Asia Pacific AI in Oil and Gas Market - Industry Dynamics, Market Size, And Opportunity Forecast To 2030

Report ID: MS-1052 | IT and Telecom | Last updated: Jun, 2025 | Formats*:

The use of AI (Artificial Intelligence) in the oil and gas industry has been steadily growing in recent years. AI technologies have the potential to transform various aspects of the industry, from exploration and drilling to production, refining, and distribution.

AI in Oil and Gas Report Highlights

| Report Metrics | Details |

|---|---|

| Forecast period | 2019-2030 |

| Base Year Of Estimation | 2025 |

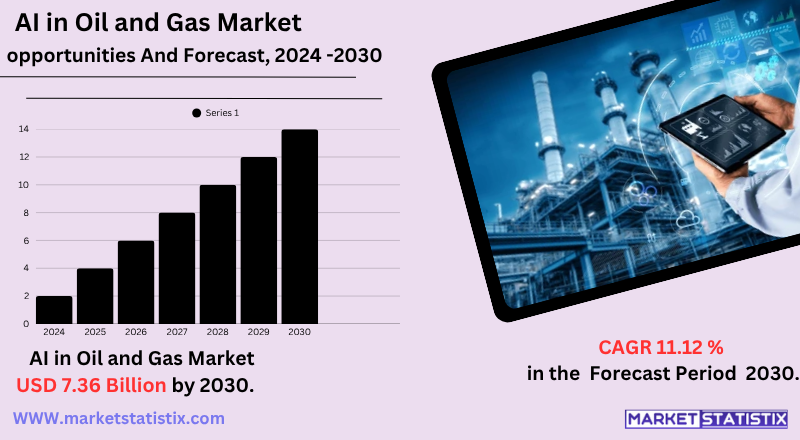

| Growth Rate | CAGR of 11.12% |

| Forecast Value (2030) | USD 7.36 Billion |

| By Product Type | Software, Hardware, Services |

| Key Market Players |

|

| By Region |

|

AI in Oil and Gas Market Trends

- Autonomous drilling and operations

Oilfield service leaders such as SLB and Equinor are implementing AI-based systems that control drilling rigs autonomously, improving efficiency and reducing human risk in hazardous environments.

- AI-driven investment in analytics firms

Significant capital is being pumped into AI analysis startups, such as Novi Labs, which offer real-time predictions and data insights for upstream capital planning.

- AI aiding decommissioning and emissions oversight

Innovative tools such as Rahd AI are optimising control of North Sea decommissioning and emissions, showing the growing role of AI in the cleaning and sustainability of the sector.

AI in Oil and Gas Market Leading Players

The key players profiled in the report are Accenture (Republic of Ireland), Google (United States), Cisco (United States), IBM (United States), General Vision (UniteStates), Oracle (United States), Intel (United States), Microsoft (United States), Inbenta (United States), Sentient Technologies (United States)Growth Accelerators

- Operational cost reduction through predictive maintenance

AI systems analyse live sensor data to predict equipment failures and proactively schedule maintenance—cutting unexpected inactivity time, extending assets lives, and reducing repair expenses.

- Enhanced drilling efficiency and resource optimisation

Advanced AI models guide drill bit steering and reservoir analysis in real time, allowing companies like BP and Devon to tap complex formations faster and cheaper, increasing well productivity.

- Supply chain resilience and logistics optimisation

AI tools evaluate real-time climate demand data, shipping, and fuel demand to optimise route planning and inventory, making the midstream industry more robust and responsive to interruptions.

AI in Oil and Gas Market Segmentation analysis

The Asia Pacific AI in Oil and Gas is segmented by Type, Application, and Region. By Type, the market is divided into Distributed Software, Hardware, Services . The Application segment categorizes the market based on its usage such as Upstream, Midstream, Downstream. Geographically, the market is assessed across key Regions like Asia Pacific (China, Japan, India, South Korea, Australia, Southeast Asia, Rest of Asia-Pacific) and others, each presenting distinct growth opportunities and challenges influenced by the regions.Competitive Landscape

AI in oil and gas is shaped by a mixture of global technology giants, specialised suppliers, and energy-focused startups, all vying to offer integrated platforms, predictive analysis, and specific domain applications. Main players include IBM, Microsoft, Google/Accenture, Intel, and C3.ai, which bring scale and AI expertise to exploration, maintenance, and operations. Meanwhile, niche companies such as Esserv (digital twins), Cognite (industrial data ops), and SensorUp (methane emissions) are gaining strength with specialised solutions adapted to critical challenges in the industry. With adoption accelerating in the upstream, middle, and downstream segments, the competitive advantage now depends on the integration of domains, alliances between industries, and the ability to provide modular and scalable AI systems.

