Market Insights: The State of the Loan Servicing Software Market

Home

> Press Releases

> Market Insights: The State of the Loan Servicing Software Market

Oct 09,2024 Application Software

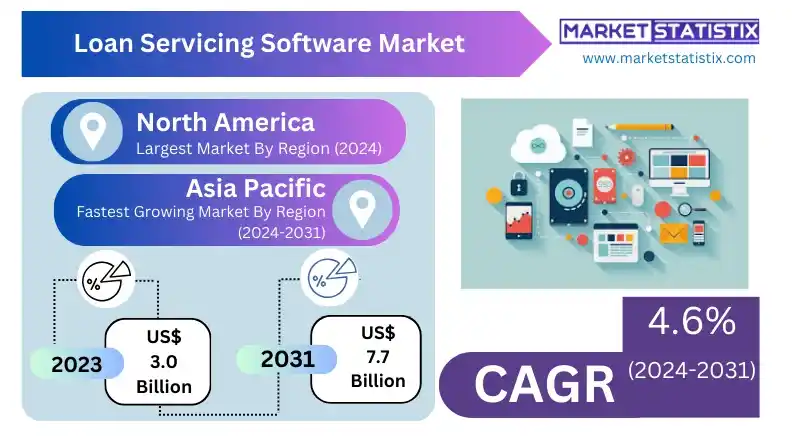

Market Statistix Research analyzes the Loan Servicing Software Market is expected to grow with a CAGR of 10.7% in the forecast period of 2031.

The Loan Servicing Software market is witnessing consistent growth, with this momentum expected to persist in the coming years. Forecasts suggest robust growth rates from 2023 to 2031, underscoring its increasing impact and potential in the industry. As companies continue to invest and innovate, the market is poised to play a significant role in shaping future trends. This period marks a crucial phase of expansion and opportunity for key players.

Access Full Report: https://www.marketstatistix.com/report/global-loan-servicing-software-market

Market Segment Analysis

The Global Loan Servicing Software is segmented by Type, and Region.

By Type, the market is divided into Collection Software, Risk Management Software, Origination Software, Loan Management Software, Others . Geographically, the market is assessed across key Regions like North America (United States, Canada, Mexico), South America (Brazil, Argentina, Chile, Rest of South America), Europe (Germany, France, Italy, United Kingdom, Benelux, Nordics, Rest of Europe), Asia Pacific (China, Japan, India, South Korea, Australia, Southeast Asia, Rest of Asia-Pacific), MEA (Middle East, Africa) and others.

Get Free Sample Report: https://www.marketstatistix.com/sample-report/global-loan-servicing-software-market

Key Players

Key companies in the Loan Servicing Software market include Nortridge Software, Mortgage Builder, Financial Industry Computer Systems Inc., Cloud Lending, Q2 Software, Emphasys Software, GOLDPoint Systems, Bryt Software, LoanPro, C-Loans Inc., Fiserv, Graveco Software, Shaw Systems, Altisource, Applied Business Software, AutoPal Software). These industry leaders use strategies like approvals and market expansion to strengthen their positions in the global Loan Servicing Software.

About Market Statistix

Market Statistix offers comprehensive research solutions, combining primary and secondary studies on one platform to provide valuable industry insights.

Our expert analysts use advanced techniques and years of experience to deliver accurate and informative reports, helping clients understand trends and make data-driven decisions.

We value trust, integrity, and authenticity, partnering with clients to support strategic growth and ensure they stay competitive.

Contact Details:

Call: +1 (315) 908-7975

Email: sales@marketstatistix.com

Website: https://www.marketstatistix.com

The Loan Servicing Software market is witnessing consistent growth, with this momentum expected to persist in the coming years. Forecasts suggest robust growth rates from 2023 to 2031, underscoring its increasing impact and potential in the industry. As companies continue to invest and innovate, the market is poised to play a significant role in shaping future trends. This period marks a crucial phase of expansion and opportunity for key players.

Access Full Report: https://www.marketstatistix.com/report/global-loan-servicing-software-market

Market Segment Analysis

The Global Loan Servicing Software is segmented by Type, and Region.

By Type, the market is divided into Collection Software, Risk Management Software, Origination Software, Loan Management Software, Others . Geographically, the market is assessed across key Regions like North America (United States, Canada, Mexico), South America (Brazil, Argentina, Chile, Rest of South America), Europe (Germany, France, Italy, United Kingdom, Benelux, Nordics, Rest of Europe), Asia Pacific (China, Japan, India, South Korea, Australia, Southeast Asia, Rest of Asia-Pacific), MEA (Middle East, Africa) and others.

Get Free Sample Report: https://www.marketstatistix.com/sample-report/global-loan-servicing-software-market

Key Players

Key companies in the Loan Servicing Software market include Nortridge Software, Mortgage Builder, Financial Industry Computer Systems Inc., Cloud Lending, Q2 Software, Emphasys Software, GOLDPoint Systems, Bryt Software, LoanPro, C-Loans Inc., Fiserv, Graveco Software, Shaw Systems, Altisource, Applied Business Software, AutoPal Software). These industry leaders use strategies like approvals and market expansion to strengthen their positions in the global Loan Servicing Software.

About Market Statistix

Market Statistix offers comprehensive research solutions, combining primary and secondary studies on one platform to provide valuable industry insights.

Our expert analysts use advanced techniques and years of experience to deliver accurate and informative reports, helping clients understand trends and make data-driven decisions.

We value trust, integrity, and authenticity, partnering with clients to support strategic growth and ensure they stay competitive.

Contact Details:

Call: +1 (315) 908-7975

Email: sales@marketstatistix.com

Website: https://www.marketstatistix.com