Asia Pacific Avocado Market – Industry Trends and Forecast to 2030

Report ID: MS-819 | Healthcare and Pharma | Last updated: Apr, 2025 | Formats*:

Avocado Report Highlights

| Report Metrics | Details |

|---|---|

| Forecast period | 2019-2030 |

| Base Year Of Estimation | 2024 |

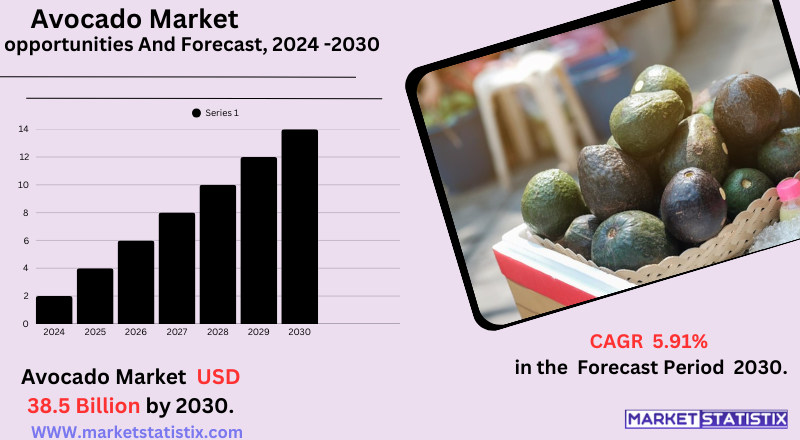

| Growth Rate | CAGR of 5.91% |

| Forecast Value (2030) | USD 38.5 Billion |

| By Product Type | Lula, A cultivars (Choquette, Pinkerton, Others |

| Key Market Players |

|

| By Region |

|

Avocado Market Trends

The avocado market is presently scaling good heights and is set for an upward trend in years to come. There are many trends responsible for this development. This growth is partly due to a surge in global awareness of the presumed health effects of avocados: their high fat, fibre, vitamin, and mineral content has attracted health-conscious consumers to consider an avocado a useful dietary item. Moreover, another contributing factor to the growth of the market is the purchasing power and lifestyle change taking place across the globe. Consumers consider it worth their while to spend money on premium and nutritious options like avocados. Expansion in food retailing encourages the introduction of new avocado-based products such as guacamole and avocado oil, processed food, and cosmetics containing avocado.Avocado Market Leading Players

The key players profiled in the report are Henry Avocado, Mexicola Holdings LLC, Camposol, Nature's Pride, Propal, Del Monte Fresh Produce, Costa Group, Mission Produce, Calavo Growers, Westfalia Fruit, West Pak Avocado, Inc., Agricola Cerro Prieto, Avo-King, Hass Avocado Board, Fresh Del Monte Produce IncGrowth Accelerators

Avocado becoming a major boom of health consciousness, avocados are widely considered a nutrient-dense superfood with ample healthy monounsaturated fats and essential vitamins (especially K, C, E, and B vitamins), minerals (notably potassium), and fibre. Within its nutritional framework, the avocado has become an emergent area of consumer dietary attention and a healthful lifestyle. It must find a legitimate place in the various dietary formats, which increasingly demand compliance with lifestyles. Equally indeed, with the plant-based and vegan diets being trendy, avocados were enshrined in the very principles of the culinary arts, cleverly used sometimes as a substitute for animal-based fats and blended into a great variety of vegetarian and vegan preparations. Another great market driver is the mere versatility and culinary applications of avocados these days. No longer considered an exotic fruit, the avocado has also grounded itself in many cuisines around the world, from the traditional guacamole to more inventive innovations in salads, smoothies, and sandwiches and even desserts. The food service sector embraces avocados, with restaurants and cafes furthering their consumption. Other factors supporting market growth include the ease of adding avocados to various meal and snack occasions and increasing fresh avocado availability in supermarkets and through online retail channels.Avocado Market Segmentation analysis