Challenges In AI in Oil and Gas Market

- Legacy infrastructure and systems integration

Most oil and gas companies operate with hardware settings and decades that are not designed for modern AI tools. The update or integration of these systems is complex, expensive, and time-consuming, usually paralysing the implementation of wider AI.

- Data quality, availability, and preparation

Effective AI hinges on structured, clean, and extensive data sets. However, companies usually deal with inconsistent, silent, or low-quality data and spend most of the project time on data cleaning—reliability and scalability.

- High implementation and operational costs

In addition to the initial software investment, operators must allocate budgets for sensors, infrastructure updates, training, and continuous maintenance. These expenses often exceed projections and dissuade large-scale releases.

Risks & Prospects in AI in Oil and Gas Market

AI in the oil and gas industry has strong market opportunities driven by the growing demand for digital oilfield solutions, predictive maintenance and intelligent automation in exploration and production workflows. The main opportunities are reservoir modelling optimisation, improving drilling accuracy and improving operational safety through AI-powered monitoring systems. The dominance of upstream applications stems from their high data intensity and cost sensitivity, where even marginal efficiency gains translate into significant economies. In addition, the growing emphasis on sustainability and emission control is pressuring companies to adopt AI for real-time environmental analysis. These cumulative factors form upstream operations, and in the midst of AI integration, they position them as dominant segments in the evolving energy technology scenario.

Key Target Audience

,,, Oil and gas C-suite executives take advantage of AI and real-time insights to guide capital expenses, optimisation of operations, and sustainability initiatives—a change from instinct to data-orientated strategy.

,

- , Responsible for equipment uptime, they implement AI predictive maintenance systems to detect anomalies before failure, minimising the time of inactivity and prolonging the life of assets.

,

, These teams use AI-orientated analyses to interpret seismic data, optimise perforation sites, and evaluate reservoir potential, making decisions in complex geological environments.

, ,

Merger and acquisition

- Invictus Growth Partners acquires stake in Novi Labs.

Invictus Growth Partners, based in Israel, has invested in Novo Labs, an AI-powered energy analysis startup. The Novo Platform enhances investment decisions upstream using predictive models and geological data insights.

- ADNOC XRG expands U.S. gas/LNG footprint via acquisitions.

The investment arm of Abu Dhabi National Petroleum Company, XRG, is seeking strategic mergers and acquisitions in gas and LNG assets in North America. This aligns with its broader plan to expand capacity and support the growth of AI-orientated demand in energy infrastructure.

- Shell–BP merger rumors spark sector-wide speculation.

Although not yet confirmed, early-stage discussions between Shell and BP-both heavy users for optimisation. It's possible the union would consolidate AI-orientated efficiencies across exploration, trading and emissions.

>

Analyst Comment

The adoption of AI in oil and gas is accelerating, driven by its ability to optimise exploration, drilling, production, and maintenance workflows. Currently, the market is valued in the range of US $3 to 4 billion for 2025, with projections to double by about 2030, supported by generalised deployment of machine learning, predictive analysis, and automation tools. North America leads in market share, with Asia-Pacific growing rapidly thanks to infrastructure updates and regulatory support. Main applications include predictive maintenance, seismic interpretation, drilling optimisation, security monitoring, and emission control, presenting the AI's real-time impact on operational efficiency and environmental compliance.

