupo CRM in September 2023. These strategic acquisitions are the market's reaction to changing consumer tastes and seeking expansion in new markets.

Analyst Comment

The global chocolate market is witnessing steady growth, with estimates putting the market at USD 180–220 billion by the early 2030s. This is being fuelled by expanding demand for premium and speciality chocolates, growing disposable incomes in emerging economies, and a trend for healthier alternatives like dark, organic, and sugar-free chocolates. Occasions and gifting events as well as innovation in terms of flavours and packaging are also driving consumer appetite and broadening the market base.

In addition, health and wellness trends are having a strong influence on the market. Consumers increasingly demand lower-sugar chocolates, organic, vegan, and free-from products (gluten-free, dairy-free). The industry is reacting by creating new product formulations that appeal to these health-related consumers while not sacrificing taste and indulgence.

- 1.1 Report description

- 1.2 Key market segments

- 1.3 Key benefits to the stakeholders

2: Executive Summary

- 2.1 Chocolate- Snapshot

- 2.2 Chocolate- Segment Snapshot

- 2.3 Chocolate- Competitive Landscape Snapshot

3: Market Overview

- 3.1 Market definition and scope

- 3.2 Key findings

- 3.2.1 Top impacting factors

- 3.2.2 Top investment pockets

- 3.3 Porter’s five forces analysis

- 3.3.1 Low bargaining power of suppliers

- 3.3.2 Low threat of new entrants

- 3.3.3 Low threat of substitutes

- 3.3.4 Low intensity of rivalry

- 3.3.5 Low bargaining power of buyers

- 3.4 Market dynamics

- 3.4.1 Drivers

- 3.4.2 Restraints

- 3.4.3 Opportunities

4: Chocolate Market by Type

- 4.1 Overview

- 4.1.1 Market size and forecast

- 4.2 Dark Chocolate

- 4.2.1 Key market trends, factors driving growth, and opportunities

- 4.2.2 Market size and forecast, by region

- 4.2.3 Market share analysis by country

- 4.3 Milk Chocolate

- 4.3.1 Key market trends, factors driving growth, and opportunities

- 4.3.2 Market size and forecast, by region

- 4.3.3 Market share analysis by country

- 4.4 White Chocolate

- 4.4.1 Key market trends, factors driving growth, and opportunities

- 4.4.2 Market size and forecast, by region

- 4.4.3 Market share analysis by country

- 4.5 Others

- 4.5.1 Key market trends, factors driving growth, and opportunities

- 4.5.2 Market size and forecast, by region

- 4.5.3 Market share analysis by country

5: Chocolate Market by Region

- 5.1 Overview

- 5.1.1 Market size and forecast By Region

- 5.2 China

- 5.2.1 Key trends and opportunities

- 5.2.2 Market size and forecast, by Type

- 5.2.3 Market size and forecast, by Application

- 5.2.4 Market size and forecast, by country

- 5.3 Japan

- 5.3.1 Key trends and opportunities

- 5.3.2 Market size and forecast, by Type

- 5.3.3 Market size and forecast, by Application

- 5.3.4 Market size and forecast, by country

- 5.4 India

- 5.4.1 Key trends and opportunities

- 5.4.2 Market size and forecast, by Type

- 5.4.3 Market size and forecast, by Application

- 5.4.4 Market size and forecast, by country

- 5.5 South Korea

- 5.5.1 Key trends and opportunities

- 5.5.2 Market size and forecast, by Type

- 5.5.3 Market size and forecast, by Application

- 5.5.4 Market size and forecast, by country

- 5.6 Australia

- 5.6.1 Key trends and opportunities

- 5.6.2 Market size and forecast, by Type

- 5.6.3 Market size and forecast, by Application

- 5.6.4 Market size and forecast, by country

- 5.7 Southeast Asia

- 5.7.1 Key trends and opportunities

- 5.7.2 Market size and forecast, by Type

- 5.7.3 Market size and forecast, by Application

- 5.7.4 Market size and forecast, by country

- 5.8 Rest of Asia-Pacific

- 5.8.1 Key trends and opportunities

- 5.8.2 Market size and forecast, by Type

- 5.8.3 Market size and forecast, by Application

- 5.8.4 Market size and forecast, by country

- 6.1 Overview

- 6.2 Key Winning Strategies

- 6.3 Top 10 Players: Product Mapping

- 6.4 Competitive Analysis Dashboard

- 6.5 Market Competition Heatmap

- 6.6 Leading Player Positions, 2022

7: Company Profiles

- 7.1 August Storck KG (Germany)

- 7.1.1 Company Overview

- 7.1.2 Key Executives

- 7.1.3 Company snapshot

- 7.1.4 Active Business Divisions

- 7.1.5 Product portfolio

- 7.1.6 Business performance

- 7.1.7 Major Strategic Initiatives and Developments

- 7.2 Bourbon Corp. (Japan)