The Asia Pacific Avocado is segmented by Type, Application, and Region. By Type, the market is divided into Distributed Lula, A cultivars (Choquette, Pinkerton, Others . The Application segment categorizes the market based on its usage such as Food processing industry, Healthcare, Cosmetic industry, Other. Geographically, the market is assessed across key Regions like Asia Pacific (China, Japan, India, South Korea, Australia, Southeast Asia, Rest of Asia-Pacific) and others, each presenting distinct growth opportunities and challenges influenced by the regions.Competitive Landscape

The avocado market has recently seen some exciting sounds of activity in merger and acquisition (M&A) shapes, throwing reflections on a trend towards consolidation and expansion in the industry. The latest one is of Fresh Del Monte Produce Inc. acquiring a majority stake in Avolio, a leading supplier of avocado oil from Uganda, in late March 2025. This acquisition marks Fresh Del Monte's strategic entry into speciality, high-value-added ingredients and helps the company to gain from the burgeoning avocado oil market and, on the other hand, decreases food waste by utilising fruit unsuitable for whole fruit sale. Another key event of early April 2025 was the acquisition of Montana Fruits by Frutura, the Colombian avocado packer, shipper, and marketer. This move defines a wider footprint for Frutura in Latin America, one of the crucial avocado-growing regions of the world, as part of making the company year-round closer to its customers around the globe. The recent developments indicate a focus on vertical integration and use of value-added products like avocado oil, stabilising the supply chain through strategic acquisitions in key producing regions.Challenges In Avocado Market

Further, the avocado market is growing healthily but facing some of the most critical problems. The continuing supply chain disruptions in most cases are triggered by the variable climate experienced in the main producing regions, causing the unpredicted availabilities and volatility of prices. Environmental issues concerning deforestation and massive water consumption due to avocado farming have initiated concern from many consumers and advocacy groups and have compelled producers to practice more sustainable production. In spite of the fact that consumer demand is rising, especially from health-conscious and younger groups, price volatility still is a crucial challenge due to supply constraints, increased costs of production and logistics, and severe global competition. This, in turn, keeps narrow profit margins. Impacts of financial and social nature, however, are different in every country and thus need localised analysis for different markets. There will also be a stronger cooperative tie within the value chain and, meanwhile, ever-changing regulatory frameworks to ensure and realise sustainable growth and risk mitigation across the newly developing avocado industry worldwide.Risks & Prospects in Avocado Market

Some of these other drivers include innovation in avocado products such as oils, purees, snacks, and cosmetics; sustainable agricultural practices; and better supply chains. E-commerce, demand for convenience foods, and plant-based diets that attract consumers provide further impetus to these markets. Geographically, North America – and especially the U.S. – is the market leader, claiming almost half of world consumption, supported by local production and importation from Mexico, the world's leading avocado-growing nation. A growing market in Europe is also present, driven by trends toward healthy eating and exotic fruits. There are dynamics at play that enable the introduction of different avocado varieties while simultaneously using avocados in cosmetics and personal care. These dynamics are extending the market's reach and creating new avenues for global growth.Key Target Audience

The important target consumers of the avocado market are health-conscious consumers, millennials, and middle- to upper-income groups who seek healthy, natural foods. These groups have avocados for the high content of healthy fats, fibre, and vitamins. Demand is particularly high among people who follow diets such as keto, vegans, plant-based lifestyles, or urban dwellers looking for quick and versatile meals.,, Another important part of the target audience includes retailers, food service providers, and food manufacturers. They use avocados in a multitude of applications – from fresh produce offerings to value-added products such as guacamole, smoothies, or ready-to-eat meals. The consumers would be influenced by parameters like consistent quality, origin assurance, sustainability, and availability throughout the year in meeting the increasing expectations of consumers.Merger and acquisition