- 1.1 Report description

- 1.2 Key market segments

- 1.3 Key benefits to the stakeholders

2: Executive Summary

- 2.1 AI in Oil and Gas- Snapshot

- 2.2 AI in Oil and Gas- Segment Snapshot

- 2.3 AI in Oil and Gas- Competitive Landscape Snapshot

3: Market Overview

- 3.1 Market definition and scope

- 3.2 Key findings

- 3.2.1 Top impacting factors

- 3.2.2 Top investment pockets

- 3.3 Porter’s five forces analysis

- 3.3.1 Low bargaining power of suppliers

- 3.3.2 Low threat of new entrants

- 3.3.3 Low threat of substitutes

- 3.3.4 Low intensity of rivalry

- 3.3.5 Low bargaining power of buyers

- 3.4 Market dynamics

- 3.4.1 Drivers

- 3.4.2 Restraints

- 3.4.3 Opportunities

4: AI in Oil and Gas Market by Type

- 4.1 Overview

- 4.1.1 Market size and forecast

- 4.2 Hardware

- 4.2.1 Key market trends, factors driving growth, and opportunities

- 4.2.2 Market size and forecast, by region

- 4.2.3 Market share analysis by country

- 4.3 Software

- 4.3.1 Key market trends, factors driving growth, and opportunities

- 4.3.2 Market size and forecast, by region

- 4.3.3 Market share analysis by country

- 4.4 Services

- 4.4.1 Key market trends, factors driving growth, and opportunities

- 4.4.2 Market size and forecast, by region

- 4.4.3 Market share analysis by country

5: AI in Oil and Gas Market by Application / by End Use

- 5.1 Overview

- 5.1.1 Market size and forecast

- 5.2 Upstream

- 5.2.1 Key market trends, factors driving growth, and opportunities

- 5.2.2 Market size and forecast, by region

- 5.2.3 Market share analysis by country

- 5.3 Midstream

- 5.3.1 Key market trends, factors driving growth, and opportunities

- 5.3.2 Market size and forecast, by region

- 5.3.3 Market share analysis by country

- 5.4 Downstream

- 5.4.1 Key market trends, factors driving growth, and opportunities

- 5.4.2 Market size and forecast, by region

- 5.4.3 Market share analysis by country

6: AI in Oil and Gas Market by Region

- 6.1 Overview

- 6.1.1 Market size and forecast By Region

- 6.2 China

- 6.2.1 Key trends and opportunities

- 6.2.2 Market size and forecast, by Type

- 6.2.3 Market size and forecast, by Application

- 6.2.4 Market size and forecast, by country

- 6.3 Japan

- 6.3.1 Key trends and opportunities

- 6.3.2 Market size and forecast, by Type

- 6.3.3 Market size and forecast, by Application

- 6.3.4 Market size and forecast, by country

- 6.4 India

- 6.4.1 Key trends and opportunities

- 6.4.2 Market size and forecast, by Type

- 6.4.3 Market size and forecast, by Application

- 6.4.4 Market size and forecast, by country

- 6.5 South Korea

- 6.5.1 Key trends and opportunities

- 6.5.2 Market size and forecast, by Type

- 6.5.3 Market size and forecast, by Application

- 6.5.4 Market size and forecast, by country

- 6.6 Australia

- 6.6.1 Key trends and opportunities

- 6.6.2 Market size and forecast, by Type

- 6.6.3 Market size and forecast, by Application

- 6.6.4 Market size and forecast, by country

- 6.7 Southeast Asia

- 6.7.1 Key trends and opportunities

- 6.7.2 Market size and forecast, by Type

- 6.7.3 Market size and forecast, by Application

- 6.7.4 Market size and forecast, by country

- 6.8 Rest of Asia-Pacific

- 6.8.1 Key trends and opportunities

- 6.8.2 Market size and forecast, by Type

- 6.8.3 Market size and forecast, by Application

- 6.8.4 Market size and forecast, by country

- 7.1 Overview

- 7.2 Key Winning Strategies

- 7.3 Top 10 Players: Product Mapping

- 7.4 Competitive Analysis Dashboard

- 7.5 Market Competition Heatmap

- 7.6 Leading Player Positions, 2022

8: Company Profiles

- 8.1 Accenture (Republic of Ireland)

- 8.1.1 Company Overview

- 8.1.2 Key Executives

- 8.1.3 Company snapshot

- 8.1.4 Active Business Divisions

- 8.1.5 Product portfolio

- 8.1.6 Business performance

- 8.1.7 Major Strategic Initiatives and Developments

- 8.2 Cisco (United States)