- 7.2.1 Company Overview

- 7.2.2 Key Executives

- 7.2.3 Company snapshot

- 7.2.4 Active Business Divisions

- 7.2.5 Product portfolio

- 7.2.6 Business performance

- 7.2.7 Major Strategic Initiatives and Developments

- 7.3 Chocoladefabriken Lindt & Sprüngli AG(Switzerland)

- 7.3.1 Company Overview

- 7.3.2 Key Executives

- 7.3.3 Company snapshot

- 7.3.4 Active Business Divisions

- 7.3.5 Product portfolio

- 7.3.6 Business performance

- 7.3.7 Major Strategic Initiatives and Developments

- 7.4 Ezaki Glico Co. Ltd. (Japan)

- 7.4.1 Company Overview

- 7.4.2 Key Executives

- 7.4.3 Company snapshot

- 7.4.4 Active Business Divisions

- 7.4.5 Product portfolio

- 7.4.6 Business performance

- 7.4.7 Major Strategic Initiatives and Developments

- 7.5 Ferrero Group (Italy)

- 7.5.1 Company Overview

- 7.5.2 Key Executives

- 7.5.3 Company snapshot

- 7.5.4 Active Business Divisions

- 7.5.5 Product portfolio

- 7.5.6 Business performance

- 7.5.7 Major Strategic Initiatives and Developments

- 7.6 Haribo GmbH & Co. K.G. (Germany)

- 7.6.1 Company Overview

- 7.6.2 Key Executives

- 7.6.3 Company snapshot

- 7.6.4 Active Business Divisions

- 7.6.5 Product portfolio

- 7.6.6 Business performance

- 7.6.7 Major Strategic Initiatives and Developments

- 7.7 Hershey Company (United States)

- 7.7.1 Company Overview

- 7.7.2 Key Executives

- 7.7.3 Company snapshot

- 7.7.4 Active Business Divisions

- 7.7.5 Product portfolio

- 7.7.6 Business performance

- 7.7.7 Major Strategic Initiatives and Developments

- 7.8 Meiji Co. Ltd. (Japan)

- 7.8.1 Company Overview

- 7.8.2 Key Executives

- 7.8.3 Company snapshot

- 7.8.4 Active Business Divisions

- 7.8.5 Product portfolio

- 7.8.6 Business performance

- 7.8.7 Major Strategic Initiatives and Developments

- 7.9 Nestlé (Switzerland)

- 7.9.1 Company Overview

- 7.9.2 Key Executives

- 7.9.3 Company snapshot

- 7.9.4 Active Business Divisions

- 7.9.5 Product portfolio

- 7.9.6 Business performance

- 7.9.7 Major Strategic Initiatives and Developments

- 7.10 Pladis (United Kingdom)

- 7.10.1 Company Overview

- 7.10.2 Key Executives

- 7.10.3 Company snapshot

- 7.10.4 Active Business Divisions

- 7.10.5 Product portfolio

- 7.10.6 Business performance

- 7.10.7 Major Strategic Initiatives and Developments

8: Analyst Perspective and Conclusion

- 8.1 Concluding Recommendations and Analysis

- 8.2 Strategies for Market Potential

Scope of Report

| Aspects | Details |

|---|---|

By Type |

|

Report Licenses

Our Team

Frequently Asked Questions (FAQ):

What is the estimated market size of Chocolate in 2030?

+

-

Which type of Chocolate is widely popular?

+

-

What is the growth rate of Chocolate Market?

+

-

What are the latest trends influencing the Chocolate Market?

+

-

Who are the key players in the Chocolate Market?

+

-

How is the Chocolate } industry progressing in scaling its end-use implementations?

+

-

What product types are analyzed in the Chocolate Market Study?

+

-

What geographic breakdown is available in Asia Pacific Chocolate Market Study?

+

-

Which region holds the second position by market share in the Chocolate market?

+

-

How are the key players in the Chocolate market targeting growth in the future?

+

-

The growth of the chocolate market is driven by a range of major drivers that mirror changing consumer behaviour and international trends. First, with rising disposable incomes, especially within emerging economies such as India and China, a greater number of people can enjoy and spend money on chocolate goods, moving from an occasional treat to a frequent indulgence. This is in addition to the impact of urbanisation and exposure to Western cultures, which introduce new forms and consumption patterns for chocolate to the local population.

, Second, increased consciousness towards the health properties related to the moderate intake of certain forms of chocolate, notably dark chocolate high in cocoa, is a critical motivator. Buyers are opting more for chocolate high in flavonoids and antioxidants, identifying with possible cardio-protective and mood benefits. This motivates the drive for dark chocolate and premium categories. Lastly, the deep cultural importance of chocolate in gift-giving and celebrations across the globe guarantees steady demand, especially during holidays. Creative packaging and product lines specifically designed for gift-giving add to this driver.

,