The avocado market has recently seen some exciting sounds of activity in merger and acquisition (M&A) shapes, throwing reflections on a trend towards consolidation and expansion in the industry. The latest one is of Fresh Del Monte Produce Inc. acquiring a majority stake in Avolio, a leading supplier of avocado oil from Uganda, in late March 2025. This acquisition marks Fresh Del Monte's strategic entry into speciality, high-value-added ingredients and helps the company to gain from the burgeoning avocado oil market and, on the other hand, decreases food waste by utilising fruit unsuitable for whole fruit sale. Another key event of early April 2025 was the acquisition of Montana Fruits by Frutura, the Colombian avocado packer, shipper, and marketer. This move defines a wider footprint for Frutura in Latin America, one of the crucial avocado-growing regions of the world, as part of making the company year-round closer to its customers around the globe. The recent developments indicate a focus on vertical integration and use of value-added products like avocado oil, stabilising the supply chain through strategic acquisitions in key producing regions. >Analyst Comment

The predicted growth of the global avocado market is strong. It will expand from $19.37 billion in 2024 to an estimated $21.32 billion in 2025. This expansion is attributed to increased consumer awareness regarding the health benefits of avocados, increased demand for organic and nutritious foods, and people's changing eating habits. However, rising sales are also bolstered by the increasing popularity of avocado-derived products such as oils, snacks, and ready-to-eat food products, combined with the increasing penetration of eCommerce and the clean-label sustainability trend.- 1.1 Report description