- 8.2.1 Company Overview

- 8.2.2 Key Executives

- 8.2.3 Company snapshot

- 8.2.4 Active Business Divisions

- 8.2.5 Product portfolio

- 8.2.6 Business performance

- 8.2.7 Major Strategic Initiatives and Developments

- 8.3 General Vision (UniteStates)

- 8.3.1 Company Overview

- 8.3.2 Key Executives

- 8.3.3 Company snapshot

- 8.3.4 Active Business Divisions

- 8.3.5 Product portfolio

- 8.3.6 Business performance

- 8.3.7 Major Strategic Initiatives and Developments

- 8.4 Google (United States)

- 8.4.1 Company Overview

- 8.4.2 Key Executives

- 8.4.3 Company snapshot

- 8.4.4 Active Business Divisions

- 8.4.5 Product portfolio

- 8.4.6 Business performance

- 8.4.7 Major Strategic Initiatives and Developments

- 8.5 IBM (United States)

- 8.5.1 Company Overview

- 8.5.2 Key Executives

- 8.5.3 Company snapshot

- 8.5.4 Active Business Divisions

- 8.5.5 Product portfolio

- 8.5.6 Business performance

- 8.5.7 Major Strategic Initiatives and Developments

- 8.6 Inbenta (United States)

- 8.6.1 Company Overview

- 8.6.2 Key Executives

- 8.6.3 Company snapshot

- 8.6.4 Active Business Divisions

- 8.6.5 Product portfolio

- 8.6.6 Business performance

- 8.6.7 Major Strategic Initiatives and Developments

- 8.7 Intel (United States)

- 8.7.1 Company Overview

- 8.7.2 Key Executives

- 8.7.3 Company snapshot

- 8.7.4 Active Business Divisions

- 8.7.5 Product portfolio

- 8.7.6 Business performance

- 8.7.7 Major Strategic Initiatives and Developments

- 8.8 Microsoft (United States)

- 8.8.1 Company Overview

- 8.8.2 Key Executives

- 8.8.3 Company snapshot

- 8.8.4 Active Business Divisions

- 8.8.5 Product portfolio

- 8.8.6 Business performance

- 8.8.7 Major Strategic Initiatives and Developments

- 8.9 Oracle (United States)

- 8.9.1 Company Overview

- 8.9.2 Key Executives

- 8.9.3 Company snapshot

- 8.9.4 Active Business Divisions

- 8.9.5 Product portfolio

- 8.9.6 Business performance

- 8.9.7 Major Strategic Initiatives and Developments

- 8.10 Sentient Technologies (United States)

- 8.10.1 Company Overview

- 8.10.2 Key Executives

- 8.10.3 Company snapshot

- 8.10.4 Active Business Divisions

- 8.10.5 Product portfolio

- 8.10.6 Business performance

- 8.10.7 Major Strategic Initiatives and Developments

9: Analyst Perspective and Conclusion

- 9.1 Concluding Recommendations and Analysis

- 9.2 Strategies for Market Potential

Scope of Report

| Aspects | Details |

|---|---|

By Type |

|

By Application |

|

Report Licenses

Our Team

Frequently Asked Questions (FAQ):

What is the estimated market size of AI in Oil and Gas in 2030?

+

-

Which type of AI in Oil and Gas is widely popular?

+

-

What is the growth rate of AI in Oil and Gas Market?

+

-

What are the latest trends influencing the AI in Oil and Gas Market?

+

-

Who are the key players in the AI in Oil and Gas Market?

+

-

How is the AI in Oil and Gas } industry progressing in scaling its end-use implementations?

+

-

What product types are analyzed in the AI in Oil and Gas Market Study?

+

-

What geographic breakdown is available in Asia Pacific AI in Oil and Gas Market Study?

+

-

Which region holds the second position by market share in the AI in Oil and Gas market?

+

-

How are the key players in the AI in Oil and Gas market targeting growth in the future?

+

-

,

- , AI systems analyse live sensor data to predict equipment failures and proactively schedule maintenance—cutting unexpected inactivity time, extending assets lives, and reducing repair expenses.

,, ,

,

,, , Advanced AI models guide drill bit steering and reservoir analysis in real time, allowing companies like BP and Devon to tap complex formations faster and cheaper, increasing well productivity.

,

,

,