- 1.2 Key market segments

- 1.3 Key benefits to the stakeholders

2: Executive Summary

- 2.1 Avocado- Snapshot

- 2.2 Avocado- Segment Snapshot

- 2.3 Avocado- Competitive Landscape Snapshot

3: Market Overview

- 3.1 Market definition and scope

- 3.2 Key findings

- 3.2.1 Top impacting factors

- 3.2.2 Top investment pockets

- 3.3 Porter’s five forces analysis

- 3.3.1 Low bargaining power of suppliers

- 3.3.2 Low threat of new entrants

- 3.3.3 Low threat of substitutes

- 3.3.4 Low intensity of rivalry

- 3.3.5 Low bargaining power of buyers

- 3.4 Market dynamics

- 3.4.1 Drivers

- 3.4.2 Restraints

- 3.4.3 Opportunities

4: Avocado Market by Type

- 4.1 Overview

- 4.1.1 Market size and forecast

- 4.2 A cultivars (Choquette

- 4.2.1 Key market trends, factors driving growth, and opportunities

- 4.2.2 Market size and forecast, by region

- 4.2.3 Market share analysis by country

- 4.3 Lula

- 4.3.1 Key market trends, factors driving growth, and opportunities

- 4.3.2 Market size and forecast, by region

- 4.3.3 Market share analysis by country

- 4.4 Pinkerton

- 4.4.1 Key market trends, factors driving growth, and opportunities

- 4.4.2 Market size and forecast, by region

- 4.4.3 Market share analysis by country

- 4.5 Others

- 4.5.1 Key market trends, factors driving growth, and opportunities

- 4.5.2 Market size and forecast, by region

- 4.5.3 Market share analysis by country

5: Avocado Market by Application / by End Use

- 5.1 Overview

- 5.1.1 Market size and forecast

- 5.2 Food processing industry

- 5.2.1 Key market trends, factors driving growth, and opportunities

- 5.2.2 Market size and forecast, by region

- 5.2.3 Market share analysis by country

- 5.3 Cosmetic industry

- 5.3.1 Key market trends, factors driving growth, and opportunities

- 5.3.2 Market size and forecast, by region

- 5.3.3 Market share analysis by country

- 5.4 Healthcare

- 5.4.1 Key market trends, factors driving growth, and opportunities

- 5.4.2 Market size and forecast, by region

- 5.4.3 Market share analysis by country

- 5.5 Other

- 5.5.1 Key market trends, factors driving growth, and opportunities

- 5.5.2 Market size and forecast, by region

- 5.5.3 Market share analysis by country

6: Avocado Market by Region

- 6.1 Overview

- 6.1.1 Market size and forecast By Region

- 6.2 China

- 6.2.1 Key trends and opportunities

- 6.2.2 Market size and forecast, by Type

- 6.2.3 Market size and forecast, by Application

- 6.2.4 Market size and forecast, by country

- 6.3 Japan

- 6.3.1 Key trends and opportunities

- 6.3.2 Market size and forecast, by Type

- 6.3.3 Market size and forecast, by Application

- 6.3.4 Market size and forecast, by country

- 6.4 India

- 6.4.1 Key trends and opportunities

- 6.4.2 Market size and forecast, by Type

- 6.4.3 Market size and forecast, by Application

- 6.4.4 Market size and forecast, by country

- 6.5 South Korea

- 6.5.1 Key trends and opportunities

- 6.5.2 Market size and forecast, by Type

- 6.5.3 Market size and forecast, by Application

- 6.5.4 Market size and forecast, by country

- 6.6 Australia

- 6.6.1 Key trends and opportunities

- 6.6.2 Market size and forecast, by Type

- 6.6.3 Market size and forecast, by Application

- 6.6.4 Market size and forecast, by country

- 6.7 Southeast Asia

- 6.7.1 Key trends and opportunities

- 6.7.2 Market size and forecast, by Type

- 6.7.3 Market size and forecast, by Application

- 6.7.4 Market size and forecast, by country

- 6.8 Rest of Asia-Pacific

- 6.8.1 Key trends and opportunities

- 6.8.2 Market size and forecast, by Type

- 6.8.3 Market size and forecast, by Application

- 6.8.4 Market size and forecast, by country

- 7.1 Overview

- 7.2 Key Winning Strategies

- 7.3 Top 10 Players: Product Mapping

- 7.4 Competitive Analysis Dashboard

- 7.5 Market Competition Heatmap

- 7.6 Leading Player Positions, 2022

8: Company Profiles

- 8.1 Mission Produce

- 8.1.1 Company Overview

- 8.1.2 Key Executives

- 8.1.3 Company snapshot

- 8.1.4 Active Business Divisions

- 8.1.5 Product portfolio

- 8.1.6 Business performance

- 8.1.7 Major Strategic Initiatives and Developments

- 8.2 Calavo Growers

- 8.2.1 Company Overview

- 8.2.2 Key Executives

- 8.2.3 Company snapshot

- 8.2.4 Active Business Divisions

- 8.2.5 Product portfolio

- 8.2.6 Business performance

- 8.2.7 Major Strategic Initiatives and Developments

- 8.3 Westfalia Fruit

- 8.3.1 Company Overview

- 8.3.2 Key Executives

- 8.3.3 Company snapshot

- 8.3.4 Active Business Divisions

- 8.3.5 Product portfolio

- 8.3.6 Business performance

- 8.3.7 Major Strategic Initiatives and Developments

- 8.4 Del Monte Fresh Produce

- 8.4.1 Company Overview

- 8.4.2 Key Executives

- 8.4.3 Company snapshot

- 8.4.4 Active Business Divisions

- 8.4.5 Product portfolio

- 8.4.6 Business performance

- 8.4.7 Major Strategic Initiatives and Developments

- 8.5 Henry Avocado

- 8.5.1 Company Overview

- 8.5.2 Key Executives

- 8.5.3 Company snapshot

- 8.5.4 Active Business Divisions

- 8.5.5 Product portfolio

- 8.5.6 Business performance

- 8.5.7 Major Strategic Initiatives and Developments

- 8.6 Camposol

- 8.6.1 Company Overview

- 8.6.2 Key Executives

- 8.6.3 Company snapshot

- 8.6.4 Active Business Divisions

- 8.6.5 Product portfolio

- 8.6.6 Business performance

- 8.6.7 Major Strategic Initiatives and Developments

- 8.7 Costa Group

- 8.7.1 Company Overview

- 8.7.2 Key Executives

- 8.7.3 Company snapshot

- 8.7.4 Active Business Divisions

- 8.7.5 Product portfolio

- 8.7.6 Business performance

- 8.7.7 Major Strategic Initiatives and Developments

- 8.8 Hass Avocado Board

- 8.8.1 Company Overview

- 8.8.2 Key Executives

- 8.8.3 Company snapshot

- 8.8.4 Active Business Divisions

- 8.8.5 Product portfolio

- 8.8.6 Business performance

- 8.8.7 Major Strategic Initiatives and Developments

- 8.9 West Pak Avocado

- 8.9.1 Company Overview

- 8.9.2 Key Executives

- 8.9.3 Company snapshot

- 8.9.4 Active Business Divisions

- 8.9.5 Product portfolio

- 8.9.6 Business performance

- 8.9.7 Major Strategic Initiatives and Developments

- 8.10 Inc.

- 8.10.1 Company Overview

- 8.10.2 Key Executives

- 8.10.3 Company snapshot

- 8.10.4 Active Business Divisions

- 8.10.5 Product portfolio

- 8.10.6 Business performance

- 8.10.7 Major Strategic Initiatives and Developments

- 8.11 Nature's Pride

- 8.11.1 Company Overview

- 8.11.2 Key Executives

- 8.11.3 Company snapshot

- 8.11.4 Active Business Divisions

- 8.11.5 Product portfolio

- 8.11.6 Business performance

- 8.11.7 Major Strategic Initiatives and Developments

- 8.12 Propal

- 8.12.1 Company Overview

- 8.12.2 Key Executives

- 8.12.3 Company snapshot

- 8.12.4 Active Business Divisions

- 8.12.5 Product portfolio

- 8.12.6 Business performance

- 8.12.7 Major Strategic Initiatives and Developments

- 8.13 Agricola Cerro Prieto

- 8.13.1 Company Overview

- 8.13.2 Key Executives

- 8.13.3 Company snapshot

- 8.13.4 Active Business Divisions

- 8.13.5 Product portfolio

- 8.13.6 Business performance

- 8.13.7 Major Strategic Initiatives and Developments

- 8.14 Avo-King

- 8.14.1 Company Overview

- 8.14.2 Key Executives

- 8.14.3 Company snapshot

- 8.14.4 Active Business Divisions

- 8.14.5 Product portfolio

- 8.14.6 Business performance

- 8.14.7 Major Strategic Initiatives and Developments

- 8.15 Mexicola Holdings LLC

- 8.15.1 Company Overview

- 8.15.2 Key Executives

- 8.15.3 Company snapshot

- 8.15.4 Active Business Divisions

- 8.15.5 Product portfolio

- 8.15.6 Business performance

- 8.15.7 Major Strategic Initiatives and Developments

- 8.16 Fresh Del Monte Produce Inc

- 8.16.1 Company Overview

- 8.16.2 Key Executives

- 8.16.3 Company snapshot

- 8.16.4 Active Business Divisions

- 8.16.5 Product portfolio

- 8.16.6 Business performance

- 8.16.7 Major Strategic Initiatives and Developments

9: Analyst Perspective and Conclusion

- 9.1 Concluding Recommendations and Analysis

- 9.2 Strategies for Market Potential

Scope of Report

| Aspects | Details |

|---|---|

By Type |

|

By Application |

|

Report Licenses

Our Team

Frequently Asked Questions (FAQ):

What is the projected market size of Avocado in 2030?

+

-

Which application type is expected to remain the largest segment in the Asia Pacific Avocado market?

+

-

How big is the Asia Pacific Avocado market?

+

-

How do regulatory policies impact the Avocado Market?

+

-

What major players in Avocado Market?

+

-

What applications are categorized in the Avocado market study?

+

-

Which product types are examined in the Avocado Market Study?

+

-

Which regions are expected to show the fastest growth in the Avocado market?

+

-

Which application holds the second-highest market share in the Avocado market?

+

-

What are the major growth drivers in the Avocado market?

+

-